| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3917400030 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3917310000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917330000 | Doc | 33.1% | CN | US | 2025-05-12 |

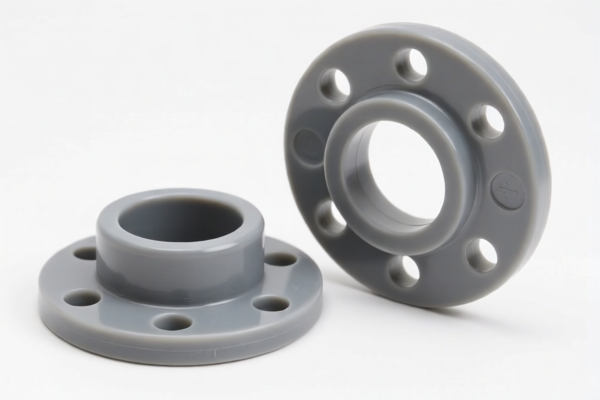

Product Classification: ABS Plastic Flanges

Based on the provided HS codes and descriptions, the classification of ABS plastic flanges depends on their pressure rating and material composition. Below is a structured breakdown of the relevant HS codes and their associated tax rates:

🔍 HS CODE: 3917400030

Description:

- ABS plastic drainage pipe flanges, ABS plastic drain pipe flanges, ABS plastic drainage pipe flange joints, ABS plastic drain pipe flange joints, etc.

- Applicable for non-pressure grade pipe fittings.

- Material: Acrylonitrile Butadiene Styrene (ABS)

Tariff Summary:

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

Key Notes:

- This code is not suitable for pressure-rated flanges.

- Ensure the product is non-pressure rated before using this classification.

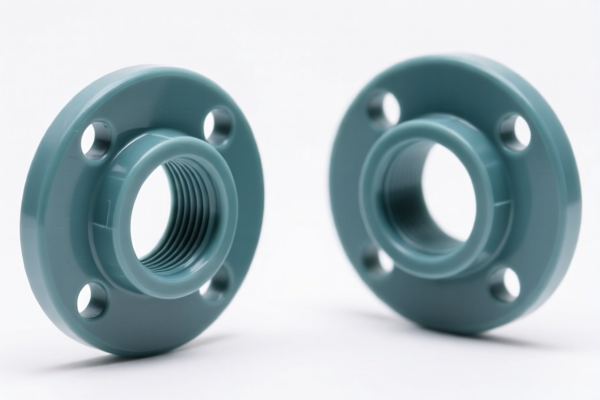

🔍 HS CODE: 3917310000

Description:

- Plastic pressure pipe flanges.

- Applicable for pressure-rated pipe fittings.

- Material: Plastic (not specified further)

Tariff Summary:

- Base Tariff Rate: 3.1%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 58.1%

Key Notes:

- This code is specific to pressure-rated flanges.

- Confirm the pressure rating of the product before using this classification.

🔍 HS CODE: 3917330000

Description:

- Plastic pipe fittings and flanges.

- Not reinforced or combined with other materials.

- Material: Plastic (not specified further)

Tariff Summary:

- Base Tariff Rate: 3.1%

- Additional Tariff (General): 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 33.1%

Key Notes:

- This code is not restricted to pressure-rated or non-pressure-rated.

- Ensure the product is not reinforced or combined with other materials.

📌 Proactive Advice for Users:

- Verify the product's pressure rating to determine the correct HS code.

- Confirm the material composition (e.g., whether it is pure ABS or combined with other materials).

- Check the unit price and certifications required (e.g., safety, environmental compliance).

- Be aware of the April 11, 2025, tariff increase and plan accordingly for import costs.

- Consult with customs or a compliance expert if the product falls into a gray area or has mixed materials.

Let me know if you need help determining which HS code applies to your specific product.

Product Classification: ABS Plastic Flanges

Based on the provided HS codes and descriptions, the classification of ABS plastic flanges depends on their pressure rating and material composition. Below is a structured breakdown of the relevant HS codes and their associated tax rates:

🔍 HS CODE: 3917400030

Description:

- ABS plastic drainage pipe flanges, ABS plastic drain pipe flanges, ABS plastic drainage pipe flange joints, ABS plastic drain pipe flange joints, etc.

- Applicable for non-pressure grade pipe fittings.

- Material: Acrylonitrile Butadiene Styrene (ABS)

Tariff Summary:

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

Key Notes:

- This code is not suitable for pressure-rated flanges.

- Ensure the product is non-pressure rated before using this classification.

🔍 HS CODE: 3917310000

Description:

- Plastic pressure pipe flanges.

- Applicable for pressure-rated pipe fittings.

- Material: Plastic (not specified further)

Tariff Summary:

- Base Tariff Rate: 3.1%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 58.1%

Key Notes:

- This code is specific to pressure-rated flanges.

- Confirm the pressure rating of the product before using this classification.

🔍 HS CODE: 3917330000

Description:

- Plastic pipe fittings and flanges.

- Not reinforced or combined with other materials.

- Material: Plastic (not specified further)

Tariff Summary:

- Base Tariff Rate: 3.1%

- Additional Tariff (General): 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 33.1%

Key Notes:

- This code is not restricted to pressure-rated or non-pressure-rated.

- Ensure the product is not reinforced or combined with other materials.

📌 Proactive Advice for Users:

- Verify the product's pressure rating to determine the correct HS code.

- Confirm the material composition (e.g., whether it is pure ABS or combined with other materials).

- Check the unit price and certifications required (e.g., safety, environmental compliance).

- Be aware of the April 11, 2025, tariff increase and plan accordingly for import costs.

- Consult with customs or a compliance expert if the product falls into a gray area or has mixed materials.

Let me know if you need help determining which HS code applies to your specific product.

Customer Reviews

No reviews yet.