Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920591000 | Doc | 61.0% | CN | US | 2025-05-12 |

| 3920511000 | Doc | 61.0% | CN | US | 2025-05-12 |

| 3920511000 | Doc | 61.0% | CN | US | 2025-05-12 |

| 3920511000 | Doc | 61.0% | CN | US | 2025-05-12 |

| 3920511000 | Doc | 61.0% | CN | US | 2025-05-12 |

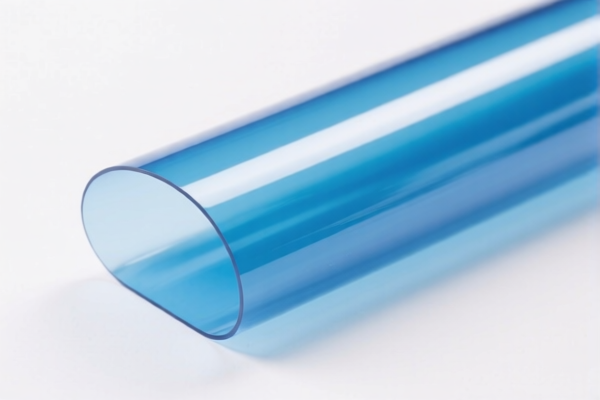

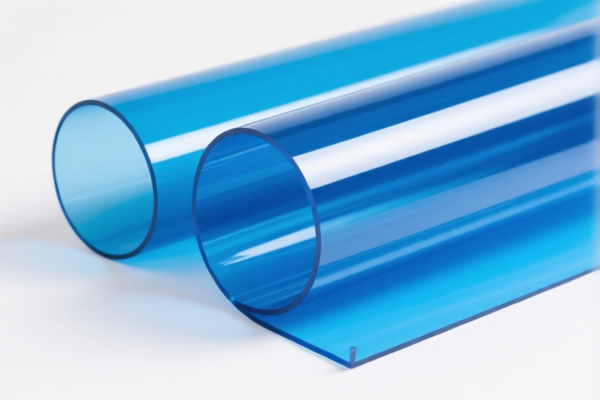

Product Name: Acrylic Flexible Film

Classification: Based on HS Code and Description

✅ HS CODE: 3920511000

Description: Acrylic flexible film (including industrial, matte, textured, and packaging films)

Total Tax Rate: 61.0%

🔍 Tariff Breakdown:

- Base Tariff Rate: 6.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is a time-sensitive policy. Ensure compliance with updated regulations after this date.

⚠️ Important Notes:

- April 11 Special Tariff: A 30.0% additional tariff will be applied to this product after April 11, 2025. This is likely due to trade policy adjustments or anti-dumping measures.

- Anti-dumping duties: Not explicitly mentioned for this product, but be cautious if the product contains iron or aluminum components, as those may be subject to additional duties.

- Material and Certification: Verify the exact material composition and unit price of the acrylic film. Some customs authorities may require specific certifications (e.g., technical specifications, origin documentation) for accurate classification.

📌 Proactive Advice:

- Confirm Product Classification: Ensure the product is correctly classified under HS Code 3920511000 based on its specific use (e.g., industrial, packaging, etc.).

- Check for Updates: Monitor any changes in tariff rates or policy updates after April 11, 2025.

- Documentation: Prepare all necessary documentation, including product specifications, invoices, and origin certificates, to avoid delays in customs clearance.

Let me know if you need help with customs documentation or further clarification on tariff implications.

Product Name: Acrylic Flexible Film

Classification: Based on HS Code and Description

✅ HS CODE: 3920511000

Description: Acrylic flexible film (including industrial, matte, textured, and packaging films)

Total Tax Rate: 61.0%

🔍 Tariff Breakdown:

- Base Tariff Rate: 6.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is a time-sensitive policy. Ensure compliance with updated regulations after this date.

⚠️ Important Notes:

- April 11 Special Tariff: A 30.0% additional tariff will be applied to this product after April 11, 2025. This is likely due to trade policy adjustments or anti-dumping measures.

- Anti-dumping duties: Not explicitly mentioned for this product, but be cautious if the product contains iron or aluminum components, as those may be subject to additional duties.

- Material and Certification: Verify the exact material composition and unit price of the acrylic film. Some customs authorities may require specific certifications (e.g., technical specifications, origin documentation) for accurate classification.

📌 Proactive Advice:

- Confirm Product Classification: Ensure the product is correctly classified under HS Code 3920511000 based on its specific use (e.g., industrial, packaging, etc.).

- Check for Updates: Monitor any changes in tariff rates or policy updates after April 11, 2025.

- Documentation: Prepare all necessary documentation, including product specifications, invoices, and origin certificates, to avoid delays in customs clearance.

Let me know if you need help with customs documentation or further clarification on tariff implications.

Customer Reviews

No reviews yet.