| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 6306120000 | Doc | 38.8% | CN | US | 2025-05-12 |

| 6306191100 | Doc | 45.5% | CN | US | 2025-05-12 |

| 7610900040 | Doc | 85.7% | CN | US | 2025-05-12 |

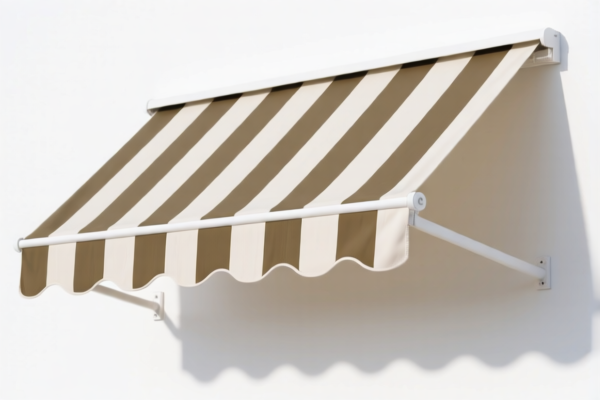

HS Code Classification & Duty Information for Awnings

This document provides a breakdown of the HS codes relevant to your declared item, "Awnings," along with associated duties and important considerations for import from China (CN).

Understanding HS Codes

HS (Harmonized System) codes are internationally standardized codes used to classify traded products. The first six digits are generally consistent worldwide, while additional digits are specific to each country. Here's a breakdown of the codes provided:

1. HS Code: 6306.12.00.00 – Tarpaulins, Awnings & Sunblinds of Synthetic Fibers

- 63: Textiles (Chapter 63 covers various textile articles)

- 06: Tarpaulins, awnings and sunblinds; tents, sails, etc.

- 12: Of synthetic fibers. This specifically covers awnings made from materials like polyester, nylon, acrylic, etc.

- 00.00: Further specification within the category.

Duty Information:

- Basic Duty: 8.8%

- Additional Duty: 0.0%

- Additional Duty (Post April 2, 2025): 30%

- Total Duty: 38.8%

Important Notes:

- This code applies to awnings where the primary material is synthetic fiber.

- The 30% additional duty will be implemented after April 2, 2025.

2. HS Code: 6306.19.11.00 – Tarpaulins, Awnings & Sunblinds of Other Textile Materials (Cotton)

- 63: Textiles

- 06: Tarpaulins, awnings and sunblinds; tents, sails, etc.

- 19: Of other textile materials

- 11: Of cotton

- 00: Further specification within the category.

Duty Information:

- Basic Duty: 8.0%

- Additional Duty: 7.5%

- Additional Duty (Post April 2, 2025): 30%

- Total Duty: 45.5%

Important Notes:

- This code applies specifically to awnings made of cotton.

- The 30% additional duty will be implemented after April 2, 2025.

3. HS Code: 7610.90.00.40 – Aluminum Structures (Architectural & Ornamental Work)

- 76: Aluminum and aluminum articles

- 10: Aluminum structures

- 90: Other (This covers structures not specifically classified elsewhere)

- 00.40: Further specification within the category.

Duty Information:

- Basic Duty: 5.7%

- Additional Duty: 25.0%

- Additional Duty (Post April 2, 2025): 30% (specifically for steel and aluminum products)

- Total Duty: 85.7%

Important Notes:

- This code applies to awnings constructed with aluminum structures. This is likely applicable if the awning has a significant aluminum frame or support system.

- The 30% additional duty will be implemented after April 2, 2025.

- This code carries the highest duty rate of the three options.

Recommendations & Key Considerations:

- Material Verification: Crucially, confirm the exact material composition of your awnings. The duty rate is heavily dependent on whether they are made of synthetic fibers, cotton, or primarily aluminum. Provide a material specification sheet if available.

- Structure Composition: If the awning has both textile and aluminum components, determine the primary function and material. If the aluminum structure is integral to the awning's function and support, 7610.90.00.40 may be the correct code.

- Single Price: Please provide the single price of the awnings.

- Certification: Depending on the end-use application of the awnings, you may need to provide certifications related to fire resistance, safety standards, or material composition. Check with the relevant import authorities in your destination country.

- Post-April 2, 2025 Duty Changes: Be aware of the upcoming duty changes on April 2, 2025, and factor them into your cost calculations.

- Invoice Description: Ensure the invoice description accurately reflects the material composition and structure of the awnings to avoid potential issues during customs clearance.

Disclaimer: This information is for general guidance only and does not constitute professional customs advice. Duty rates and regulations are subject to change. It is recommended to consult with a licensed customs broker or import specialist for specific advice tailored to your situation.

Customer Reviews

No reviews yet.