| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3903300000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3917400030 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3917400030 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3917400030 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3917400095 | Doc | 60.3% | CN | US | 2025-05-12 |

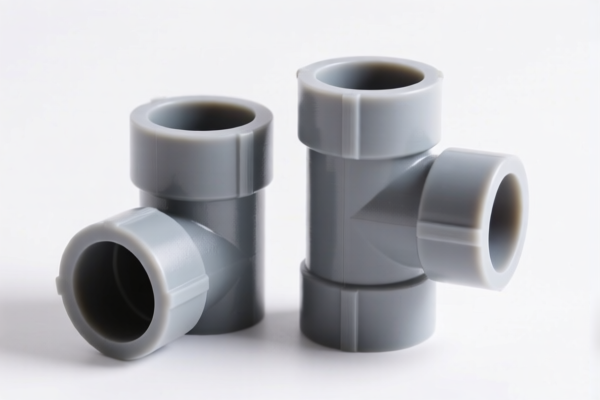

Product Name: ABS Plastic Elbows

Classification: Plastic fittings used in drainage or piping systems

✅ HS CODE Classification Overview

Below are the HS codes and corresponding tax details for ABS plastic elbows, based on their specific use and description:

🔢 HS CODE: 3903300000

Description: ABS plastic elbows made from polystyrene polymers (primary form)

Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to primary forms of ABS plastic, not finished products like elbows or fittings.

🔢 HS CODE: 3917400030

Description: ABS plastic drainage pipe elbows, fittings, or connectors

Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Applicable to:

- ABS plastic drainage pipe elbows

- ABS plastic drain pipe fittings

- ABS plastic drain pipe connectors

🔢 HS CODE: 3917400095

Description: General plastic pipe elbows (not specifically ABS)

Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for general plastic elbows, not specifically ABS. If your product is ABS, this may not be the correct classification.

⚠️ Important Notes and Recommendations

- Material Verification: Confirm that the product is ABS plastic and not another type of polymer (e.g., PVC, PE, etc.), as this will affect the correct HS code.

- Product Use: If the elbow is used in drainage systems, 3917400030 is likely the correct code. If it's a general-purpose elbow, consider 3917400095.

- Tariff Changes: The special tariff of 30% applies after April 11, 2025. Ensure your import timeline accounts for this.

- Certifications: Check if any certifications (e.g., RoHS, REACH, or specific import permits) are required for the product in the destination country.

- Unit Price: Verify the unit price and quantity for accurate customs valuation and duty calculation.

📌 Proactive Advice

- Double-check the product description and intended use to ensure the correct HS code is applied.

- Consult a customs broker or import compliance expert if the product is used in specialized applications (e.g., industrial, medical, or automotive).

- Keep documentation on material composition, manufacturing process, and intended use to support customs declarations.

Let me know if you need help determining the most accurate HS code for your specific product.

Product Name: ABS Plastic Elbows

Classification: Plastic fittings used in drainage or piping systems

✅ HS CODE Classification Overview

Below are the HS codes and corresponding tax details for ABS plastic elbows, based on their specific use and description:

🔢 HS CODE: 3903300000

Description: ABS plastic elbows made from polystyrene polymers (primary form)

Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to primary forms of ABS plastic, not finished products like elbows or fittings.

🔢 HS CODE: 3917400030

Description: ABS plastic drainage pipe elbows, fittings, or connectors

Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Applicable to:

- ABS plastic drainage pipe elbows

- ABS plastic drain pipe fittings

- ABS plastic drain pipe connectors

🔢 HS CODE: 3917400095

Description: General plastic pipe elbows (not specifically ABS)

Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for general plastic elbows, not specifically ABS. If your product is ABS, this may not be the correct classification.

⚠️ Important Notes and Recommendations

- Material Verification: Confirm that the product is ABS plastic and not another type of polymer (e.g., PVC, PE, etc.), as this will affect the correct HS code.

- Product Use: If the elbow is used in drainage systems, 3917400030 is likely the correct code. If it's a general-purpose elbow, consider 3917400095.

- Tariff Changes: The special tariff of 30% applies after April 11, 2025. Ensure your import timeline accounts for this.

- Certifications: Check if any certifications (e.g., RoHS, REACH, or specific import permits) are required for the product in the destination country.

- Unit Price: Verify the unit price and quantity for accurate customs valuation and duty calculation.

📌 Proactive Advice

- Double-check the product description and intended use to ensure the correct HS code is applied.

- Consult a customs broker or import compliance expert if the product is used in specialized applications (e.g., industrial, medical, or automotive).

- Keep documentation on material composition, manufacturing process, and intended use to support customs declarations.

Let me know if you need help determining the most accurate HS code for your specific product.

Customer Reviews

No reviews yet.