| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 8485800000 | Doc | 57.5% | CN | US | 2025-05-12 |

| 8485200000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 8485901000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 8485300000 | Doc | 57.5% | CN | US | 2025-05-12 |

| 8443399000 | Doc | 37.5% | CN | US | 2025-05-12 |

Here is the classification and tariff information for 3D printer resin based on the provided HS codes and tariff details:

✅ Product Classification: 3D Printer Resin

Note: The classification of "3D printer resin" depends on its material composition and intended use. Based on the HS codes provided, the most relevant classifications are:

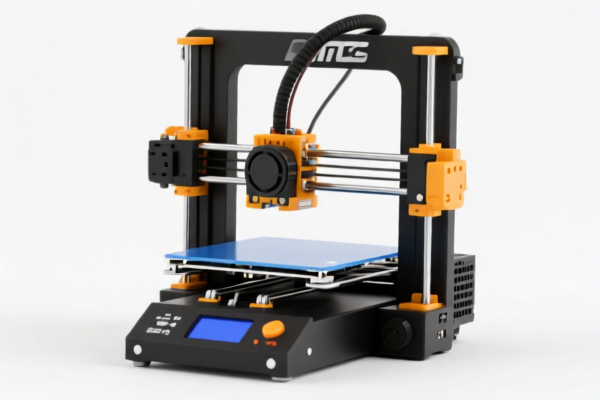

📌 HS CODE: 8485800000

Description: Resin 3D printers

Total Tax Rate: 57.5%

Tariff Breakdown:

- Base Tariff Rate: 2.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes: - This code applies to resin-based 3D printers. - The highest total tax rate among the listed options. - Time-sensitive: Tariff increases to 30.0% after April 11, 2025.

📌 HS CODE: 8485901000

Description: 3D printed plastic parts

Total Tax Rate: 58.1%

Tariff Breakdown:

- Base Tariff Rate: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes: - This code applies to 3D printed parts made of plastic, not the printer itself. - Highest total tax rate among all options. - Time-sensitive: Tariff increases to 30.0% after April 11, 2025.

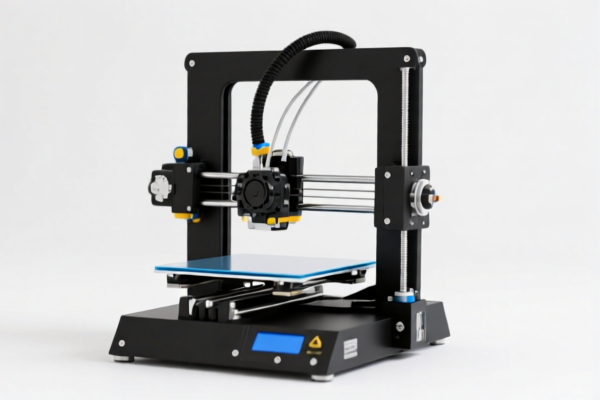

📌 HS CODE: 8485200000

Description: Rubber 3D printers

Total Tax Rate: 58.1%

Tariff Breakdown:

- Base Tariff Rate: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes: - This code applies to 3D printers using rubber materials. - Highest total tax rate among all options. - Time-sensitive: Tariff increases to 30.0% after April 11, 2025.

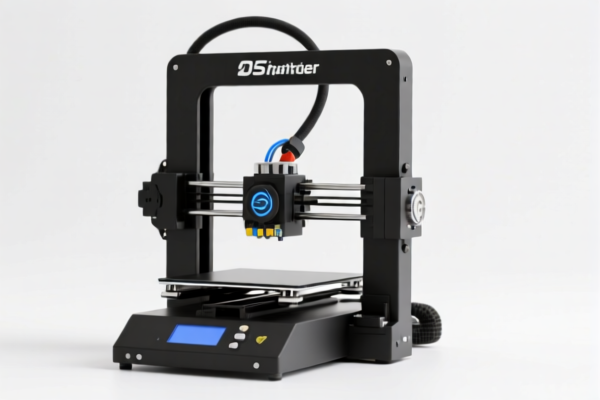

📌 HS CODE: 8485300000

Description: Cement material 3D printing equipment

Total Tax Rate: 57.5%

Tariff Breakdown:

- Base Tariff Rate: 2.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes: - This code applies to 3D printing equipment using cement or similar materials. - Moderate tax rate compared to others. - Time-sensitive: Tariff increases to 30.0% after April 11, 2025.

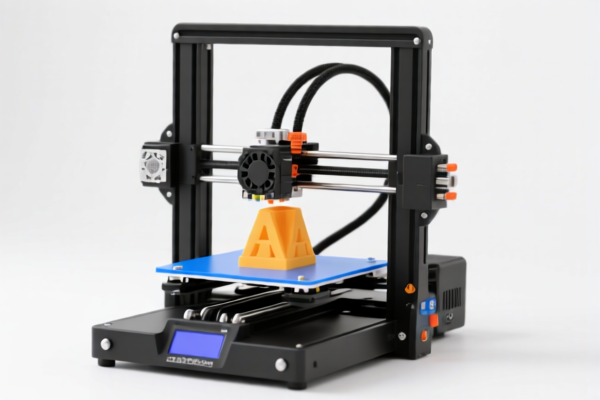

📌 HS CODE: 8443399000

Description: 3D printers classified as printing machines

Total Tax Rate: 37.5%

Tariff Breakdown:

- Base Tariff Rate: 0.0%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

Key Notes: - This code applies to general-purpose 3D printers classified under printing machinery. - Lowest total tax rate among all options. - Time-sensitive: Tariff increases to 30.0% after April 11, 2025.

📌 Proactive Advice for Importers:

- Verify the material of the 3D printer or resin used (e.g., resin, plastic, rubber, cement).

- Check the unit price and product description to ensure correct HS code classification.

- Confirm whether the product is a printer or a printed part, as this affects the code.

- Review required certifications (e.g., CE, RoHS, etc.) depending on the product type and destination country.

- Plan import timelines carefully, as tariff rates increase significantly after April 11, 2025.

Let me know if you need help determining the correct HS code based on your specific product details.

Customer Reviews

The information was helpful, but I wish there were more examples of how to determine the correct HS code based on product specifics. Still, it's a good start.

The page provided a good overview of the different HS codes for 3D printer resin. The proactive advice about verifying material and planning timelines was very useful.

I was confused about the difference between 3D printers and printed parts, but the explanation under HS code 8485200000 helped clarify everything.

Found the HS code 8485300000 for cement material 3D printing equipment. The moderate tax rate and clear description made this the best choice for my needs.

Detailed info on HS code 8485901000 for 3D printed plastic parts. The breakdown of the tax rates and the note about the special tariff after April 11 were very clear.