Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3926400010 | Doc | 35.3% | CN | US | 2025-05-12 |

| 8306290000 | Doc | 30.0% | CN | US | 2025-05-12 |

| 8308100000 | Doc | 1.1¢/kg + 2.9%+55.0% | CN | US | 2025-05-12 |

| 9505105020 | Doc | 30.0% | CN | US | 2025-05-12 |

| 4420908000 | Doc | 58.2% | CN | US | 2025-05-12 |

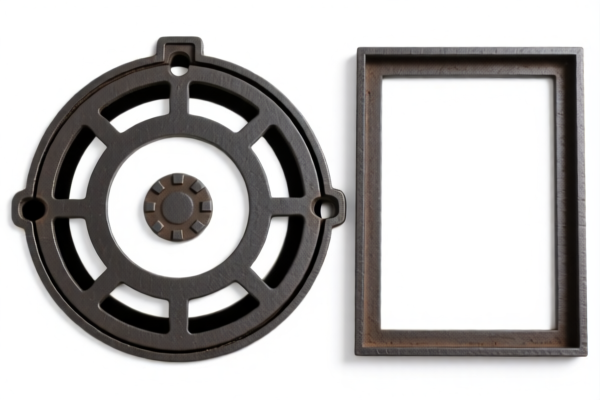

- HS CODE: 3926400010

- Product Classification: Hanging decorations made of plastic, classified under "statues and other decorative articles" in Chapter 39.

- Base Tariff Rate: 5.3%

- Additional Tariffs: 0.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 35.3%

- Proactive Advice: Confirm the material is plastic and check if any certifications (e.g., safety standards) are required for import.

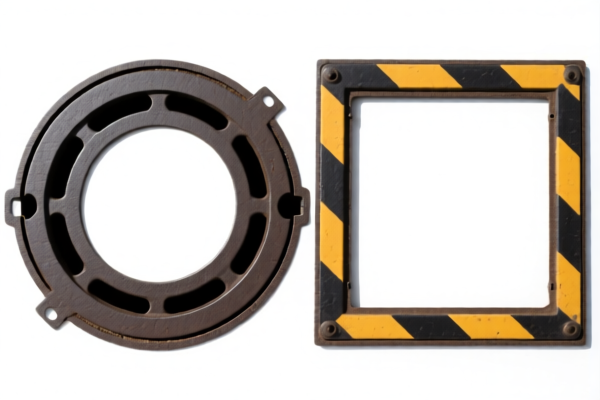

- HS CODE: 8306290000

- Product Classification: Hanging decorations made of base metal, classified under "small statues and other decorative articles" in Chapter 83.

- Base Tariff Rate: 0.0%

- Additional Tariffs: 0.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 30.0%

- Proactive Advice: Verify the material is metal and confirm if any anti-dumping duties apply.

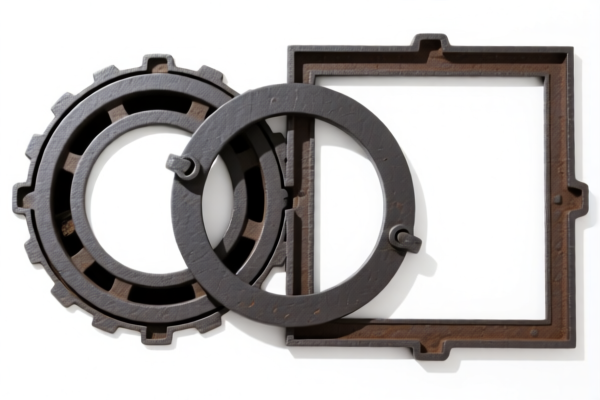

- HS CODE: 8308100000

- Product Classification: Decorative hooks made of base metal, classified under "metal hooks, rings, eyes, etc." in Chapter 83.

- Base Tariff Rate: 1.1¢/kg + 2.9%

- Additional Tariffs: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 1.1¢/kg + 2.9% + 25.0% + 30.0% = 1.1¢/kg + 57.9%

- Proactive Advice: Confirm the product is a hook or similar component and check for any anti-dumping duties on metal products.

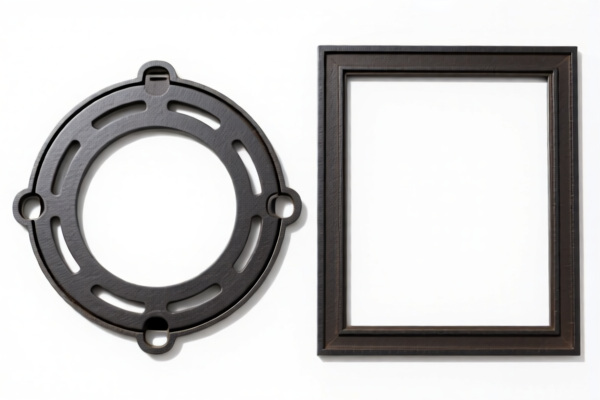

- HS CODE: 9505105020

- Product Classification: Hanging decorations with a holiday theme (e.g., Christmas), classified under "Christmas articles and parts thereof" in Chapter 95.

- Base Tariff Rate: 0.0%

- Additional Tariffs: 0.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 30.0%

- Proactive Advice: Ensure the product is clearly holiday-themed and check for any special import restrictions.

- HS CODE: 4420908000

- Product Classification: Hanging decorations made of wood, classified under "wooden statues and other wooden decorative articles" in Chapter 44.

- Base Tariff Rate: 3.2%

- Additional Tariffs: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 3.2% + 25.0% + 30.0% = 58.2%

- Proactive Advice: Confirm the product is made of wood and check for any environmental or safety certifications required.

General Reminder:

- The April 11 Special Tariff applies to all products after April 11, 2025.

- Be sure to verify the exact material and product description to ensure correct HS code classification.

- If the product contains iron or aluminum, check for anti-dumping duties that may apply.

Customer Reviews

OliviaDavis

关于4月11日特殊关税的一般提醒非常有帮助。它帮助我避免了在计算悬挂装饰品进口成本时遗漏一个重要细节。

DavidMiller

这个页面有很多有用的信息,但一开始我觉得有点令人困惑。如果HS编码分类能按材料类型进行分组,导航起来会更容易。

EmilyBrown

我需要木质装饰品的HS编码信息,4420908000包含了所有细节。58.2%的税率以及基本税率和附加税率的分解正是我所需要的。

JamesTaylor

关于HS编码9505105020的信息对我圣诞主题的悬挂装饰品非常有用。4月11日后30%的关税说明是我之前不知道的重要细节。

SophiaLee

HS编码8308100000的条目非常详细。他们对1.1美分/公斤+57.9%税率的分解清晰明了,帮助我计算了金属挂钩的确切成本。