| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3903300000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3916905000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3920991000 | Doc | 61.0% | CN | US | 2025-05-12 |

| 3921904090 | Doc | 34.2% | CN | US | 2025-05-12 |

| 3926400090 | Doc | 35.3% | CN | US | 2025-05-12 |

| 8477902580 | Doc | 58.1% | CN | US | 2025-05-12 |

Here is the detailed customs compliance analysis for ABS Engineering Plastic products, based on the provided HS codes and tax information:

📦 Product Classification Overview: ABS Engineering Plastic

Below are the HS codes and associated tariff details for various forms of ABS engineering plastic:

🔢 HS Code: 3903300000

Product Description: ABS engineering plastic granules, ABS plastic parts, ABS plastic film

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Notes: This code covers raw materials and basic components of ABS plastic. Ensure the product is not classified under a more specific category.

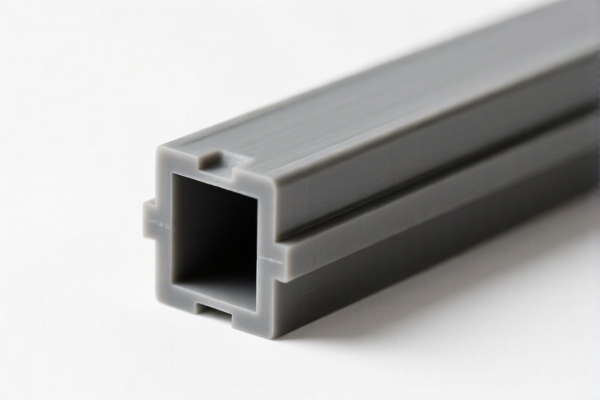

🔢 HS Code: 3916905000

Product Description: ABS engineering plastic profiles, ABS engineering plastic rods

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.8%

- Notes: This category includes semi-finished products used in manufacturing. Confirm the product is not classified under a more specific HS code.

🔢 HS Code: 3920991000

Product Description: ABS plastic sheets

- Base Tariff Rate: 6.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.0%

- Notes: This is a common form of ABS used in industrial and consumer applications. Verify the thickness and intended use for accurate classification.

🔢 HS Code: 3921904090

Product Description: ABS plastic film

- Base Tariff Rate: 4.2%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 34.2%

- Notes: This code applies to thin, flexible ABS film. No additional tariffs are currently applied, but be aware of the 2025.4.2 change.

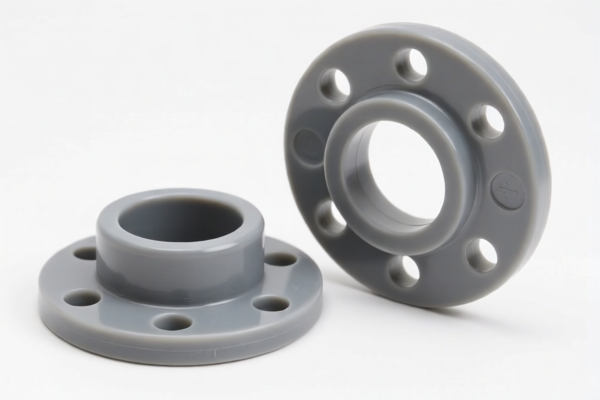

🔢 HS Code: 3926400090

Product Description: ABS plastic handicrafts

- Base Tariff Rate: 5.3%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 35.3%

- Notes: This category is for decorative or artistic ABS products. Ensure the product is not classified under a more specific code.

🔢 HS Code: 8477902580

Product Description: ABS plastic molds

- Base Tariff Rate: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 58.1%

- Notes: This code applies to molds used in manufacturing. Confirm the product is not classified under a more specific HS code.

⚠️ Important Alerts:

- April 11, 2025 Special Tariff: All listed products will be subject to an additional 30.0% tariff after this date. This is a time-sensitive policy—plan accordingly.

- Anti-dumping duties: Not currently applicable for ABS engineering plastic, but always verify with the latest customs updates.

- Certifications: Some products may require specific certifications (e.g., RoHS, REACH) depending on the destination country.

✅ Proactive Advice:

- Verify Material and Unit Price: Confirm the exact composition and pricing of the product to avoid misclassification.

- Check for More Specific HS Codes: Some products may fall under more detailed HS codes that have different tax rates.

- Consult Customs Authority: For high-value or complex products, consult local customs or a customs broker for accurate classification and compliance.

Let me know if you need help with a specific product or shipment! Here is the detailed customs compliance analysis for ABS Engineering Plastic products, based on the provided HS codes and tax information:

📦 Product Classification Overview: ABS Engineering Plastic

Below are the HS codes and associated tariff details for various forms of ABS engineering plastic:

🔢 HS Code: 3903300000

Product Description: ABS engineering plastic granules, ABS plastic parts, ABS plastic film

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Notes: This code covers raw materials and basic components of ABS plastic. Ensure the product is not classified under a more specific category.

🔢 HS Code: 3916905000

Product Description: ABS engineering plastic profiles, ABS engineering plastic rods

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.8%

- Notes: This category includes semi-finished products used in manufacturing. Confirm the product is not classified under a more specific HS code.

🔢 HS Code: 3920991000

Product Description: ABS plastic sheets

- Base Tariff Rate: 6.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.0%

- Notes: This is a common form of ABS used in industrial and consumer applications. Verify the thickness and intended use for accurate classification.

🔢 HS Code: 3921904090

Product Description: ABS plastic film

- Base Tariff Rate: 4.2%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 34.2%

- Notes: This code applies to thin, flexible ABS film. No additional tariffs are currently applied, but be aware of the 2025.4.2 change.

🔢 HS Code: 3926400090

Product Description: ABS plastic handicrafts

- Base Tariff Rate: 5.3%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 35.3%

- Notes: This category is for decorative or artistic ABS products. Ensure the product is not classified under a more specific code.

🔢 HS Code: 8477902580

Product Description: ABS plastic molds

- Base Tariff Rate: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 58.1%

- Notes: This code applies to molds used in manufacturing. Confirm the product is not classified under a more specific HS code.

⚠️ Important Alerts:

- April 11, 2025 Special Tariff: All listed products will be subject to an additional 30.0% tariff after this date. This is a time-sensitive policy—plan accordingly.

- Anti-dumping duties: Not currently applicable for ABS engineering plastic, but always verify with the latest customs updates.

- Certifications: Some products may require specific certifications (e.g., RoHS, REACH) depending on the destination country.

✅ Proactive Advice:

- Verify Material and Unit Price: Confirm the exact composition and pricing of the product to avoid misclassification.

- Check for More Specific HS Codes: Some products may fall under more detailed HS codes that have different tax rates.

- Consult Customs Authority: For high-value or complex products, consult local customs or a customs broker for accurate classification and compliance.

Let me know if you need help with a specific product or shipment!

Customer Reviews

No reviews yet.