| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 5705002090 | Doc | 58.3% | CN | US | 2025-05-12 |

| 5703108000 | Doc | 61.0% | CN | US | 2025-05-12 |

| 5702492000 | Doc | 59.0% | CN | US | 2025-05-12 |

| 5704900190 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4016910000 | Doc | 57.7% | CN | US | 2025-05-12 |

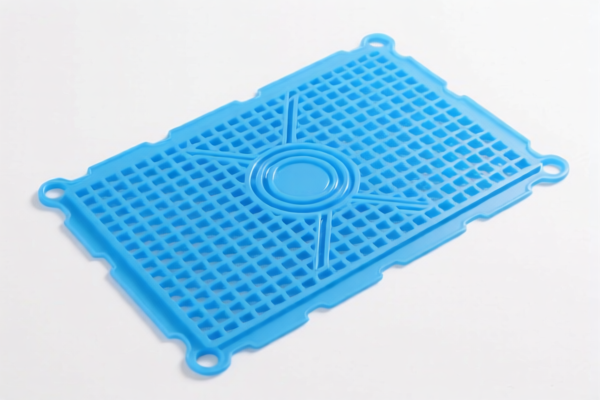

Product Classification and Tariff Analysis for "Stair Mat" (楼梯防滑垫)

Based on the product description and provided HS codes, the classification and tariff details are as follows:

✅ HS CODE: 5705002090

Product Category: Other carpets and other textile floor coverings (e.g., stair mats made of textile materials)

Base Tariff Rate: 3.3%

Additional Tariff (2025.4.2 onwards): 30.0%

Total Tariff Rate: 58.3%

Key Notes:

- Applicable if the stair mat is made of textile materials and is not classified under other categories (e.g., wool or plush carpets).

- Time-sensitive alert: Additional tariffs of 30.0% will be imposed after April 11, 2025.

✅ HS CODE: 5703108000

Product Category: Tufted carpets made of wool or fine animal hair

Base Tariff Rate: 6.0%

Additional Tariff (2025.4.2 onwards): 30.0%

Total Tariff Rate: 61.0%

Key Notes:

- Applicable if the stair mat is a tufted carpet made of wool or fine animal hair.

- Time-sensitive alert: Additional tariffs of 30.0% will be imposed after April 11, 2025.

✅ HS CODE: 5702492000

Product Category: Other carpets and other textile floor coverings with pile

Base Tariff Rate: 4.0%

Additional Tariff (2025.4.2 onwards): 30.0%

Total Tariff Rate: 59.0%

Key Notes:

- Applicable if the stair mat is a textile product with pile (e.g., loop pile or cut pile).

- Time-sensitive alert: Additional tariffs of 30.0% will be imposed after April 11, 2025.

✅ HS CODE: 5704900190

Product Category: Other毡制 carpets or other textile floor coverings

Base Tariff Rate: 0.0%

Additional Tariff (2025.4.2 onwards): 30.0%

Total Tariff Rate: 55.0%

Key Notes:

- Applicable if the stair mat is made of felt or other textile materials and not covered under other categories.

- Time-sensitive alert: Additional tariffs of 30.0% will be imposed after April 11, 2025.

✅ HS CODE: 4016910000

Product Category: Other vulcanized rubber products (e.g., rubber stair mats)

Base Tariff Rate: 2.7%

Additional Tariff (2025.4.2 onwards): 30.0%

Total Tariff Rate: 57.7%

Key Notes:

- Applicable if the stair mat is made of rubber or vulcanized rubber.

- Time-sensitive alert: Additional tariffs of 30.0% will be imposed after April 11, 2025.

📌 Proactive Advice for Importers:

- Verify the material composition of the stair mat (e.g., textile, wool, rubber, or felt) to determine the correct HS code.

- Check the unit price and product specifications to ensure compliance with customs valuation rules.

- Confirm whether any certifications (e.g., safety, environmental, or quality standards) are required for import.

- Monitor the April 11, 2025 deadline for additional tariffs and plan accordingly.

- Be aware of anti-dumping duties if the product is made of iron or aluminum (though not applicable here, it's good to be informed).

Let me know if you need help determining the exact HS code based on your product's specifications.

Customer Reviews

该页面提供了关于所有五个HS编码的清晰且详细的信息。每个关税率的分解和关键说明对我的进口计划非常有帮助。

主动建议部分是一个很好的补充。关于验证材料组成和检查4月11日截止日期的提示非常及时且相关。

HS编码5704900190的清晰度令我印象深刻。55.0%的关税率以及关于毡或纺织材料的说明让我很容易确定正确的分类。

HS编码5702492000的信息帮助我理解了纺织地毯垫的59.0%关税。关于地毯材料的说明对我的产品分类很有帮助。

关于HS编码5703108000的详细分解正是我所需要的。61.0%的关税率和时效提醒对于我的计划非常有用。