| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 9105995000 | Doc | 7.5¢ each + 3.2%+30.0% | CN | US | 2025-05-12 |

| 9105996000 | Doc | 23¢ each + 3.2%+37.5% | CN | US | 2025-05-12 |

| 9106908500 | Doc | 15¢ each + 2.3% + 0.8¢/jewel+55.0% | CN | US | 2025-05-12 |

| 9106906500 | Doc | 15¢ each + 2.3% + 0.8¢/jewel+55.0% | CN | US | 2025-05-12 |

| 3926901000 | Doc | 40.9% | CN | US | 2025-05-12 |

| 3923900080 | Doc | 58.0% | CN | US | 2025-05-12 |

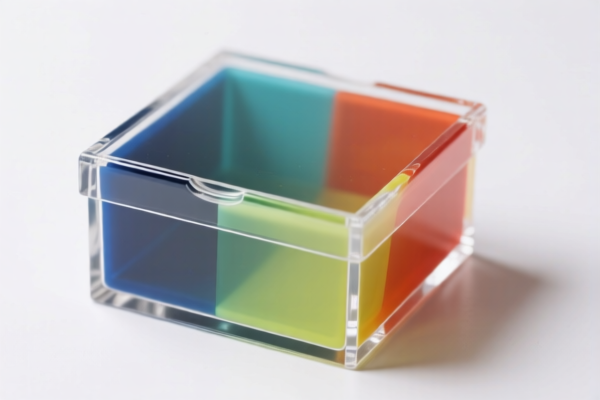

HS Code Classification for AQUARIUM ISOLATION BOX

Based on the provided reference data and general trade practices, here's a breakdown of potential HS codes for "AQUARIUM ISOLATION BOX", along with explanations to aid in accurate classification. Please note that the final determination depends on the material composition and specific function of the box.

1. 3926901000 - Other articles of plastics and articles of other materials of headings 3901 to 3914: Other: Buckets and pails

- 39: Plastics and articles thereof. This chapter covers articles made of plastics.

- 26: Other articles of plastics and articles of other materials.

- 90: Buckets and pails. If the isolation box is primarily constructed of plastic and resembles a bucket or pail in form, this code is a strong possibility.

- Tax Details: Base Duty: 3.4% + Additional Duty: 7.5% + Post 2025.4.2 Additional Duty: 30%. Total: 40.9%

- Considerations: This code is suitable if the box is a simple plastic container.

2. 3923900080 - Articles for the conveyance or packing of goods, of plastics; stoppers, lids, caps and other closures, of plastics: Other Other

- 39: Plastics and articles thereof.

- 23: Articles for the conveyance or packing of goods, of plastics.

- 90: Other. This code applies if the box is designed for containing or transporting aquarium items.

- Tax Details: Base Duty: 3.0% + Additional Duty: 25.0% + Post 2025.4.2 Additional Duty: 30%. Total: 58.0%

- Considerations: If the box is specifically designed for packaging or transporting aquarium fish or other items, this code is appropriate.

Important Notes & Recommendations:

- Material Composition: The primary material of the isolation box is crucial. If it's not plastic, other HS codes may apply (e.g., glass, metal, etc.).

- Functionality: Is the box simply a container, or does it have specialized features (e.g., filtration, heating, lighting)? Specialized features may require a different classification.

- Certification: Depending on the intended use and destination country, you may need to provide certifications related to material safety (e.g., BPA-free plastics) or electrical safety (if it includes electrical components).

- Single vs. Multiple Components: If the isolation box is sold as a kit with multiple components (e.g., filter, heater), each component may need to be classified separately.

- Check with Customs: It is highly recommended to consult with the customs authorities in the importing country to confirm the correct HS code for your specific product. Provide them with detailed information about the box's material, function, and intended use.

- Post 2025.4.2 Tariffs: Be aware of the increased tariffs that will take effect after April 2, 2025.

Disclaimer: This information is for general guidance only and does not constitute professional customs advice. HS code classification is complex and subject to interpretation. Always verify with the relevant customs authorities for accurate classification.

Customer Reviews

No reviews yet.