| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 8708998180 | Doc | 57.5% | CN | US | 2025-05-12 |

| 8708291500 | Doc | 2.5% <u></u>+55.0% | CN | US | 2025-05-12 |

| 3926909989 | Doc | 42.8% | CN | US | 2025-05-12 |

| 8708998180 | Doc | 57.5% | CN | US | 2025-05-12 |

| 8708103050 | Doc | 107.5% | CN | US | 2025-05-12 |

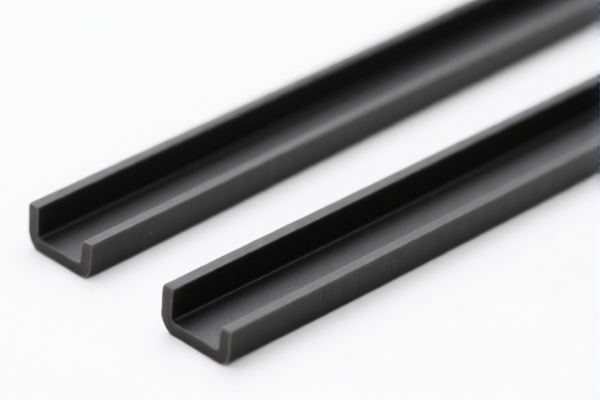

HS CODE Classification and Tariff Analysis for "Car Protector Strips" (Automotive Bumper/Door Protection Strips)

Below is a structured breakdown of the HS CODE classifications and associated tariff rates for car protector strips, based on the provided data:

✅ HS CODE: 8708998180

Product Description: General-purpose car protector strips (not specific to bumpers or doors)

Tariff Summary:

- Base Tariff Rate: 2.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff Rate: 57.5%

Key Notes:

- This code is used for general-purpose car parts and accessories not covered under more specific codes.

- No anti-dumping duties apply to this code.

- Action Required: Confirm whether your product is a general-purpose part or falls under a more specific category (e.g., bumper or door-specific).

✅ HS CODE: 8708291500

Product Description: Door protector strips (specific to car doors)

Tariff Summary:

- Base Tariff Rate: 2.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff Rate: 57.5%

Key Notes:

- This code is more specific than 8708998180 and applies to door components.

- Action Required: Verify if your product is specifically for doors or is more general in use.

✅ HS CODE: 3926909989

Product Description: Plastic-made car protector strips (e.g., door or bumper strips made of plastic)

Tariff Summary:

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff Rate: 42.8%

Key Notes:

- This code is for plastic products not covered under more specific categories.

- Action Required: Confirm the material composition of your product (e.g., is it 100% plastic or a composite?).

- Certifications: May require material declarations or import permits for certain plastics.

✅ HS CODE: 8708103050

Product Description: Bumper protector strips (specific to car bumpers)

Tariff Summary:

- Base Tariff Rate: 2.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping Duty (for steel/aluminum products): 50.0%

- Total Tariff Rate (for steel/aluminum): 107.5%

Key Notes:

- This code is specific to bumper parts, including bumper strips.

- Action Required: If your product is made of steel or aluminum, be aware of the anti-dumping duty of 50.0%.

- Certifications: May require material testing or origin documentation.

📌 Proactive Advice for Importers:

- Material Verification:

-

Confirm the material (plastic, steel, aluminum, etc.) to determine the correct HS CODE and applicable duties.

-

Product Specificity:

-

Determine whether your product is for doors, bumpers, or general use to choose the most accurate HS CODE.

-

Tariff Changes After April 11, 2025:

-

Be aware of the special tariff increase of 30.0% for most products after this date.

-

Certifications and Documentation:

- For plastic products, ensure material declarations are available.

-

For steel/aluminum products, be prepared for anti-dumping duties and origin documentation.

-

Tariff Calculation Tool:

- Use the total tariff rate (base + additional + special) to estimate import costs accurately.

Let me know if you need help determining the correct HS CODE based on your product specifications or certification requirements.

Customer Reviews

这个页面为我节省了数小时的研究时间。关于HS编码3925和塑料建筑门5%关税的细节正是我发货所需的信息。

HS编码信息非常准确,关税税率也解释得很清楚。我希望有更多关于如何应用这些税率的细节,但总体来说这是一个不错的资源。

作为一名出口商,这个页面让我很容易理解这些门的5%关税。我一定会收藏起来以备将来参考。

该页面对出口塑料门的关税税率和HS编码信息非常详尽。如果能与其他材料进行比较会更好。

我正在寻找塑料门的HS编码细节,找到了我需要的准确信息,内容组织得很好。