| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3906905000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3926904800 | Doc | 33.4% | CN | US | 2025-05-12 |

| 3926909910 | Doc | 42.8% | CN | US | 2025-05-12 |

| 4911998000 | Doc | 37.5% | CN | US | 2025-05-12 |

| 4911996000 | Doc | 37.5% | CN | US | 2025-05-12 |

| 4908900000 | Doc | 37.5% | CN | US | 2025-05-12 |

| 4908100000 | Doc | 37.5% | CN | US | 2025-05-12 |

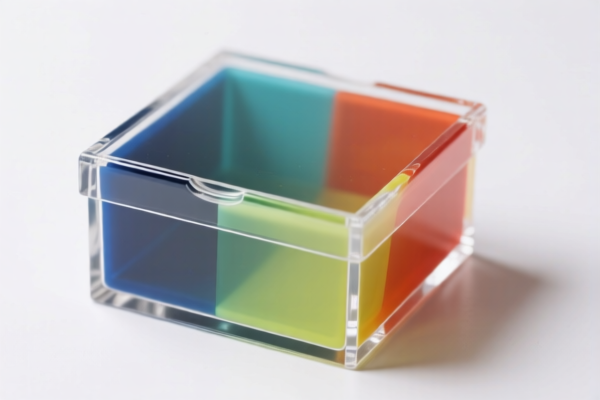

HS Code Classification for ACRYLIC LABEL HOLDER

Based on the provided reference data and the description "ACRYLIC LABEL HOLDER", here's a breakdown of potential HS code classifications. The correct code will depend on the specific characteristics of the holder.

1. 3906905000 – Acrylic polymers in primary forms: Other: Other: Other

- 39: Plastics and articles thereof. This chapter covers a wide range of plastic materials.

- 06: Acrylic polymers. Specifically focuses on polymers like polymethyl methacrylate (PMMA), commonly known as acrylic.

- 90: Other. This indicates the product isn't specifically covered in earlier subheadings within the chapter.

- 50: Other. Further specifies the product type.

-

00: A general code for other acrylic polymers.

- Applicability: If the label holder is supplied as a raw acrylic sheet or profile before being formed into the final holder shape, this code is likely appropriate. It's essentially the base material.

- Tax Rate: 59.2% (Base Tariff: 4.2%, Additional Tariff: 25.0%, Post 2025.4.2: 30%)

2. 3926904800 – Other articles of plastics and articles of other materials of headings 3901 to 3914: Other: Photo albums

- 39: Plastics and articles thereof.

- 26: Articles of plastics and articles of other materials. This covers finished or semi-finished plastic products.

- 90: Other.

- 48: Photo albums. While seemingly unrelated, this code is sometimes used for plastic holders designed for displaying or protecting items, especially if they have a binding or album-like structure.

-

00: General code.

- Applicability: If the label holder is a finished product designed to hold and display labels, and has a structure resembling a photo album (e.g., with pockets or sleeves), this code might be applicable.

- Tax Rate: 33.4% (Base Tariff: 3.4%, Additional Tariff: 0.0%, Post 2025.4.2: 30%)

3. 3926909910 – Other articles of plastics and articles of other materials of headings 3901 to 3914: Other: Other Laboratory ware

- 39: Plastics and articles thereof.

- 26: Articles of plastics and articles of other materials.

- 90: Other.

- 99: Other.

- 10: Other Laboratory ware. If the label holder is specifically designed for laboratory use (e.g., holding samples, test tubes), this code could be relevant.

-

00: General code.

- Applicability: If the label holder is used in a laboratory setting.

- Tax Rate: 42.8% (Base Tariff: 5.3%, Additional Tariff: 7.5%, Post 2025.4.2: 30%)

Important Considerations & Recommendations:

- Material Composition: Confirm the exact material of the label holder. Is it 100% acrylic, or does it contain other plastics or materials?

- Functionality: What is the primary purpose of the holder? Is it simply a protective sleeve, or does it have a more specialized function?

- End Use: Where will the label holder be used? (e.g., retail, laboratory, industrial)

- Single vs. Multiple Materials: If the holder is made of multiple materials, the classification becomes more complex.

- Post 2025.4.2 Tariff Changes: Be aware of the upcoming tariff increases on April 2, 2025, for certain codes.

Disclaimer: HS code classification is complex and subject to interpretation by customs authorities. This information is for guidance only. It is recommended to consult with a licensed customs broker or the relevant customs authority for a definitive classification.

Customer Reviews

No reviews yet.