90开头 HS code typically represents optical, photographic, cinematographic, measuring, testing, analyzing, and control instruments and their parts and accessories.

Specifically, the 90 category includes the following main categories:

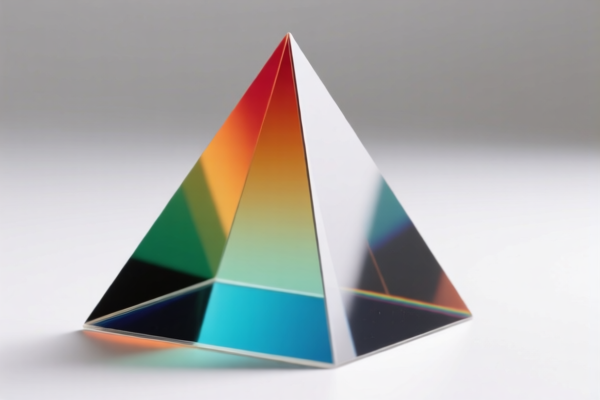

- Optical instruments: Including glasses, telescopes, microscopes, prisms, lenses, etc.

- Photographic and cinematographic instruments: Including cameras, video cameras, film, negatives, developing equipment, etc.

- Measuring and testing instruments: Including instruments for measuring length, weight, angle, temperature, pressure, flow, and other parameters.

- Analyzing instruments: Including spectrometers, chromatographs, analytical balances, etc.

- Control instruments: Including automatic control systems, industrial automation equipment, etc.

- Medical, surgical, and dental instruments: Including some precision optical and electronic instruments.

Why is it category 90?

These goods share common characteristics of high precision, high technical content, and reliance on optical, electronic, or mechanical principles, and are mainly used in scientific research, industrial production, healthcare, safety inspection, and other fields. Therefore, customs classify them into category 90 for easier management and statistics.

In short, HS codes starting with 90 represent precision instruments and meters, typically used in situations requiring precise measurement, analysis, control, or observation.

First four digits explanation:

9001 represents:

Optical fibers and fiber bundles; fiber cables other than those of chapter 8544; sheets and plates of polarizing materials; lenses (including contact lenses), prisms, mirrors, and other optical elements, of any material, not mounted, except unoptically worked glass elements.

Six-digit explanation:

HS code: 9001.50

Classification: Optical fibers and fiber bundles; fiber cables other than those of chapter 8544; sheets and plates of polarizing materials; lenses (including contact lenses), prisms, mirrors, and other optical elements, of any material, not mounted, except unoptically worked glass elements.

Specific meaning: Includes lenses made of other materials.

Eight to ten-digit explanation:

HS code: 9001500000

Classification: Optical fibers and fiber bundles; fiber cables other than those of chapter 8544; polarizing material sheets and plates not mounted, lenses (including contact lenses), prisms, and mirrors made of non-glass materials.

Explanation: This classification includes optical fibers and fiber bundles, fiber cables other than those of chapter 8544, and non-glass optical elements not mounted, such as polarizing material sheets and plates, lenses (including contact lenses), prisms, and mirrors. The focus is on non-glass optical elements not mounted, and fiber cables other than those of chapter 8544.

Examples of products:

- Contact lenses (non-glass)

- Non-glass optical lenses (e.g., plastic lenses)

- Non-glass prisms

- Non-glass mirrors

- Polarizing material sheets

- Non-glass optical components used in cameras or microscopes

- Non-glass fiber bundles (not classified under 8544)

Customer Reviews

The information on the 90 category and its sub-classifications was clear, but the examples could have been more varied. Still, it was a good start for understanding HS code 90.

This is the most comprehensive HS code page I've seen. The explanation of HS code 9001.50 and its sub-classifications was extremely helpful for my trade documentation.

The page has a clear breakdown of the 90 category, but I would have liked to see a comparison with other HS codes for better context. Still, it was a good resource.

I was looking for info on contact lenses and found this page very useful. The HS code 9001500000 explanation made it easy to understand the classification for non-glass lenses.

The detailed explanation of HS code 9001500000 was a lifesaver. I was exporting prisms and needed to confirm the correct classification, and this page made it clear.