49 chapter classification reasons:

The first two digits of the HS code provided by you are "49".

Chapter 49 classification reasons:

HS code Chapter 49 covers books, newspapers, printed matter, maps, and commercial drawings.

Specifically, this chapter is mainly classified based on the following reasons:

- Information transmission and knowledge carrier: The main function of these products is to transmit information, record knowledge, and provide cultural and entertainment value.

- Printing and reproduction technology: These products all involve printing, typesetting, and reproduction technologies.

- Content and form: The products in this chapter are diverse in form, including books, newspapers, magazines, musical scores, maps, posters, brochures, etc., but all are printed or reproduced in a similar manner.

More detailed classification scope includes:

- Books: Including various types of books, such as novels, textbooks, dictionaries, field guides, etc.

- Newspapers and periodicals: Including daily newspapers, weekly newspapers, monthly magazines, etc.

- Printed matter: Including posters, flyers, brochures, labels, instructions, etc.

- Maps and commercial drawings: Including various types of maps, nautical charts, geological maps, architectural drawings, etc.

- Musical scores: Including musical scores for various instruments.

- Other printed matter: Including cards with printed patterns, wallpaper, printed textile products, etc.

Notes to keep in mind:

- HS code classification is based on the specific characteristics and purposes of the product, not the product name.

- If a product has multiple characteristics, it should be classified based on its main characteristic.

- Customs may adjust the classification of products based on actual circumstances.

Hope the above explanation helps you understand the classification reasons for HS code "49". If you need more detailed information or need to classify specific products, please provide a more detailed product description, and I will try my best to answer for you.

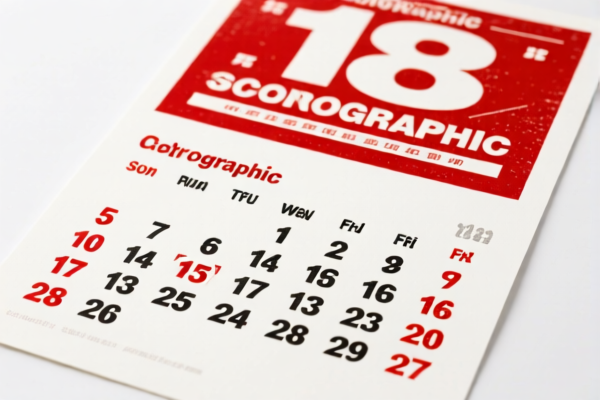

HS code: 4910

Classification description: Various calendars, printed matter, including calendar blocks.

Meaning: Refers to printed calendars of all kinds, including complete calendars and calendar blocks.

HS code: 4910.00

Classification: Any kind of calendar, printed matter, including calendar pages.

Specific meaning: Refers to calendars printed on paper or cardboard using entirely or partially flat printing techniques, with a thickness exceeding 0.51 millimeters.

HS code 8-10 digits: No corresponding HS code, the user input HS code is incorrect.

Examples of products:

- Calendar books

- Desk calendars

- Wall calendars

- Monthly planners

- Printed calendars with special themes (e.g., holidays, festivals)

- Calendar blocks for children

- Printed calendar pages for office use

- Custom printed calendars with company logos

- Calendar stickers and calendar cards

- Art calendars with illustrations

Customer Reviews

This page was a lifesaver. It gave me all the necessary info about HS Code 3925 and the 5% tariff for exporting plastic doors to the US.

The details on the 5% tariff and HS Code 3925 were spot on. I just wish the page had more links to related trade regulations.

I couldn’t have done it without this page. The HS Code 3925 info and tariff rates made everything so much clearer for my business.

I was looking for HS Code details for plastic doors, and this page had exactly what I needed. Very helpful for exporting to the US.

The page provided good information on trade regulations, but I wish there were more examples of similar products under the same HS Code.