39 归类原因:

The HS code "39" is classified under "Plastics and articles thereof".

Specifically, this chapter mainly includes:

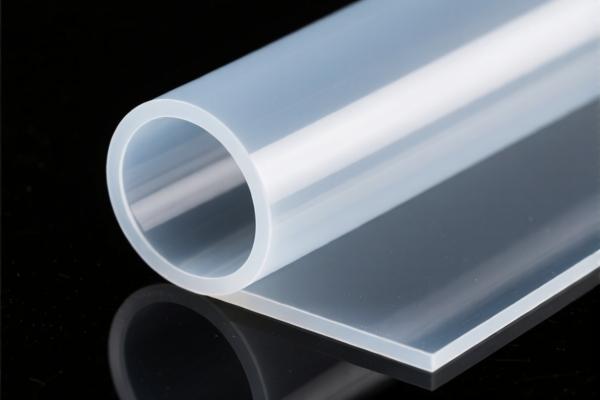

- Primary plastic forms: Such as plastic granules, powder, sheets, rods, tubes, etc.

- Plastic products: Including various types of plastic products, such as:

- Packaging materials (plastic bags, plastic bottles, plastic boxes, etc.)

- Building materials (plastic pipes, plastic sheets, plastic films, etc.)

- Daily necessities (plastic basins, plastic buckets, plastic furniture, etc.)

- Medical equipment (plastic syringes, plastic infusion bags, etc.)

- Automotive parts (plastic bumpers, plastic interior parts, etc.)

- Electrical insulation materials (plastic wire and cable sheaths, etc.)

Classification basis:

The customs classification of plastics and their products mainly depends on the following principles:

- Material composition: If the main component is plastic, it is classified under Chapter 39.

- Product nature: Even if plastic is combined with other materials, if plastic is the main component or plays a decisive role, it is generally classified under Chapter 39.

-

- Usage: Some specific plastic products may be classified into other chapters based on their function, but most plastic products are classified under Chapter 39.

In short, as long as the main component of the product is plastic, or plastic plays a major role in the product, it should be considered for classification under Chapter 39.

If you need more detailed classification information or want to determine the HS code of a specific plastic product, please provide more detailed product descriptions, such as:

- Type of plastic (polyethylene, polypropylene, polyvinyl chloride, etc.)

- Specific use of the product

- Shape and size of the product

- Whether the product is combined with other materials

I will do my best to help you classify it more accurately.

Disclaimer: HS code classification is a professional matter, and the final classification result is based on the official interpretation of customs. The information I provide is for reference only and cannot be used as the final basis for classification.

3909: Amino resins, phenolic resins and polyurethanes, primary forms:

3909.50 is classified as:

Amino resins, phenolic resins and polyurethanes, primary forms:

- Polyurethane:

- Cement

8-10 digits explanation: No corresponding HS CODE, the user-entered HS CODE is incorrect

Examples of products:

- Plastic bottles (HS Code: 3920.10)

- Plastic bags (HS Code: 3920.90)

- Plastic pipes (HS Code: 3920.10)

- Plastic containers (HS Code: 3920.90)

- Plastic sheets (HS Code: 3920.10)

- Plastic toys (HS Code: 3920.90)

- Plastic furniture (HS Code: 3920.90)

- Plastic packaging (HS Code: 3920.90)

Customer Reviews

No reviews yet.