The first two digits of the HS code "74" represent mineral products.

Specifically, this chapter includes various products extracted, processed, or manufactured from minerals, mainly including:

- Stone, gravel, cement, gypsum, and other building materials

- Ceramic products (such as tiles, tableware, sanitary ceramics, etc.)

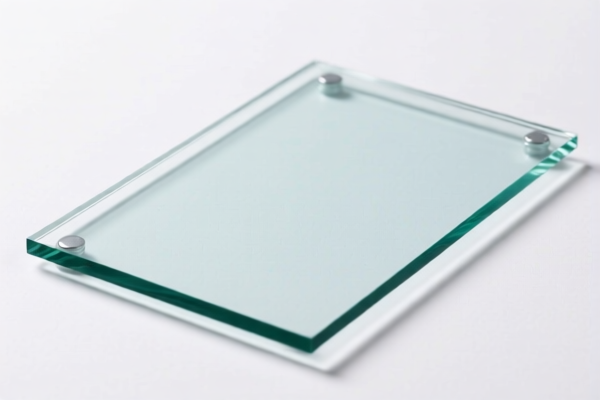

- Glass products (such as flat glass, glass fiber, glass containers, etc.)

- Other mineral products (such as mica, asbestos, refractory materials, etc.)

Therefore, if your product is one of the above types of mineral products, its HS code is likely to start with "74".

To more accurately determine the HS code for your product, you also need to consider factors such as the specific composition, use, and processing method of the product.

First four digits explanation: hsCode: 7411

Description: Copper tubes and copper tube fittings.

Six-digit explanation: Classification: Copper tubes and copper tubes

Specific meaning: Copper alloy tubes and copper tubes, especially copper-nickel based alloy tubes (cupronickel) or copper-nickel-zinc based alloy tubes (nickel silver).

8-10 digit explanation: hscode: 7411220000 Classification: Copper tubes and copper tubes: --> Copper alloy made: --> Copper-nickel based alloy (cupronickel) or copper-nickel-zinc based alloy (nickel silver) Explanation: This hscode belongs to the classification of copper tubes and copper tubes, specifically copper alloy made, and is a product made of copper-nickel based alloy (cupronickel) or copper-nickel-zinc based alloy (nickel silver).

Examples of products: * Copper-nickel alloy water pipes * Copper-nickel alloy heat exchanger tubes * Copper-nickel alloy electrical conduits * Copper-nickel-zinc alloy valves * Copper-nickel-zinc alloy fittings

Customer Reviews

No reviews yet.