| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 7614904000 | Doc | 59.9% | CN | US | 2025-05-12 |

| 9403999040 | Doc | 80.0% | CN | US | 2025-05-12 |

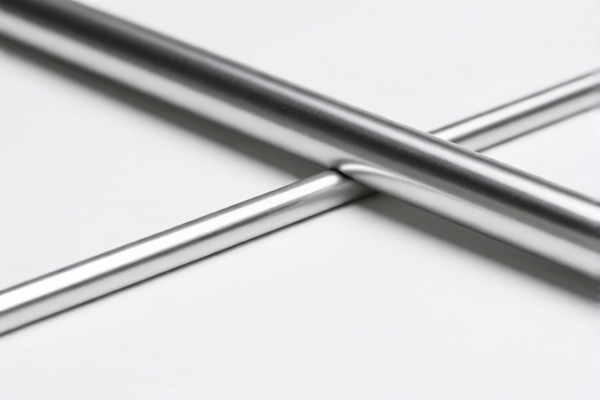

Declaration Item Analysis: ALUMINUM LINE

This document provides a detailed analysis of the declared items under the category "ALUMINUM LINE", focusing on HS codes, tariff details, and important considerations for customs clearance.

Understanding HS Codes:

The Harmonized System (HS) code is a globally standardized system of names and numbers to classify traded products. It's crucial for determining tariffs, trade regulations, and statistical reporting. Here's a breakdown of the HS codes provided:

1. Stranded wire, cables, plaited bands and the like, of aluminum, not electrically insulated (HS Code: 7614.90.40.00)

- 76: Aluminum and aluminum articles. This indicates the primary material of the product is aluminum.

- 14: Wire, cables, plaited bands and the like, of aluminum. This specifies the product type – aluminum wire, cables, or similar items.

- 90: Other. This signifies that the product falls into a category not specifically defined within the more detailed subheadings.

- 40.00: Further specifies "Other: Not fitted with fittings and not made up into articles: Other". This means the aluminum wire/cable is not pre-fitted with connectors and isn't assembled into finished products.

Tariff Details:

- Basic Duty: 4.9%

- Additional Duty: 25.0% (Currently)

- Additional Duty (Post April 2, 2025): 30.0%

- Total Tax: 59.9%

Important Considerations:

- Material Verification: Ensure the product is entirely aluminum. Any other metal content may require a different HS code.

- Fittings: Confirm that the wire/cable does not have any pre-attached fittings (connectors, clamps, etc.). If fittings are present, a different HS code and tariff rate will apply.

- Finished Goods: The description specifies "not made up into articles." If the wire/cable is part of a finished product (e.g., a pre-assembled lighting fixture), a different HS code is needed.

2. Other furniture and parts thereof: Parts: Other: Other Other: Of metal: Parts for steel racks of statistical reporting number 9403.20.0082 (HS Code: 9403.99.90.40)

- 94: Furniture; bedding, mattresses, supportings, lamps or lighting fittings, prefabricated buildings. This indicates the product is related to furniture or furniture parts.

- 03: Other furniture and parts thereof. This narrows down the category to furniture components.

- 99: Parts. This specifies that the item is a part of a larger furniture piece.

- 90: Other. This signifies that the product falls into a category not specifically defined within the more detailed subheadings.

- 40: Further specifies "Other: Of metal: Parts for steel racks of statistical reporting number 9403.20.0082". This means the parts are made of metal and are specifically designed for steel racks (statistical reporting number 9403.20.0082).

Tariff Details:

- Basic Duty: 0.0%

- Additional Duty: 25.0% (Currently)

- Additional Duty (Post April 2, 2025): 30.0% (Specifically for steel and aluminum products)

- Total Tax: 80.0%

Important Considerations:

- Material Composition: While the description states "Of metal," the 2025 tariff update specifically mentions steel and aluminum. Confirm the exact metal composition (steel, aluminum, or a combination).

- Rack Compatibility: Ensure the parts are specifically designed for steel racks with statistical reporting number 9403.20.0082. Different parts for other types of racks may have a different HS code.

- Part Function: Clarify the function of the parts. Different types of furniture parts (e.g., legs, backs, arms) may have different HS codes.

General Recommendations:

- Detailed Invoice: Provide a comprehensive invoice with a clear description of each item, including material composition, dimensions, and intended use.

- Certifications: Depending on the specific application of the aluminum products, you may need to provide certifications (e.g., quality certificates, safety standards).

- Consult with a Customs Broker: For complex cases or if you are unsure about the correct HS code, it is highly recommended to consult with a licensed customs broker. They can provide expert guidance and ensure compliance with all relevant regulations.

- Monitor Tariff Changes: Be aware of potential tariff changes, especially the additional duties scheduled to take effect on April 2, 2025.

Disclaimer: This analysis is based on the information provided and general customs regulations. It is not a definitive ruling and should not be used as a substitute for professional advice.

Customer Reviews

No reviews yet.