| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 5408321000 | Doc | 67.0% | CN | US | 2025-05-12 |

| 6006420085 | Doc | 65.0% | CN | US | 2025-05-12 |

| 6006330080 | Doc | 65.0% | CN | US | 2025-05-12 |

| 5509692000 | Doc | 64.0% | CN | US | 2025-05-12 |

| 5506300000 | Doc | 60.0% | CN | US | 2025-05-12 |

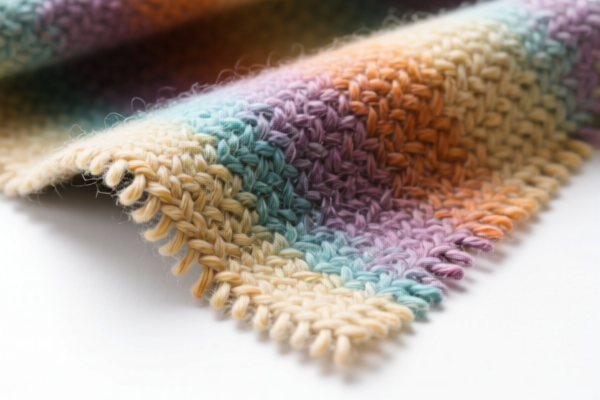

Product Name: Acrylic Blended Combed Wool Woven Fabric

Classification HS Code: 6006.42.00.85

🔍 HS CODE: 6006.42.00.85

Description: Knitted or crocheted fabrics of acrylic, suitable for classification under HS CODE 6006.42.00.85.

📊 Tariff Breakdown (as of now):

- Base Tariff Rate: 10.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 65.0%

⚠️ Important Notes:

- April 11 Special Tariff: A 30.0% additional tariff will be imposed after April 11, 2025. This is a time-sensitive policy and may significantly increase the total cost of importation.

- No Anti-dumping duties on iron and aluminum: Not applicable for this product category.

- Material Verification Required: Ensure the fabric is indeed made of acrylic blended with combed wool and not misclassified as a different blend (e.g., acrylic with polyester or cotton).

- Unit Price and Certification: Confirm the unit price and whether any certifications (e.g., textile standards, origin documentation) are required for customs clearance.

📌 Proactive Advice:

- Double-check the composition of the fabric to ensure it meets the HS CODE 6006.42.00.85 criteria.

- Monitor the April 11, 2025 deadline for the special tariff to plan your import schedule accordingly.

- Consult with customs brokers or trade compliance experts if the product is part of a larger shipment or involves multiple HS CODEs.

📌 Alternative HS CODEs for Reference:

| HS CODE | Description | Total Tax Rate |

|---|---|---|

| 6006.33.00.80 | Knitted acrylic blended fabric (colored) | 65.0% |

| 5509.69.20.00 | Knitted acrylic腈 blended yarn | 64.0% |

| 5509.69.60.00 | Knitted acrylic fiber blended yarn | 68.2% |

| 5506.30.00.00 | Acrylic腈 fiber (combed) | 60.0% |

If you have more details about the fabric (e.g., exact composition, end-use, or country of origin), I can provide a more tailored compliance analysis.

Product Name: Acrylic Blended Combed Wool Woven Fabric

Classification HS Code: 6006.42.00.85

🔍 HS CODE: 6006.42.00.85

Description: Knitted or crocheted fabrics of acrylic, suitable for classification under HS CODE 6006.42.00.85.

📊 Tariff Breakdown (as of now):

- Base Tariff Rate: 10.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 65.0%

⚠️ Important Notes:

- April 11 Special Tariff: A 30.0% additional tariff will be imposed after April 11, 2025. This is a time-sensitive policy and may significantly increase the total cost of importation.

- No Anti-dumping duties on iron and aluminum: Not applicable for this product category.

- Material Verification Required: Ensure the fabric is indeed made of acrylic blended with combed wool and not misclassified as a different blend (e.g., acrylic with polyester or cotton).

- Unit Price and Certification: Confirm the unit price and whether any certifications (e.g., textile standards, origin documentation) are required for customs clearance.

📌 Proactive Advice:

- Double-check the composition of the fabric to ensure it meets the HS CODE 6006.42.00.85 criteria.

- Monitor the April 11, 2025 deadline for the special tariff to plan your import schedule accordingly.

- Consult with customs brokers or trade compliance experts if the product is part of a larger shipment or involves multiple HS CODEs.

📌 Alternative HS CODEs for Reference:

| HS CODE | Description | Total Tax Rate |

|---|---|---|

| 6006.33.00.80 | Knitted acrylic blended fabric (colored) | 65.0% |

| 5509.69.20.00 | Knitted acrylic腈 blended yarn | 64.0% |

| 5509.69.60.00 | Knitted acrylic fiber blended yarn | 68.2% |

| 5506.30.00.00 | Acrylic腈 fiber (combed) | 60.0% |

If you have more details about the fabric (e.g., exact composition, end-use, or country of origin), I can provide a more tailored compliance analysis.

Customer Reviews

No reviews yet.