| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3903110000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921135000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 6806900090 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4008115000 | Doc | 58.3% | CN | US | 2025-05-12 |

| 8480300000 | Doc | 57.8% | CN | US | 2025-05-12 |

Here is the classification and tariff information for foam blocks (泡沫字母块) based on the provided HS codes and details:

✅ HS CODE: 3903110000

Product Description: Foam plastic particles, foam plastic balls, foam plastic beads, and raw materials for expanded polystyrene (EPS), etc.

Applicable to: Foam blocks made from polystyrene or similar materials.

📌 Tariff Information:

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff Rate: 61.5%

⚠️ Notes:

- This code applies to primary forms of polystyrene foam, such as beads or particles used in manufacturing.

- If your product is not made from polystyrene, this code may not apply.

✅ HS CODE: 3921135000

Product Description: Polyurethane foam blocks, categorized under "other plastic sheets, films, foils, and strips, cellular."

Applicable to: Foam blocks made from polyurethane.

📌 Tariff Information:

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff Rate: 59.2%

⚠️ Notes:

- This code is for cellular polyurethane products, such as foam blocks used in insulation or packaging.

- Ensure your product is not classified under a more specific code.

✅ HS CODE: 6806900090

Product Description: Foam strips or blocks made from mineral-based insulating materials (e.g., mineral wool, glass wool, etc.).

Applicable to: Foam blocks used for thermal or acoustic insulation made from mineral-based materials.

📌 Tariff Information:

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff Rate: 55.0%

⚠️ Notes:

- This code is for non-plastic foam blocks made from mineral-based insulating materials.

- If your product is not mineral-based, this code may not apply.

✅ HS CODE: 4008115000

Product Description: Foam rubber sheets or blocks, made from vulcanized rubber with a cellular structure.

Applicable to: Foam rubber blocks used for cushioning or insulation.

📌 Tariff Information:

- Base Tariff Rate: 3.3%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff Rate: 58.3%

⚠️ Notes:

- This code applies to foam rubber products, not plastic or mineral-based.

- Confirm the material composition of your product before classification.

✅ HS CODE: 8480300000

Product Description: Foam blocks used as molds in metal casting processes, made from rubber or plastic.

Applicable to: Foam blocks used as mold cores or patterns in industrial casting.

📌 Tariff Information:

- Base Tariff Rate: 2.8%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff Rate: 57.8%

⚠️ Notes:

- This code is for industrial molds, not general-purpose foam blocks.

- Ensure your product is used in metal casting or similar industrial applications.

📌 Proactive Advice:

- Verify the material (e.g., polystyrene, polyurethane, rubber, mineral-based) to determine the correct HS code.

- Check the unit price and certifications required (e.g., safety, environmental compliance).

- Monitor the April 11, 2025 tariff change to avoid unexpected costs.

- If your product is used in industrial casting, consider HS CODE 8480300000.

Let me know if you need help determining the exact material or intended use of your foam blocks.

Customer Reviews

关于HS编码3921135000总关税率的说明对我使用的聚氨酯泡沫块非常有用,我现在感觉更有信心了。

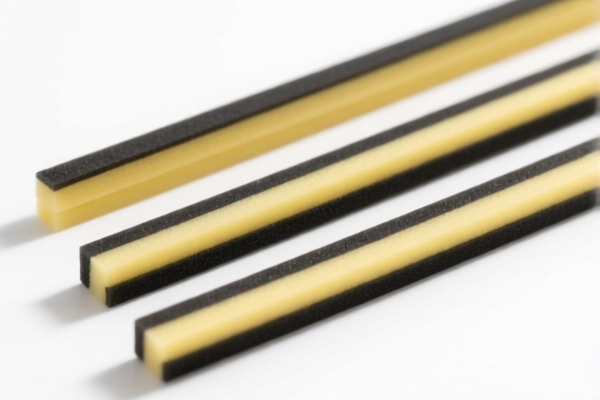

我印象深刻的是不同HS编码的解释非常清晰。泡沫块的图片也帮助我更好地理解了产品。

HS编码6806900090部分很有帮助,但我发现在没有更多矿物基泡沫产品示例的情况下,有些令人困惑。

关于2025年4月11日关税变更的主动建议非常有用,我不知道这会影响我的出口成本。

关于HS编码4008115000的信息清晰且专门针对泡沫橡胶块,关税详情解释得很好。