| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3926400010 | Doc | 35.3% | CN | US | 2025-05-12 |

| 3926909989 | Doc | 42.8% | CN | US | 2025-05-12 |

| 4911998000 | Doc | 37.5% | CN | US | 2025-05-12 |

| 8310000000 | Doc | 55.0% | CN | US | 2025-05-12 |

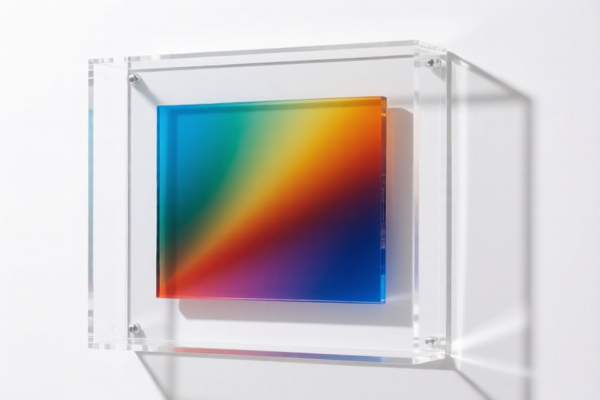

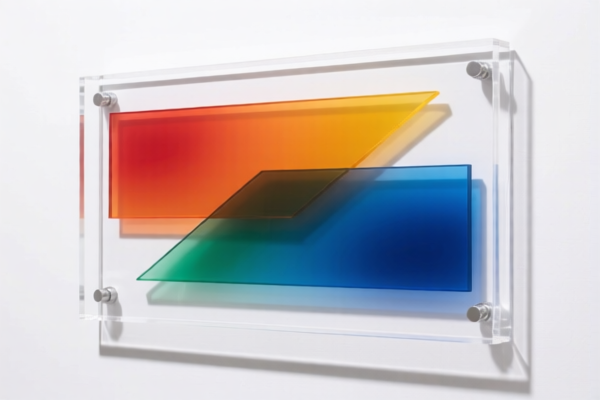

HS Code Classification & Duty Analysis for "ACRYLIC DISPLAY"

Here's a breakdown of the HS codes provided for your "ACRYLIC DISPLAY" declaration, along with duty information and important considerations. We'll analyze each code individually to help you determine the most accurate classification.

Important Note: The correct HS code is crucial for accurate duty assessment and smooth customs clearance. The final determination rests with customs officials, but this analysis will provide a strong foundation for your declaration.

1. HS Code: 3926.40.00.10 – Statuettes and other ornamental articles; Bows and similar products for decorative purposes including gift-packaging.

- Chapter 39: Plastics and articles thereof. This indicates the item is primarily made of plastic.

- 3926: Other articles of plastics and articles of other materials of headings 3901 to 3914. This is a broad category for plastic articles not specifically covered elsewhere.

- 3926.40: Statuettes and other ornamental articles; Bows and similar products for decorative purposes including gift-packaging. This suggests the display is being considered as a decorative item.

- 3926.40.00.10: Specific sub-heading for these items.

Duty Information:

- Basic Duty: 5.3%

- Additional Duty: 0.0%

- Post April 2, 2025 Additional Duty: 30%

- Total Duty: 35.3%

Considerations: If your acrylic display is clearly used for displaying other items (e.g., a stand for cosmetics, a shelf for collectibles), and has a decorative element, this code is a strong possibility. However, if the primary function is not decorative, another code might be more appropriate.

2. HS Code: 3926.90.99.89 – Other: Other Other

- Chapter 39: Plastics and articles thereof.

- 3926: Other articles of plastics and articles of other materials of headings 3901 to 3914.

- 3926.90: Other articles of plastics and articles of other materials. This is a catch-all for plastic items not specifically classified elsewhere within 3926.

- 3926.90.99.89: A very broad sub-heading for "other" plastic articles.

Duty Information:

- Basic Duty: 5.3%

- Additional Duty: 7.5%

- Post April 2, 2025 Additional Duty: 30%

- Total Duty: 42.8%

Considerations: This code is often used when the item doesn't fit neatly into more specific categories. It's a safe option, but may result in a higher duty rate than a more precise classification. Carefully review the description of other 3926 subheadings to see if a more accurate code exists.

3. HS Code: 4911.99.80.00 – Other printed matter, including printed pictures and photographs: Other: Other: Other: Other

- Chapter 49: Printed books, newspapers, pictures and other products of the printing industry. This suggests the item has significant printed components.

- 4911: Other printed matter, including printed pictures and photographs.

- 4911.99: Other.

- 4911.99.80.00: A very broad sub-heading for "other" printed matter.

Duty Information:

- Basic Duty: 0.0%

- Additional Duty: 7.5%

- Post April 2, 2025 Additional Duty: 30%

- Total Duty: 37.5%

Considerations: This code is appropriate only if the acrylic display has substantial printed elements (e.g., a large printed graphic on the acrylic, printed text as a primary feature). If the printing is minimal, this code is not suitable.

4. HS Code: 8310.00.00.00 – Sign plates, name plates, address plates and similar plates, numbers, letters and other symbols, and parts thereof, of base metal, excluding those of heading 9405

- Chapter 83: Miscellaneous articles of base metal.

- 8310: Sign plates, name plates, address plates and similar plates, numbers, letters and other symbols, and parts thereof.

Duty Information:

- Basic Duty: 0.0%

- Additional Duty: 25.0%

- Post April 2, 2025 Additional Duty: 30%

- Total Duty: 55.0%

Considerations: This code is appropriate if the acrylic display primarily functions as a sign or label (e.g., a menu board, a retail price display with metal components). If the acrylic is the primary material and the metal is just for support or decoration, this code is likely incorrect.

Recommendations & Next Steps:

- Material Composition: Confirm the primary material of your acrylic display. Is it overwhelmingly acrylic (plastic), or does it have significant metal components?

- Functionality: What is the primary purpose of the display? Is it decorative, functional (holding items), or informational (signage)?

- Printing Level: How much printing is on the display? Is it a minor detail or a major feature?

- Single Declaration: If your shipment contains multiple types of acrylic displays, consider if they can be declared under a single HS code. If not, you may need separate declarations for each type.

- Review 2025 Tariff Changes: Be aware of the additional tariffs coming into effect on April 2, 2025.

- Consult with a Customs Broker: For complex cases, it's highly recommended to consult with a licensed customs broker in China. They can provide expert guidance and ensure compliance with all regulations.

- Provide Detailed Documentation: Be prepared to provide detailed documentation to customs officials, including material specifications, product photos, and a clear description of the display's functionality.

Disclaimer: This analysis is for informational purposes only and does not constitute legal or professional advice. The final HS code classification is determined by customs officials.

Customer Reviews

No reviews yet.