| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3903300000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3812396000 | Doc | 61.5% | CN | US | 2025-05-12 |

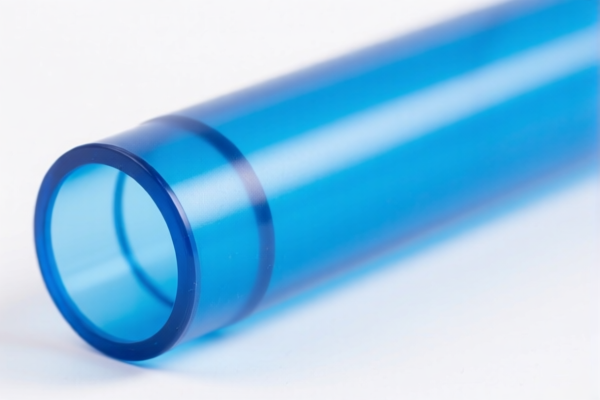

Product Name: ABS Resin Reinforced Material

Classification HS Code: 3903300000 (Primary classification)

Alternative HS Code: 3812396000 (if the product contains additives like stabilizers)

🔍 HS Code Explanation:

- 3903300000

- Description: This code applies to the primary form of styrene polymers, specifically acrylonitrile-butadiene-styrene (ABS) copolymers.

-

Product Fit: ABS resin reinforced material is typically classified under this code if it is in its base polymer form or as a composite material without significant modification.

-

3812396000

- Description: This code applies to stabilizers, antioxidants, or other composite stabilizers used for rubber or plastics.

- Product Fit: If the ABS resin reinforced material includes additives such as stabilizers or antioxidants, it may fall under this code.

📊 Tariff Summary (as of now):

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tariff Rate: 61.5% (6.5% + 25.0% + 30.0%)

⚠️ Important Notes:

- April 11 Special Tariff: A 30.0% additional tariff will be imposed after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning.

- Anti-dumping duties: Not currently applicable for this product category, but always verify with the latest customs updates.

- Material and Certification: Confirm the exact composition of the ABS resin reinforced material (e.g., whether it contains additives or is in its base form). This will determine the correct HS code and required certifications (e.g., Material Safety Data Sheet, technical specifications).

✅ Proactive Advice:

- Verify the product composition (e.g., whether it is a pure ABS polymer or contains additives like stabilizers).

- Check the unit price and total value to ensure correct classification and tariff calculation.

- Consult customs or a compliance expert if the product is a composite or contains multiple components.

- Keep updated documentation (e.g., commercial invoice, packing list, and product specifications) for customs clearance.

Let me know if you need help with HS code verification or customs documentation!

Product Name: ABS Resin Reinforced Material

Classification HS Code: 3903300000 (Primary classification)

Alternative HS Code: 3812396000 (if the product contains additives like stabilizers)

🔍 HS Code Explanation:

- 3903300000

- Description: This code applies to the primary form of styrene polymers, specifically acrylonitrile-butadiene-styrene (ABS) copolymers.

-

Product Fit: ABS resin reinforced material is typically classified under this code if it is in its base polymer form or as a composite material without significant modification.

-

3812396000

- Description: This code applies to stabilizers, antioxidants, or other composite stabilizers used for rubber or plastics.

- Product Fit: If the ABS resin reinforced material includes additives such as stabilizers or antioxidants, it may fall under this code.

📊 Tariff Summary (as of now):

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tariff Rate: 61.5% (6.5% + 25.0% + 30.0%)

⚠️ Important Notes:

- April 11 Special Tariff: A 30.0% additional tariff will be imposed after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning.

- Anti-dumping duties: Not currently applicable for this product category, but always verify with the latest customs updates.

- Material and Certification: Confirm the exact composition of the ABS resin reinforced material (e.g., whether it contains additives or is in its base form). This will determine the correct HS code and required certifications (e.g., Material Safety Data Sheet, technical specifications).

✅ Proactive Advice:

- Verify the product composition (e.g., whether it is a pure ABS polymer or contains additives like stabilizers).

- Check the unit price and total value to ensure correct classification and tariff calculation.

- Consult customs or a compliance expert if the product is a composite or contains multiple components.

- Keep updated documentation (e.g., commercial invoice, packing list, and product specifications) for customs clearance.

Let me know if you need help with HS code verification or customs documentation!

Customer Reviews

No reviews yet.