| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920995000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3923109000 | Doc | 58.0% | CN | US | 2025-05-12 |

| 9403708031 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3924902000 | Doc | 33.4% | CN | US | 2025-05-12 |

| 3926904800 | Doc | 33.4% | CN | US | 2025-05-12 |

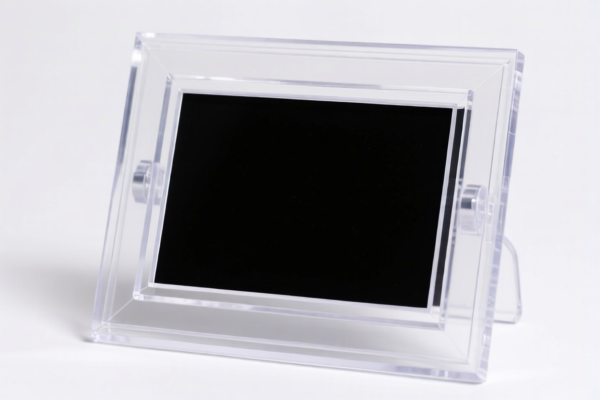

Product Classification and Tariff Analysis for "Plastic Transparent Plate Stand" (展示架plastic transparent plate stand)

Based on the product description, the most appropriate HS code is 3920995000, which classifies plastic display boards. However, depending on the exact structure and function of the "plastic transparent plate stand," other HS codes may also be relevant. Below is a structured breakdown of the applicable HS codes and their associated tariffs:

✅ HS CODE: 3920995000

Product Description: Plastic display boards (e.g., transparent plastic plate stands)

Total Tariff Rate: 60.8%

Tariff Details:

- Base Tariff Rate: 5.8%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this category

Key Notes:

- This code is suitable if the product is primarily a plastic plate used for display purposes, possibly layered or combined with other materials.

- Verify the material composition (e.g., whether it's a single-layer or multi-layered plastic board) to ensure correct classification.

📌 Alternative HS Codes (for reference):

1. HS CODE: 3923109000

Product Description: Transparent plastic display boxes or containers

Total Tariff Rate: 58.0%

Tariff Details:

- Base Tariff Rate: 3.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code applies if the product is more of a box or container rather than a flat plate.

- Check the structure (e.g., whether it has a box-like form or is a flat panel).

2. HS CODE: 9403708031

Product Description: Plastic display stands (as furniture)

Total Tariff Rate: 55.0%

Tariff Details:

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code is for plastic furniture, such as display stands or shelves.

- If the product is used as a stand or shelf, this may be a more accurate classification.

3. HS CODE: 3924902000

Product Description: Plastic photo frames or display stands (as household items)

Total Tariff Rate: 33.4%

Tariff Details:

- Base Tariff Rate: 3.4%

- Additional Tariff (General): 0.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code applies if the product is used for displaying photos or similar items and is considered a household item.

- Check if the product is used for decorative or photo-display purposes.

4. HS CODE: 3926904800

Product Description: Plastic photo albums or display stands

Total Tariff Rate: 33.4%

Tariff Details:

- Base Tariff Rate: 3.4%

- Additional Tariff (General): 0.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code is for plastic photo albums or similar items.

- If the product is used to hold or display photos, this may be a valid classification.

📌 Proactive Advice for Importers:

- Verify the product structure and function (e.g., is it a flat board, a box, a stand, or a photo frame?).

- Check the material composition (e.g., single-layer vs. multi-layer plastic, whether it's combined with other materials).

- Confirm the unit price and quantity for accurate tariff calculation.

- Check if any certifications are required (e.g., safety, environmental, or product standards).

- Be aware of the April 11, 2025, special tariff that may increase the total rate by 5% for most plastic products.

📌 Time-Sensitive Alert:

- Special Tariff after April 11, 2025:

- Applies to most plastic products, including those classified under 3920995000, 3923109000, 9403708031, 3924902000, and 3926904800.

- Impact: Tariff rate will increase by 5% (from 25% to 30%) for most products.

- Action Required: Plan import timelines accordingly to avoid higher costs.

Let me know if you need help determining the most accurate HS code based on product specifications or certification requirements.

Customer Reviews

对5%关税率的解释很清晰,但我想有一个关于如何计算关税成本的部分。

我找到了出口塑料门到美国所需的信息。HS编码3925在这里解释得很清楚。

对于像我这样刚开始接触国际贸易的人来说,这是完美的资源。HS编码和关税信息非常准确。

HS编码的细节准确,但我需要查找一下精确的产品描述。不过还是值得花时间的。

这个网站帮助我了解了塑料门5%的关税率。对我的美国市场业务非常有帮助。