| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 5111112000 | Doc | 62.0% | CN | US | 2025-05-12 |

| 5111191000 | Doc | 62.0% | CN | US | 2025-05-12 |

| 5112111000 | Doc | 62.0% | CN | US | 2025-05-12 |

| 5112192000 | Doc | 62.0% | CN | US | 2025-05-12 |

| 5603941010 | Doc | 55.0% | CN | US | 2025-05-12 |

| 5603941090 | Doc | 55.0% | CN | US | 2025-05-12 |

| 5602210000 | Doc | 49.5¢/kg + 7.5%+55.0% | CN | US | 2025-05-12 |

| 5602101000 | Doc | 67.0% | CN | US | 2025-05-12 |

| 5601290020 | Doc | 59.0% | CN | US | 2025-05-12 |

| 5601290090 | Doc | 59.0% | CN | US | 2025-05-12 |

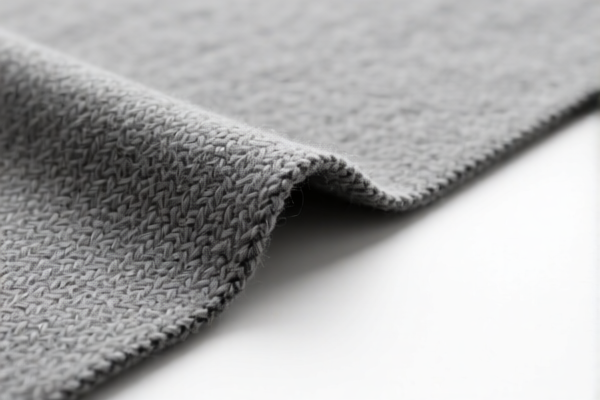

Customs Classification and Tariff Analysis for 85%+ Wool Upholstery Fabric

Below is a structured breakdown of the HS codes and associated tariffs for 85%+ wool upholstery fabric, based on your provided product descriptions and tariff details.

✅ HS Code: 5111112000

Description: Woven fabrics of carded wool or of carded fine animal hair, containing 85% or more by weight of wool or fine animal hair, of a weight not exceeding 300 g/m², tapestry and upholstery fabrics of a weight not exceeding 140 g/m².

🔍 Tariff Breakdown:

- Base Tariff: 7.0%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Total Tariff: 62.0%

📌 Key Notes:

- This code applies to lightweight (≤140 g/m²) woven upholstery fabrics made of carded wool with ≥85% wool content.

- No anti-dumping duties are mentioned for this category.

- Certifications may be required for textile exports (e.g., origin, fiber content).

✅ HS Code: 5111191000

Description: Woven fabrics of carded wool or of carded fine animal hair, containing 85% or more by weight of wool or fine animal hair, other than those of a weight not exceeding 300 g/m², tapestry and upholstery fabrics.

🔍 Tariff Breakdown:

- Base Tariff: 7.0%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Total Tariff: 62.0%

📌 Key Notes:

- This code applies to woven upholstery fabrics made of carded wool with ≥85% wool content, but not limited to ≤300 g/m².

- Same tariff structure as 5111112000.

- Ensure fabric weight is correctly classified to avoid misclassification.

✅ HS Code: 5112111000

Description: Woven fabrics of combed wool or of combed fine animal hair, containing 85% or more by weight of wool or fine animal hair, of a weight not exceeding 200 g/m², tapestry and upholstery fabrics of a weight not exceeding 140 g/m².

🔍 Tariff Breakdown:

- Base Tariff: 7.0%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Total Tariff: 62.0%

📌 Key Notes:

- This code applies to combed wool upholstery fabrics with ≥85% wool content, ≤140 g/m².

- Combed wool is generally of higher quality than carded wool.

- Same tariff structure as above.

✅ HS Code: 5112192000

Description: Woven fabrics of combed wool or of combed fine animal hair, containing 85% or more by weight of wool or fine animal hair, other than those of a weight not exceeding 200 g/m², tapestry and upholstery fabrics.

🔍 Tariff Breakdown:

- Base Tariff: 7.0%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Total Tariff: 62.0%

📌 Key Notes:

- This code applies to combed wool upholstery fabrics with ≥85% wool content, not limited to ≤200 g/m².

- Same tariff structure as above.

- Ensure fabric weight is correctly classified to avoid misclassification.

⚠️ Other Relevant HS Codes (Non-Woven or Felt Products)

✅ HS Code: 5603941010 / 5603941090

Description: Nonwovens, weighing more than 150 g/m², floor covering underlays of wool or fine animal hair (or other).

🔍 Tariff Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Total Tariff: 55.0%

📌 Key Notes:

- These codes apply to nonwoven underlays used in floor coverings, not upholstery.

- Not applicable to woven upholstery fabrics.

✅ HS Code: 5602210000

Description: Felt, not impregnated, coated, covered or laminated, of wool or fine animal hair.

🔍 Tariff Breakdown:

- Base Tariff: 49.5¢/kg + 7.5%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Total Tariff: 49.5¢/kg + 7.5% + 55.0%

📌 Key Notes:

- This code applies to felt made of wool or fine animal hair.

- Not applicable to woven upholstery fabrics.

- Tariff includes a specific rate per kg.

✅ HS Code: 5602101000

Description: Needleloom felt and stitchbonded fiber fabrics, laminated fabrics.

🔍 Tariff Breakdown:

- Base Tariff: 12.0%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Total Tariff: 67.0%

📌 Key Notes:

- This code applies to laminated needleloom or stitchbonded fabrics.

- Not applicable to woven upholstery fabrics.

📌 Proactive Advice for Importers/Exporters

- Verify fabric composition: Ensure the product contains ≥85% wool or fine animal hair.

- Check fabric weight: Classify based on weight per square meter (e.g., ≤140 g/m² vs. >140 g/m²).

- Confirm whether it's carded or combed wool – this affects HS code.

- Check for certifications: Some countries may require textile origin or fiber content certification.

- Be aware of the April 11, 2025 tariff increase: This will increase the total tariff by 5%.

- Avoid misclassification: Ensure the product is not a nonwoven or felt if using HS codes 5111 or 5112.

📅 Time-Sensitive Alert

Additional tariffs imposed after April 11, 2025:

- All applicable HS codes (5111, 5112, 5601, 5602, 5603) will see an additional 5% increase in total tariff.

Let me know if you need help with certification requirements, customs documentation, or tariff calculation tools.

Customs Classification and Tariff Analysis for 85%+ Wool Upholstery Fabric

Below is a structured breakdown of the HS codes and associated tariffs for 85%+ wool upholstery fabric, based on your provided product descriptions and tariff details.

✅ HS Code: 5111112000

Description: Woven fabrics of carded wool or of carded fine animal hair, containing 85% or more by weight of wool or fine animal hair, of a weight not exceeding 300 g/m², tapestry and upholstery fabrics of a weight not exceeding 140 g/m².

🔍 Tariff Breakdown:

- Base Tariff: 7.0%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Total Tariff: 62.0%

📌 Key Notes:

- This code applies to lightweight (≤140 g/m²) woven upholstery fabrics made of carded wool with ≥85% wool content.

- No anti-dumping duties are mentioned for this category.

- Certifications may be required for textile exports (e.g., origin, fiber content).

✅ HS Code: 5111191000

Description: Woven fabrics of carded wool or of carded fine animal hair, containing 85% or more by weight of wool or fine animal hair, other than those of a weight not exceeding 300 g/m², tapestry and upholstery fabrics.

🔍 Tariff Breakdown:

- Base Tariff: 7.0%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Total Tariff: 62.0%

📌 Key Notes:

- This code applies to woven upholstery fabrics made of carded wool with ≥85% wool content, but not limited to ≤300 g/m².

- Same tariff structure as 5111112000.

- Ensure fabric weight is correctly classified to avoid misclassification.

✅ HS Code: 5112111000

Description: Woven fabrics of combed wool or of combed fine animal hair, containing 85% or more by weight of wool or fine animal hair, of a weight not exceeding 200 g/m², tapestry and upholstery fabrics of a weight not exceeding 140 g/m².

🔍 Tariff Breakdown:

- Base Tariff: 7.0%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Total Tariff: 62.0%

📌 Key Notes:

- This code applies to combed wool upholstery fabrics with ≥85% wool content, ≤140 g/m².

- Combed wool is generally of higher quality than carded wool.

- Same tariff structure as above.

✅ HS Code: 5112192000

Description: Woven fabrics of combed wool or of combed fine animal hair, containing 85% or more by weight of wool or fine animal hair, other than those of a weight not exceeding 200 g/m², tapestry and upholstery fabrics.

🔍 Tariff Breakdown:

- Base Tariff: 7.0%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Total Tariff: 62.0%

📌 Key Notes:

- This code applies to combed wool upholstery fabrics with ≥85% wool content, not limited to ≤200 g/m².

- Same tariff structure as above.

- Ensure fabric weight is correctly classified to avoid misclassification.

⚠️ Other Relevant HS Codes (Non-Woven or Felt Products)

✅ HS Code: 5603941010 / 5603941090

Description: Nonwovens, weighing more than 150 g/m², floor covering underlays of wool or fine animal hair (or other).

🔍 Tariff Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Total Tariff: 55.0%

📌 Key Notes:

- These codes apply to nonwoven underlays used in floor coverings, not upholstery.

- Not applicable to woven upholstery fabrics.

✅ HS Code: 5602210000

Description: Felt, not impregnated, coated, covered or laminated, of wool or fine animal hair.

🔍 Tariff Breakdown:

- Base Tariff: 49.5¢/kg + 7.5%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Total Tariff: 49.5¢/kg + 7.5% + 55.0%

📌 Key Notes:

- This code applies to felt made of wool or fine animal hair.

- Not applicable to woven upholstery fabrics.

- Tariff includes a specific rate per kg.

✅ HS Code: 5602101000

Description: Needleloom felt and stitchbonded fiber fabrics, laminated fabrics.

🔍 Tariff Breakdown:

- Base Tariff: 12.0%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Total Tariff: 67.0%

📌 Key Notes:

- This code applies to laminated needleloom or stitchbonded fabrics.

- Not applicable to woven upholstery fabrics.

📌 Proactive Advice for Importers/Exporters

- Verify fabric composition: Ensure the product contains ≥85% wool or fine animal hair.

- Check fabric weight: Classify based on weight per square meter (e.g., ≤140 g/m² vs. >140 g/m²).

- Confirm whether it's carded or combed wool – this affects HS code.

- Check for certifications: Some countries may require textile origin or fiber content certification.

- Be aware of the April 11, 2025 tariff increase: This will increase the total tariff by 5%.

- Avoid misclassification: Ensure the product is not a nonwoven or felt if using HS codes 5111 or 5112.

📅 Time-Sensitive Alert

Additional tariffs imposed after April 11, 2025:

- All applicable HS codes (5111, 5112, 5601, 5602, 5603) will see an additional 5% increase in total tariff.

Let me know if you need help with certification requirements, customs documentation, or tariff calculation tools.

Customer Reviews

No reviews yet.