The first two digits of the HS code starting with 90 typically belong to Optical, photographic, cinematographic, measuring, checking, analyzing, and control instruments and their parts and accessories.

Specifically, the 90 category covers the following main categories:

- Optical instruments: Including glasses, telescopes, microscopes, prisms, lenses, etc.

- Photographic and cinematographic instruments: Including cameras, video cameras, film projectors, projectors, etc.

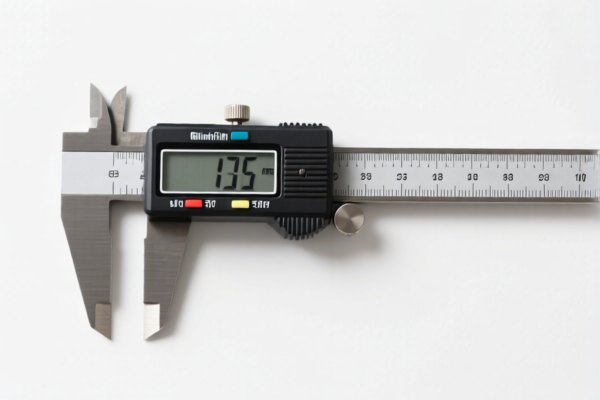

- Measuring instruments: Including measuring instruments for length, weight, capacity, angle, temperature, pressure, and so on.

- Checking and analyzing instruments: Including laboratory equipment, medical diagnostic equipment, chemical analysis instruments, etc.

- Control instruments: Including automatic control devices, industrial automation equipment, etc.

Why is it 90?

These goods are all related to precise measurement, observation, analysis, and control, and usually require a high level of technical content and professional knowledge. They play an important role in scientific research, industrial production, healthcare, environmental protection, and other fields.

Therefore, customs classify these goods into category 90 to facilitate the specialized management and statistics of these high-tech, high-value-added goods.

In summary, the core characteristics of goods with HS codes starting with 90 are precision measurement, observation, analysis, and control.

The first four digits explanation: 9013 corresponds to:

Lasers, not laser diodes; other optical instruments and devices, not otherwise specified or included in this chapter.

6-digit explanation: HS code: 9013.90

Classification: Lasers, not laser diodes; other optical instruments and devices, not specifically defined or included in this chapter.

Specific meaning: * Parts and accessories: Parts and accessories * Other: Other * Other: Other

8-10-digit explanation: HS code: 9013907000 Classification: Lasers, other than laser diodes; other optical instruments and devices, not otherwise specified or included in this chapter: --> Parts and accessories: --> Other: --> Other parts and accessories, not for use in sights or periscopes mounted on weapons. Explanation: This HS code covers lasers (not of the laser diode type), and parts and accessories of other optical instruments and devices that are not classified elsewhere in this chapter, and are not used in sights or periscopes mounted on weapons. Specifically, it applies to "other" parts and accessories, excluding those used in sights or periscopes.

Examples of products: * Laser modules for industrial applications * Components of optical measuring devices * Parts of non-laser-based optical equipment * Accessories for laboratory optical instruments * Parts of medical diagnostic optical equipment

Customer Reviews

I wish I had found this site earlier! The breakdown of HS code 90 and its subcategories is thorough and easy to understand.

The 8-10 digit explanation for HS code 9013907000 was exactly what I needed. I didn't know there were such specific subcategories.

This page gave a clear and concise explanation of why the 90 category exists. Very informative for customs professionals.

I found the examples of products under HS code 9013907000 very useful. It helped me categorize some components I was unsure about.

The detailed breakdown of HS code 9013907000 made it easy to classify parts of optical equipment. Great resource for exporters.