The first two digits of the HS code "73" represent iron and steel products.

Specifically, this chapter includes the following main contents:

- Steel structural components: Such as bridges, buildings, towers, etc.

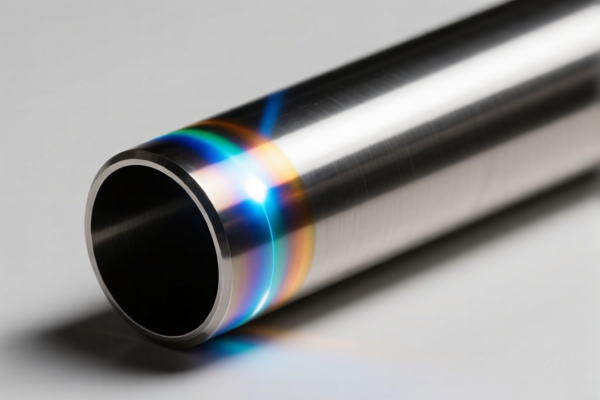

- Cast iron products: Such as pipes, pipe fittings, radiators, etc.

- Steel products: Such as steel plates, steel pipes, steel wires, nails, bolts, nuts, etc.

- Other iron and steel products: Such as springs, chains, fasteners, tools, etc.

Reason for classification:

The establishment of the "73" chapter is to classify and manage various products made primarily of iron and steel. These products typically have the following characteristics:

- Main material is iron or steel: The core component of the product is iron or steel.

- Wide range of applications: Iron and steel products are widely used in construction, machinery, transportation, energy, and other industries.

- Different manufacturing processes and product forms: Iron and steel products can be manufactured through casting, forging, rolling, welding, and other processes, and can take various forms and functions.

Therefore, the first two digits of the HS code "73" are used to identify and classify all products made primarily of iron or steel.

If you can provide a more specific HS code (e.g., 7304, 7310, etc.), I can provide a more detailed classification explanation.

First four digits explanation: HS code: 7312

Classification description: Iron wire, ropes, cables, braided cords, slings, etc., made of iron or steel, not insulated.

Specifically includes: Iron wire, ropes, cables, braided cords, slings, etc., but these products have not undergone electrical insulation treatment.

Six-digit explanation: HS code: 7312.90

Classification: Iron wire, ropes, cables, braided cords, slings, etc., made of iron or steel, not insulated → Other.

Meaning: This code covers various non-insulated iron wire, ropes, cables, braided cords, slings, etc., made of iron or steel, and belongs to the "Other" category.

8-10 digit explanation:

hscode: 7312900000

Classification: Iron wire, ropes, cables, braided cords, slings, etc., made of iron or steel, not insulated → Other

Explanation: This HS code belongs to the "Other" subcategory under the classification of non-insulated iron wire, ropes, cables, braided cords, slings, etc., made of iron or steel.

Product examples: * Steel wire for construction * Steel ropes used in lifting equipment * Steel braided cords for industrial applications * Steel slings for load handling * Steel cables for temporary structures * Steel wire used in fencing * Steel ropes for agricultural use * Steel braided cords for mechanical systems

Customer Reviews

The HS code 3925 explanation was spot on, but I wish there was more about how to apply it in practice.

Excellent resource for anyone exporting plastic doors. The tariff rates and HS code info were very accurate.

This page made it easy to understand the tariff rates for plastic builder’s doors. Definitely worth checking out.

The trade details section was a bit technical, but overall the page provided good HS code info for exporting to the US.

I was looking for HS code details for plastic doors and this page had exactly what I needed. Very helpful!