| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920598000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920591000 | Doc | 61.0% | CN | US | 2025-05-12 |

| 3920594000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3920515050 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3906902000 | Doc | 61.3% | CN | US | 2025-05-12 |

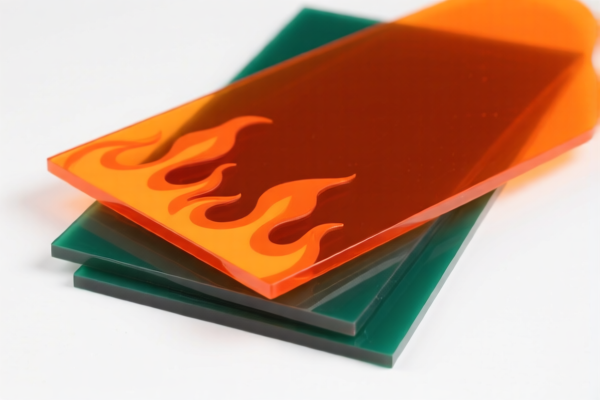

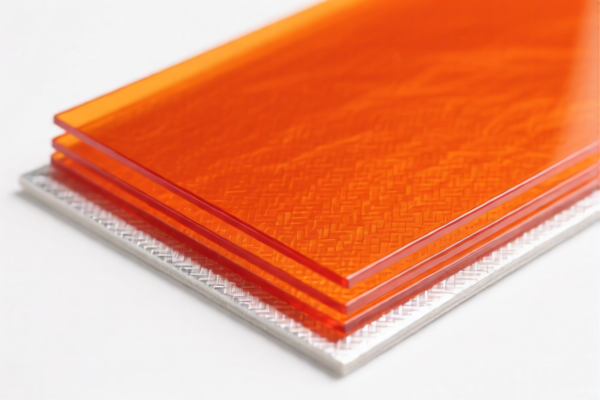

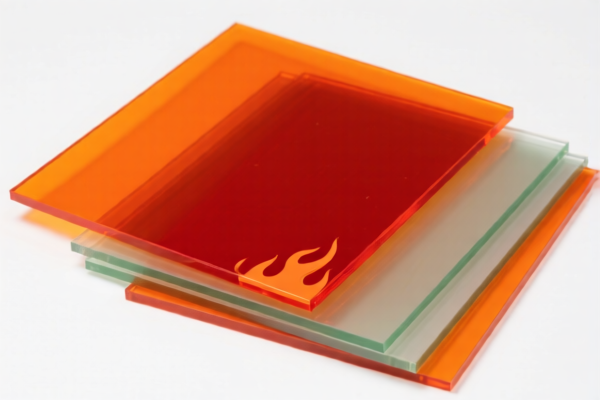

Product Name: Acrylic Flame Retardant Sheets

Classification: Plastic products made of acrylic polymers with flame retardant properties

🔍 HS CODE Classification and Tax Details (April 2025 Update)

Below are the HS codes and corresponding tax rates for Acrylic Flame Retardant Sheets, based on the provided data:

✅ HS CODE: 3920598000

Description: Plastic products based on acrylic polymers

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is a general category for acrylic-based plastic products, not specifically for flame-retardant sheets.

✅ HS CODE: 3920591000

Description: Flexible plastic sheets made of acrylic polymers

- Total Tax Rate: 61.0%

- Breakdown:

- Base Tariff: 6.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to flexible acrylic sheets, not flame-retardant ones.

✅ HS CODE: 3920594000

Description: Plastic sheets made of acrylic polymers

- Total Tax Rate: 55.0%

- Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is the lowest tax rate among the options, but it applies to general acrylic sheets, not flame-retardant ones.

✅ HS CODE: 3920515050

Description: Non-flexible sheets containing flame retardants

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is the most relevant code for Acrylic Flame Retardant Sheets.

- Key Point: This code specifically includes non-flexible sheets with flame retardants, which matches your product description.

✅ HS CODE: 3906902000

Description: Plastic products made of acrylic resins

- Total Tax Rate: 61.3%

- Breakdown:

- Base Tariff: 6.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is a general category for acrylic resin products, not specific to flame-retardant sheets.

📌 Recommendation and Actions Required

- ✅ Choose the correct HS code:

-

3920515050 is the most accurate for Acrylic Flame Retardant Sheets.

-

⚠️ Time-sensitive policy alert:

- Additional tariffs of 30.0% apply after April 11, 2025.

-

Ensure your customs declaration is completed before this date to avoid higher costs.

-

🔍 Verify product details:

- Confirm the material composition (e.g., type of acrylic, flame retardant used).

-

Check if the product is flexible or non-flexible (this affects classification).

-

📄 Required Certifications:

-

Flame retardant certification (e.g., UL, GB, etc.) may be required for compliance and customs clearance.

-

💰 Cost Estimation:

- For 100 kg of product:

- Base + Additional Tariff: 25.0%

- After April 11, 2025: 30.0%

- Total tax cost = (Product value) × (Applicable tax rate)

📞 Proactive Advice:

- Consult a customs broker or HS code expert for confirmation, especially if the product has multiple components or additives.

- Keep documentation on flame retardant compliance and material specifications for customs inspections.

Product Name: Acrylic Flame Retardant Sheets

Classification: Plastic products made of acrylic polymers with flame retardant properties

🔍 HS CODE Classification and Tax Details (April 2025 Update)

Below are the HS codes and corresponding tax rates for Acrylic Flame Retardant Sheets, based on the provided data:

✅ HS CODE: 3920598000

Description: Plastic products based on acrylic polymers

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is a general category for acrylic-based plastic products, not specifically for flame-retardant sheets.

✅ HS CODE: 3920591000

Description: Flexible plastic sheets made of acrylic polymers

- Total Tax Rate: 61.0%

- Breakdown:

- Base Tariff: 6.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to flexible acrylic sheets, not flame-retardant ones.

✅ HS CODE: 3920594000

Description: Plastic sheets made of acrylic polymers

- Total Tax Rate: 55.0%

- Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is the lowest tax rate among the options, but it applies to general acrylic sheets, not flame-retardant ones.

✅ HS CODE: 3920515050

Description: Non-flexible sheets containing flame retardants

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is the most relevant code for Acrylic Flame Retardant Sheets.

- Key Point: This code specifically includes non-flexible sheets with flame retardants, which matches your product description.

✅ HS CODE: 3906902000

Description: Plastic products made of acrylic resins

- Total Tax Rate: 61.3%

- Breakdown:

- Base Tariff: 6.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is a general category for acrylic resin products, not specific to flame-retardant sheets.

📌 Recommendation and Actions Required

- ✅ Choose the correct HS code:

-

3920515050 is the most accurate for Acrylic Flame Retardant Sheets.

-

⚠️ Time-sensitive policy alert:

- Additional tariffs of 30.0% apply after April 11, 2025.

-

Ensure your customs declaration is completed before this date to avoid higher costs.

-

🔍 Verify product details:

- Confirm the material composition (e.g., type of acrylic, flame retardant used).

-

Check if the product is flexible or non-flexible (this affects classification).

-

📄 Required Certifications:

-

Flame retardant certification (e.g., UL, GB, etc.) may be required for compliance and customs clearance.

-

💰 Cost Estimation:

- For 100 kg of product:

- Base + Additional Tariff: 25.0%

- After April 11, 2025: 30.0%

- Total tax cost = (Product value) × (Applicable tax rate)

📞 Proactive Advice:

- Consult a customs broker or HS code expert for confirmation, especially if the product has multiple components or additives.

- Keep documentation on flame retardant compliance and material specifications for customs inspections.

Customer Reviews

No reviews yet.