Found 6 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3906905000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3926905000 | Doc | 41.3% | CN | US | 2025-05-12 |

| 3926909400 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4414900000 | Doc | 41.4% | CN | US | 2025-05-12 |

| 4414900000 | Doc | 41.4% | CN | US | 2025-05-12 |

| 4421999880 | Doc | 58.3% | CN | US | 2025-05-12 |

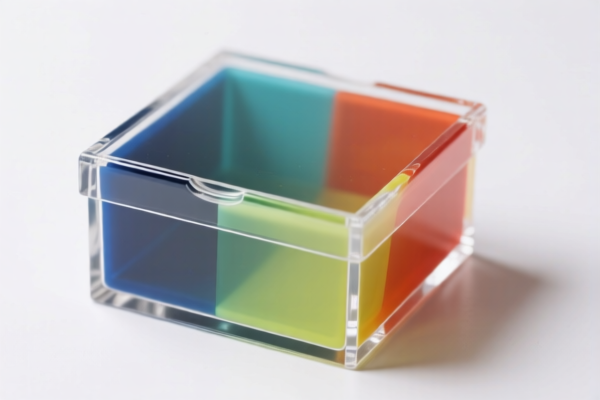

Here's a classification breakdown for "ACRYLIC FRAME" based on the provided reference data, aiming for the most accurate HS codes and relevant details:

-

3906905000 – Acrylic polymers in primary forms: Other: Other: Other

- 39: Plastics and articles thereof. This chapter covers a wide range of plastic materials.

- 06: Acrylic polymers. Specifically focuses on polymers based on acrylic monomers.

- 90: Other. This indicates the product isn't specifically listed within the more detailed acrylic polymer categories.

- 5000: Further specifies the 'other' category.

- Applicability: If the frame is made directly from acrylic polymers in a raw or semi-processed state (e.g., sheets, rods, etc., that are then cut and assembled), this HS code is likely appropriate.

- Tax Rate: 59.2% (Base Tariff: 4.2%, Additional Tariff: 25.0%, Post 2025.4.2: 30%)

-

3926905000 – Other articles of plastics and articles of other materials of headings 3901 to 3914: Other: Frames or mounts for photographic slides

- 39: Plastics and articles thereof.

- 26: Articles of plastics and articles of other materials.

- 90: Other.

- 5000: Further specifies the 'other' category.

- Applicability: If the frame is specifically designed to hold photographic slides, this HS code is a strong possibility.

- Tax Rate: 41.3% (Base Tariff: 3.8%, Additional Tariff: 7.5%, Post 2025.4.2: 30%)

-

4414900000 – Wooden frames for paintings, photographs, mirrors or similar objects: Other

- 44: Wood and articles of wood.

- 14: Wooden frames.

- 90: Other.

- 0000: Further specifies the 'other' category.

- Applicability: If the frame is made of wood, this HS code is appropriate.

- Tax Rate: 41.4% (Base Tariff: 3.9%, Additional Tariff: 7.5%, Post 2025.4.2: 30%)

Important Considerations & Recommendations:

- Material Composition: The primary material of the frame is crucial. Is it predominantly acrylic plastic, wood, or a combination?

- Function: What is the frame used for? Photographic slides, paintings, mirrors, or general display?

- Combined Materials: If the frame is a composite (e.g., a wood frame with an acrylic front), the HS code will depend on the dominant material by weight and function.

- Post 2025.4.2 Tariffs: Be aware of the tariff changes taking effect after April 2, 2025.

- Certification: Depending on the end-use and destination country, you may need certifications related to wood sourcing (e.g., FSC certification) or plastic composition (e.g., RoHS compliance).

- Detailed Description: Provide a very detailed description of the frame to customs officials, including dimensions, weight, and specific materials used.

- Single Declaration: It is important to declare the correct HS code to avoid potential penalties and delays. If you are unsure, consult with a customs broker or seek an official binding ruling from the customs authority.

Customer Reviews

No reviews yet.