The first two digits of the HS code "85" represent electronic devices and other electrical equipment.

Specifically, this chapter covers the following main categories:

- Electronic tubes and semiconductor devices

- Vacuum tubes, electronic tubes, semiconductor diodes, transistors, integrated circuits, etc.

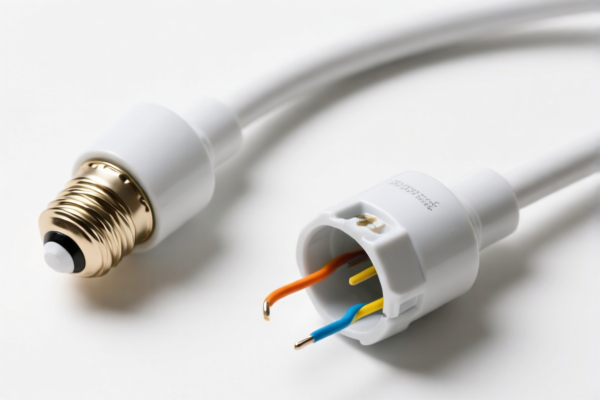

- Wires, cables

- Capacitors, resistors, inductors, etc.

- Electromagnets, inductors, transformers

- Power control equipment

- Television and radio receivers, tape recorders, cameras, etc.

- Data processing equipment, automatic data processing machines

- Medical, dental, veterinary instruments

- Lighting equipment

- Motors, generators

- Other electrical equipment

In summary, if the primary function of the product is to utilize or transmit electricity, electronic signals, or is used in electronic data processing, communication, broadcasting, medical fields, then it is likely to fall under Chapter 85 of the HS code.

To determine the classification more accurately, further information about the product's specific function, material, and usage is required.

The first four digits of the HS code: 8538

Classification description: Applicable to parts used exclusively or mainly with the instruments, equipment, or apparatus under headings 8535, 8536, or 8537.

The six-digit explanation: HS code: 8538.90

Classification: Applicable to parts of the machines under headings 8535, 8536, or 8537:

Meaning: Other → Other → Other → Other → Other.

Please note that this HS code applies to parts specifically designed for machines under headings 8535, 8536, or 8537.

8-10 digit explanation: HS code: 8538904000

Classification: Parts suitable for use solely or mainly with the apparatus of heading 8535, 8536, or 8537: → Other: → Other, for the articles of subheading 8535.90.40, 8536.30.40, or 8536.50.40, of ceramic or metallic materials, electrically or mechanically reactive to changes in temperature

Explanation: Parts applicable to machines under headings 8535, 8536, or 8537, other categories of parts, specifically applicable to subheadings 8535.90.40, 8536.30.40, or 8536.50.40, made of ceramic or metal materials, electrically or mechanically reactive to changes in temperature.

Examples of products: - Ceramic temperature-sensitive resistor for a medical device - Metal-based thermistor used in a data processing machine - Ceramic sensor component for a broadcasting equipment - Metal temperature-reactive part for an automatic data processing machine - Ceramic part for a control system in a broadcasting receiver

Customer Reviews

I was impressed with how specific the details were about HS code 3925. Great resource for anyone exporting plastic doors.

The page was helpful, but I had to look up a few terms related to trade compliance. Still, the tariff info was spot on.

This page saved me time! The HS code 3925 and tariff details were exactly what I needed for my plastic door exports.

The tariff rate information was clear, though I wish there were more examples of similar products in the same category.

The page provided helpful details about the export process for plastic doors. I found the HS code explanation very straightforward.