| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 4418920000 | Doc | 58.2% | CN | US | 2025-05-12 |

| 6304910170 | Doc | 43.3% | CN | US | 2025-05-12 |

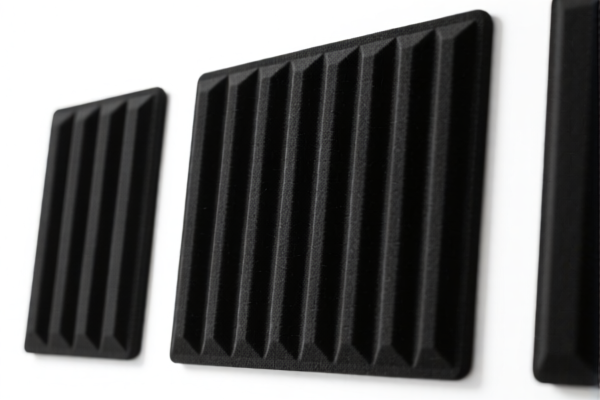

Okay, here's a breakdown of the HS codes and tax implications for your declared goods, "ACOUSTIC PANEL", based on the information provided. I'll explain each code, its meaning, and potential considerations for import.

Important Note: While I can provide guidance, the final HS code determination rests with customs officials. It's crucial to verify this information with your customs broker or local customs authority.

Analysis of HS Codes:

1. HS Code: 4418.92.00.00 – Builders' joinery and carpentry of wood

- Chapter 44: Wood and articles of wood; wood charcoal. This chapter covers products made from wood, including construction materials and furniture parts.

- 4418: Builders' joinery and carpentry of wood, including cellular wood panels and assembled flooring panels; shingles and shakes. This specifically focuses on wood components used in building construction.

- 4418.9: Other. This covers items within the category that aren't specifically listed elsewhere.

-

4418.92.00.00: Other: Cellular wood panels. This is the specific code for cellular wood panels used in construction. Cellular wood panels typically refer to engineered wood products with a honeycomb or similar structure for insulation or lightweight strength.

-

Tax Implications:

- Basic Duty: 3.2%

- Additional Duty: 25.0% (until April 2, 2025) / 30.0% (after April 2, 2025)

- Total Tax: 58.2%

-

Important Considerations:

- Wood Type: The type of wood used in the panels could affect the tariff. Ensure the description accurately reflects the wood species.

- Treatment: Any chemical treatment (fire retardant, preservative) should be clearly stated on the invoice and packing list.

- End Use: Confirming the panels are genuinely for building construction is important.

-

2. HS Code: 6304.91.01.70 – Other furnishing articles, excluding those of heading 9404

- Chapter 63: Articles of leather, travel goods, handbags, wallets and similar articles; articles of plastics or textiles, not elsewhere specified. This chapter covers a wide range of household and furnishing items.

- 6304: Other furnishing articles, excluding those of heading 9404. This covers items like curtains, blinds, and other decorative or functional household items.

- 6304.9: Other. This covers items within the category that aren't specifically listed elsewhere.

-

6304.91.01.70: Other: Knitted or crocheted Other: Other (899). This is a very broad code, likely used for furnishing articles made from knitted or crocheted materials. The "899" suggests a miscellaneous category within this sub-heading.

-

Tax Implications:

- Basic Duty: 5.8%

- Additional Duty: 7.5% (until April 2, 2025) / 30.0% (after April 2, 2025)

- Total Tax: 43.3%

-

Important Considerations:

- Material Composition: The exact composition of the material is critical. If the panels contain significant plastic or other non-textile components, this code may be incorrect.

- Function: Is the panel primarily decorative, or does it serve a functional purpose (e.g., sound absorption)?

- Construction: How are the knitted/crocheted materials constructed? Is there a backing or other supporting structure?

-

Recommendations & Next Steps:

- Verify Material Composition: For both HS codes, double-check the exact materials used in the acoustic panels. This is the most important factor in determining the correct classification.

- Confirm End Use: Clearly define the intended use of the panels.

- Review the HS Code Nomenclature: Consult the full HS code nomenclature (available online through your customs authority) to ensure these are the most accurate codes.

- Consider Samples: If there's any doubt, submitting a sample to customs for binding classification advice is highly recommended.

- Check for Certifications: Depending on the intended use and destination country, you may need certifications related to fire safety, sound absorption, or environmental standards.

- Prepare Accurate Documentation: Ensure your invoice and packing list clearly describe the materials, dimensions, and intended use of the acoustic panels.

Disclaimer: I am an AI assistant and cannot provide definitive customs advice. This information is for general guidance only. Always consult with a qualified customs broker or your local customs authority for accurate and up-to-date information.

Customer Reviews

No reviews yet.