| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 8443399000 | Doc | 37.5% | CN | US | 2025-05-12 |

| 8485909000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 8485909000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 8485909000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 8485909000 | Doc | 55.0% | CN | US | 2025-05-12 |

Here is the structured classification and tariff information for 3D printers and related products, based on the provided HS codes and tax details:

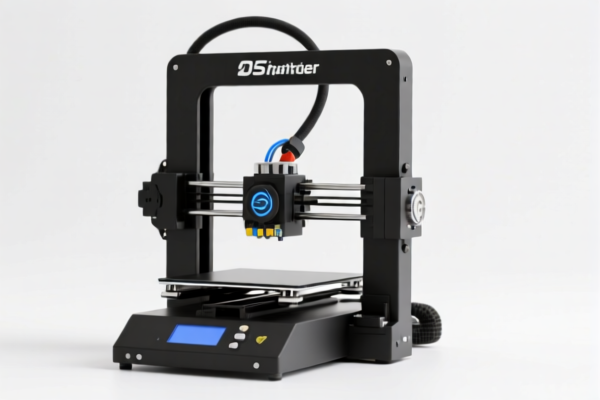

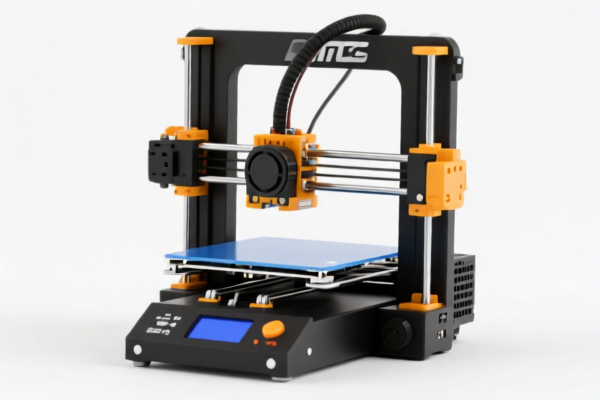

✅ HS CODE: 8443399000

Product Description: 3D printers (classified under printing machines, other than those in heading 8442)

Total Tax Rate: 37.5%

Tax Breakdown:

- Base Tariff Rate: 0.0%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This classification applies to general-purpose 3D printers not specifically covered under other headings.

- Action Required: Verify if the printer is a standalone unit or part of a larger system. Confirm if it is used for industrial or commercial purposes, which may affect classification.

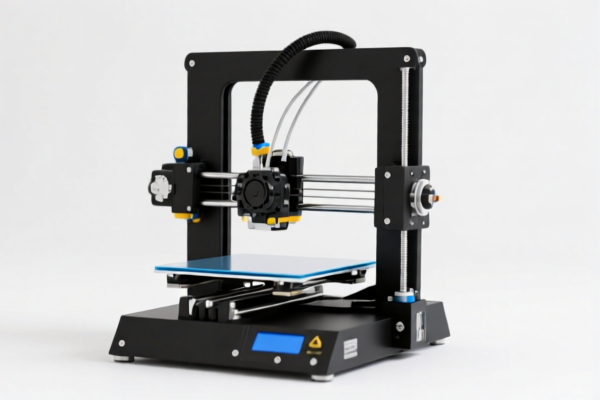

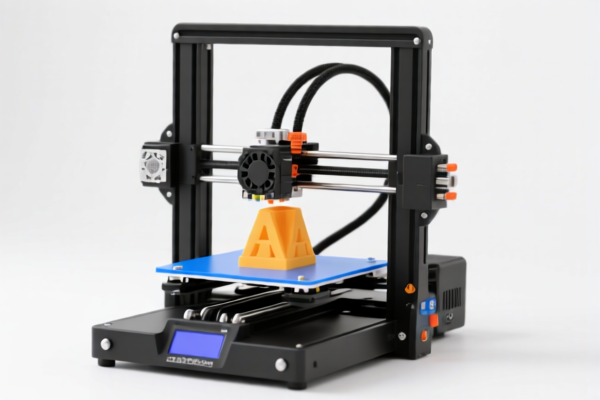

✅ HS CODE: 8485909000

Product Description: 3D printer parts or components (classified under parts of additive manufacturing machines)

Total Tax Rate: 55.0%

Tax Breakdown:

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code applies to parts or components used in 3D printers, such as nozzles, extruders, or control boards.

- Action Required: Confirm the exact nature of the component and whether it is a "part" or a "complete unit" for customs purposes.

✅ HS CODE: 8528695500

Product Description: 3D color projectors (classified under projectors, not elsewhere specified)

Total Tax Rate: 41.4%

Tax Breakdown:

- Base Tariff Rate: 3.9%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code applies to projectors used in 3D printing or related processes.

- Action Required: Ensure the device is indeed a projector and not a standalone 3D printer.

✅ HS CODE: 8528696000

Product Description: 3D color projectors (alternative classification)

Total Tax Rate: 42.5%

Tax Breakdown:

- Base Tariff Rate: 5.0%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code may apply to more advanced or specialized 3D color projectors.

- Action Required: Confirm the exact model and function of the projector to ensure correct classification.

✅ HS CODE: 8443321020

Product Description: Laser printers (classified under other printers, including those connected to data processing systems)

Total Tax Rate: 37.5%

Tax Breakdown:

- Base Tariff Rate: 0.0%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code applies to laser printers that can be connected to computers or networks.

- Action Required: Ensure the device is not a 3D printer but a traditional laser printer, as misclassification can lead to incorrect tariffs.

📌 Proactive Advice for Importers:

- Verify Product Specifications: Confirm whether the device is a 3D printer, a laser printer, a projector, or a component.

- Check Material and Unit Price: This may affect whether the product is classified as a complete machine or a part.

- Review Required Certifications: Some products may require CE, RoHS, or other certifications for import compliance.

- Monitor Tariff Changes: The April 11, 2025 tariff increase applies to all listed products, so plan accordingly.

- Consult a Customs Broker: For complex or high-value imports, professional assistance is recommended to avoid delays or penalties.

Let me know if you need help determining the correct HS code for a specific 3D printer model.

Customer Reviews

Excellent resource for HS codes related to 3D printers. The detailed tax breakdown and notes saved me time and potential errors.

The advice on verifying product specs and certifications was really useful. I didn't realize how important that is for customs compliance.

The tax breakdown for 8443321020 was very clear. I was confused about laser printers vs. 3D printers, and this clarified everything.

Good overview of the different HS codes for 3D printers. The warnings about classification differences were a nice touch.

The explanations for HS code 8528695500 were very helpful. I wasn't sure if my 3D projector fell under this category, but now I'm confident.