| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920591000 | Doc | 61.0% | CN | US | 2025-05-12 |

| 3920598000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920200055 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920511000 | Doc | 61.0% | CN | US | 2025-05-12 |

| 3906901000 | Doc | 55.0% | CN | US | 2025-05-12 |

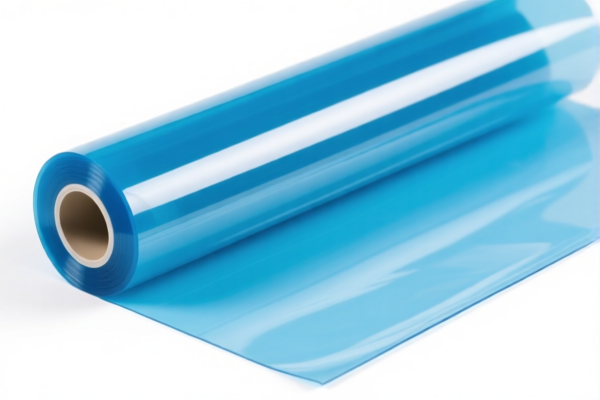

Here is the structured classification and tariff information for Acrylic Flexible Plastic Film based on the provided HS codes:

🔍 Product Classification Overview: Acrylic Flexible Plastic Film

✅ HS CODE: 3920591000

- Description: Acrylic plastic flexible film, sheets, foils, etc.

- Total Tax Rate: 61.0%

- Base Tariff: 6.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is a common code for general acrylic flexible films.

✅ HS CODE: 3920598000

- Description: Acrylic plastic thin sheets, polymer plastic films

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Slightly higher base tariff than 3920591000.

✅ HS CODE: 3920200055

- Description: Acrylic plastic film

- Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Lower base tariff, possibly for specific types of acrylic films.

✅ HS CODE: 3920511000

- Description: Methyl methacrylate flexible film

- Total Tax Rate: 61.0%

- Base Tariff: 6.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is a specific type of acrylic film with a methyl methacrylate base.

✅ HS CODE: 3906901000

- Description: Acrylic elastomer film

- Total Tax Rate: 55.0%

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Lowest base tariff, possibly for specialized or elastic acrylic films.

⚠️ Important Notes and Recommendations:

-

April 11, 2025 Special Tariff: All the above HS codes will be subject to an additional 30.0% tariff after April 11, 2025. This is a time-sensitive policy and should be considered in your import planning.

-

Anti-dumping duties: Not applicable for acrylic films unless specified by the importing country (e.g., China may have specific anti-dumping measures for certain plastics). Verify with local customs or a customs broker.

-

Material and Certification Requirements:

- Confirm the exact material composition (e.g., whether it's PMMA, MMA, or other derivatives).

-

Check if certifications (e.g., RoHS, REACH, or specific import permits) are required for your destination country.

-

Unit Price and Classification:

- Ensure the HS code matches the product description and unit price. Misclassification can lead to delays or penalties.

📌 Proactive Advice:

- Verify the product's exact composition and intended use to ensure correct HS code selection.

- Consult a customs broker or tax consultant for accurate tariff calculation and compliance.

- Monitor policy updates after April 11, 2025, as additional tariffs may change or be extended.

Let me know if you need help selecting the most appropriate HS code for your specific product. Here is the structured classification and tariff information for Acrylic Flexible Plastic Film based on the provided HS codes:

🔍 Product Classification Overview: Acrylic Flexible Plastic Film

✅ HS CODE: 3920591000

- Description: Acrylic plastic flexible film, sheets, foils, etc.

- Total Tax Rate: 61.0%

- Base Tariff: 6.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is a common code for general acrylic flexible films.

✅ HS CODE: 3920598000

- Description: Acrylic plastic thin sheets, polymer plastic films

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Slightly higher base tariff than 3920591000.

✅ HS CODE: 3920200055

- Description: Acrylic plastic film

- Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Lower base tariff, possibly for specific types of acrylic films.

✅ HS CODE: 3920511000

- Description: Methyl methacrylate flexible film

- Total Tax Rate: 61.0%

- Base Tariff: 6.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is a specific type of acrylic film with a methyl methacrylate base.

✅ HS CODE: 3906901000

- Description: Acrylic elastomer film

- Total Tax Rate: 55.0%

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Lowest base tariff, possibly for specialized or elastic acrylic films.

⚠️ Important Notes and Recommendations:

-

April 11, 2025 Special Tariff: All the above HS codes will be subject to an additional 30.0% tariff after April 11, 2025. This is a time-sensitive policy and should be considered in your import planning.

-

Anti-dumping duties: Not applicable for acrylic films unless specified by the importing country (e.g., China may have specific anti-dumping measures for certain plastics). Verify with local customs or a customs broker.

-

Material and Certification Requirements:

- Confirm the exact material composition (e.g., whether it's PMMA, MMA, or other derivatives).

-

Check if certifications (e.g., RoHS, REACH, or specific import permits) are required for your destination country.

-

Unit Price and Classification:

- Ensure the HS code matches the product description and unit price. Misclassification can lead to delays or penalties.

📌 Proactive Advice:

- Verify the product's exact composition and intended use to ensure correct HS code selection.

- Consult a customs broker or tax consultant for accurate tariff calculation and compliance.

- Monitor policy updates after April 11, 2025, as additional tariffs may change or be extended.

Let me know if you need help selecting the most appropriate HS code for your specific product.

Customer Reviews

No reviews yet.