| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 8536610000 | Doc | 57.7% | CN | US | 2025-05-12 |

| 3926909910 | Doc | 42.8% | CN | US | 2025-05-12 |

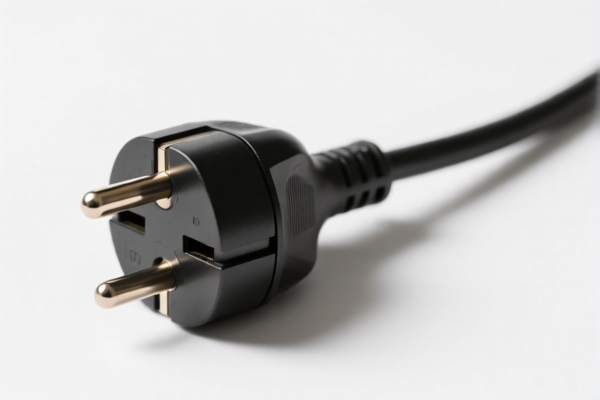

Okay, let's break down the HS codes and tax implications for your declared goods, "(UK PLUG TOP)". Based on the information provided, it appears you have two potential classifications. Here's a detailed analysis:

Understanding HS Codes: A Quick Primer

HS codes (Harmonized System codes) are internationally standardized codes used to classify traded products. The first two digits generally indicate the chapter, the first four digits the heading, and the first six digits the subheading. More digits may be used for further specificity.

1. HS Code: 8536.61.00.00 – Electrical apparatus for switching or protecting electrical circuits… Lamp-holders, plugs and sockets

- Chapter 85: Electrical machinery and equipment. This broadly covers electrical components.

- Heading 8536: Electrical apparatus for switching or protecting electrical circuits, or for making connections to or in electrical circuits. This is where plugs and sockets fall.

-

Subheading 8536.61: Lamp-holders, plugs and sockets. This specifically identifies your "UK PLUG TOP" if it functions as a standard electrical connector.

-

Tax Implications:

- Basic Duty: 2.7%

- Additional Tariff: 25.0% (until April 2, 2025)

- Additional Tariff (after April 2, 2025): 30.0%

- Total Tax: 57.7%

-

Important Considerations:

- Voltage: This HS code is for items not exceeding 1,000V. Ensure your plug tops meet this requirement.

- Functionality: Is this solely a plug top, or does it include any switching or protective features? If it has additional functions, another HS code might be more appropriate.

- Material: The material composition can sometimes influence the classification.

-

2. HS Code: 3926.90.99.10 – Other articles of plastics… Other Laboratory ware

- Chapter 39: Plastics and articles thereof.

- Heading 3926: Other articles of plastics and articles of other materials of headings 3901 to 3914.

-

Subheading 3926.90.99.10: Other Laboratory ware. This code is more suitable if the plug top is made of plastic and is used as laboratory equipment.

-

Tax Implications:

- Basic Duty: 5.3%

- Additional Tariff: 7.5% (until April 2, 2025)

- Additional Tariff (after April 2, 2025): 30.0%

- Total Tax: 42.8%

-

Important Considerations:

- Material Composition: This code is specifically for plastic articles. Confirm the primary material is plastic.

- Intended Use: Is it specifically designed for laboratory use? If it's a general-purpose plug top, this code is likely incorrect.

-

Recommendation & Next Steps:

Based on the description "(UK PLUG TOP)", HS Code 8536.61.00.00 is the more likely classification, assuming it functions as a standard electrical connector. However, the material and intended use are critical.

To ensure accurate classification and avoid potential issues with customs, I recommend the following:

- Material Verification: Confirm the primary material of the plug top.

- Functionality Check: Does it have any features beyond basic connection (e.g., surge protection, switching)?

- Intended Use: Is it for general household/industrial use, or specifically for laboratory applications?

- Provide a detailed product specification sheet: This will help determine the correct HS code.

- Check for Certifications: Depending on the destination country, you may need certifications (e.g., CE marking for Europe) to demonstrate compliance with safety standards.

- Single Invoice: Ensure the invoice clearly describes the goods and their quantity.

Disclaimer: I am an AI assistant and cannot provide definitive customs rulings. This information is for guidance only. It is always best to consult with a qualified customs broker or the customs authorities in the importing country for a final determination.

Customer Reviews

The site made it easy to compare the two HS codes for UK plug tops. I wish there were more examples, but it was still very useful.

I was looking for HS code info on electrical connectors and found exactly what I needed. The tax breakdown was clear and easy to follow.

The explanation of the two HS codes was very helpful. I had to double-check the product specs, but it gave me a solid starting point.

The HS code 8536610000 was exactly what I needed for my UK plug tops. The detailed tariff breakdown made it easy to understand the costs.

This site is a lifesaver for anyone dealing with export tariffs on plastic building materials. Highly recommend it!