| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3925900000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3926909905 | Doc | 42.8% | CN | US | 2025-05-12 |

| 3923900080 | Doc | 58.0% | CN | US | 2025-05-12 |

| 3926909905 | Doc | 42.8% | CN | US | 2025-05-12 |

| 3926909905 | Doc | 42.8% | CN | US | 2025-05-12 |

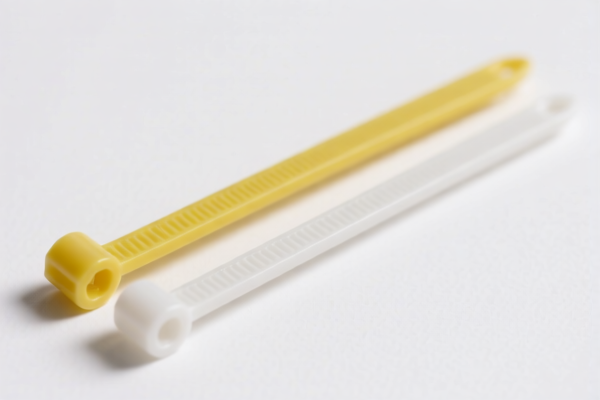

Product Classification and Tariff Analysis for Plastic Tie (Plastic扎带)

Based on the provided HS codes and tariff details, here is a structured breakdown of the classification and applicable tariffs for plastic tie:

✅ HS CODE: 3926909905

Description:

- This code applies to elastic plastic bands, which aligns with the product description of plastic tie.

- It is part of the broader category of "other plastic products" under Chapter 39.

Tariff Details:

- Base Tariff Rate: 5.3%

- Additional Tariff (before April 11, 2025): 7.5%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tariff Rate: 42.8% (as of now)

- Note: The 30.0% additional tariff applies after April 11, 2025, and will significantly increase the total duty.

⚠️ Time-Sensitive Policy Alert:

- April 11, 2025 Special Tariff:

- If your import is scheduled after April 11, 2025, the additional tariff will jump from 7.5% to 30.0%, increasing the total duty from 42.8% to 65.3%.

- This is a critical date for customs clearance planning.

📌 Other Possible HS Codes:

1. HS CODE: 3925900000

- Description: "Other plastic products not elsewhere specified."

- Total Tariff Rate: 60.3%

- Tariff Breakdown:

- Base: 5.3%

- Additional: 25.0%

- After April 11, 2025: 30.0%

- Note: This code is a catch-all category and may not be the most accurate for your product unless it doesn't fit under 3926909905.

2. HS CODE: 3923900080

- Description: "Other plastic products not elsewhere specified."

- Total Tariff Rate: 58.0%

- Tariff Breakdown:

- Base: 3.0%

- Additional: 25.0%

- After April 11, 2025: 30.0%

- Note: This is also a general category and may not be the best fit unless the product is not clearly defined under 3926909905.

📌 Proactive Advice for Importers:

- Verify Material and Unit Price:

-

Ensure the product is pure plastic and not a composite or metal-based product, which may fall under different HS codes (e.g., iron/aluminum products may be subject to anti-dumping duties).

-

Check Required Certifications:

-

Confirm if any certifications (e.g., RoHS, REACH, or import permits) are required for the product in the destination country.

-

Plan Ahead for April 11, 2025:

-

If your shipment is scheduled after this date, be prepared for a significant increase in duty (from 42.8% to 65.3%).

-

Consult a Customs Broker:

- For complex or high-value shipments, consider engaging a customs broker to ensure accurate classification and compliance.

✅ Recommended HS Code: 3926909905

- Most Accurate Classification for plastic tie.

- Total Tariff Rate: 42.8% (before April 11, 2025)

- Watch for Tariff Increase: 65.3% after April 11, 2025.

Let me know if you need help with certification requirements or customs documentation.

Customer Reviews

关于检查塑料是纯质还是复合材料的提示非常有用。这让我避免了可能的分类错误。

信息不错,但希望有更多的实际进口场景中如何应用HS编码的例子。尽管如此,它还是很有用的。

我很欣赏对3926909905和3925900000的对比。这让我更容易为我的塑料绑带产品选择最准确的HS编码。

对HS编码3926909905的解析非常准确。关税详情和关于4月11日截止日期的提醒对我的规划非常有帮助。

这个网站给了我出口塑料绑带所需的所有细节。图片示例是个很好的补充,有助于确认产品类型。