The first two digits of the HS code 73 indicate that it generally represents steel products.

Specifically, Chapter 73 covers the following main contents:

- Steel structural components: For example, bridges, buildings, towers, etc.

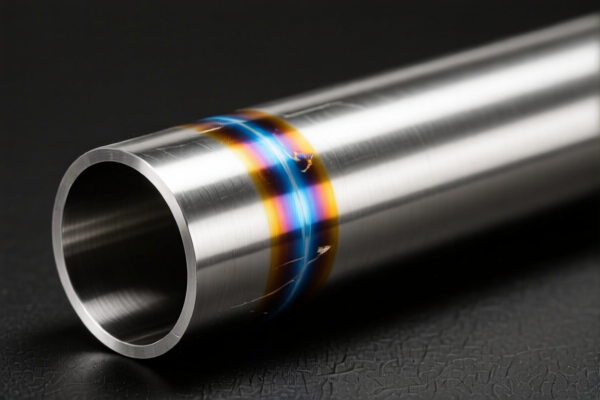

- Steel plates, steel strips, steel pipes, steel sections, etc.: Various shapes and sizes of steel materials.

- Cast iron products: Such as pipes, pipe fittings, radiators, etc.

- Other steel products: For example, screws, bolts, washers, springs, chains, etc.

Reason for classification:

Chapter 73 was established to classify various steel products for management purposes, facilitating the statistics of trade data, the collection of tariffs, and the implementation of trade policies. Steel is an important industrial basic material, widely used in construction, machinery, transportation, energy, and other fields. Therefore, it is of great significance to classify and manage steel products specifically.

In short, if the product is made of steel and is not a steel product that has already been clearly classified in other chapters (such as tools, machinery, etc.), it is likely to fall under Chapter 73.

For a more accurate determination, please provide a more detailed product description or more digits of the HS code.

First four digits explanation: HS Code: 7315

Classification Description: Chains and parts of chains, of iron or steel.

Other Information: No additional information available.

Six-digit explanation: HS Code: 7315.90

Classification: Chains and parts of chains, of iron or steel --> Other parts

Meaning: This code covers parts of chains and chains made of iron or steel that do not fall under other specific sub-items.

8-10 digits explanation: HS Code: 7315900000

Classification: Chains and parts of chains, of iron or steel --> Other parts

Explanation: This HS code belongs to the category of chains and parts of chains made of iron or steel, specifically classified as "Other parts."

Product Examples: - Steel chain links - Steel chain components (excluding those specifically listed) - Steel parts for industrial chains - Steel chain fittings (not otherwise specified) - Steel chain connectors (not otherwise specified)

Customer Reviews

The content is okay, but I found it a bit too technical. Maybe a bit more guidance for beginners would help.

Perfect resource for understanding the 5% tariff rate and HS code 3925. Definitely worth bookmarking for future reference.

This was the most accurate information I found on HS code 3925. Saved me time and money on my first export shipment.

The page gave a good overview of the tariff rates and HS code classifications. It would be better with a comparison table, but it's still very useful.

The information on the 5% tariff rate was exactly what I needed. It's clear and to the point, though I wish there were more examples.