| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920591000 | Doc | 61.0% | CN | US | 2025-05-12 |

| 3920598000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3906901000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3920631000 | Doc | 59.2% | CN | US | 2025-05-12 |

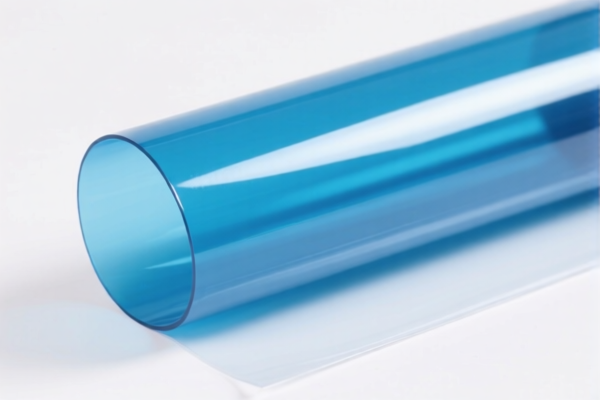

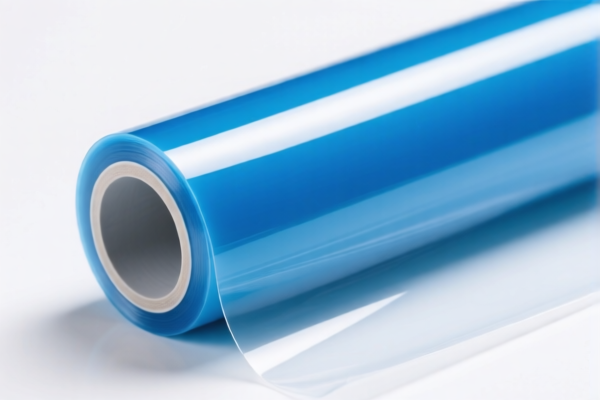

- Product Classification: Acrylic Flexible Plastic Foil

- HS CODE: 3920591000

- Description: Acrylic plastic flexible sheets, films, foils, and strips

- Base Tariff Rate: 6.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Total Tax Rate: 61.0%

-

Key Notes:

- This HS code is specifically for acrylic (polymethyl methacrylate) flexible plastic foil, which includes sheets, films, and foils.

- The additional 25% tariff is likely a general import duty or trade policy measure.

-

A special 30% tariff will be applied after April 11, 2025, which may be related to specific trade agreements or anti-dumping measures.

-

Proactive Advice:

- Verify the material composition to ensure it is indeed acrylic (PMMA) and not a blend or composite.

- Check the unit price to determine if it falls under any preferential tariff categories.

- Confirm if any certifications (e.g., RoHS, REACH) are required for import into the destination country.

-

Monitor the April 11, 2025 deadline to avoid unexpected increases in import costs.

-

Alternative HS Codes for Similar Products:

- 3920598000 – Acrylic plastic thin sheets (slightly different from flexible foils)

- 3906901000 – Acrylic elastomer sheets (elastic, not flexible)

-

3920631000 – Flexible polyester plastic sheets (not acrylic)

-

Tariff Comparison:

- 3920591000 (Acrylic flexible foil): 61.0%

- 3920598000 (Acrylic thin sheets): 61.5%

- 3906901000 (Acrylic elastomer sheets): 55.0%

-

3920631000 (Polyester flexible sheets): 59.2%

-

Recommendation:

- If your product is flexible and made of acrylic, 3920591000 is the most accurate classification.

- If in doubt, consult a customs broker or use a product classification tool with detailed material specifications.

- Product Classification: Acrylic Flexible Plastic Foil

- HS CODE: 3920591000

- Description: Acrylic plastic flexible sheets, films, foils, and strips

- Base Tariff Rate: 6.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Total Tax Rate: 61.0%

-

Key Notes:

- This HS code is specifically for acrylic (polymethyl methacrylate) flexible plastic foil, which includes sheets, films, and foils.

- The additional 25% tariff is likely a general import duty or trade policy measure.

-

A special 30% tariff will be applied after April 11, 2025, which may be related to specific trade agreements or anti-dumping measures.

-

Proactive Advice:

- Verify the material composition to ensure it is indeed acrylic (PMMA) and not a blend or composite.

- Check the unit price to determine if it falls under any preferential tariff categories.

- Confirm if any certifications (e.g., RoHS, REACH) are required for import into the destination country.

-

Monitor the April 11, 2025 deadline to avoid unexpected increases in import costs.

-

Alternative HS Codes for Similar Products:

- 3920598000 – Acrylic plastic thin sheets (slightly different from flexible foils)

- 3906901000 – Acrylic elastomer sheets (elastic, not flexible)

-

3920631000 – Flexible polyester plastic sheets (not acrylic)

-

Tariff Comparison:

- 3920591000 (Acrylic flexible foil): 61.0%

- 3920598000 (Acrylic thin sheets): 61.5%

- 3906901000 (Acrylic elastomer sheets): 55.0%

-

3920631000 (Polyester flexible sheets): 59.2%

-

Recommendation:

- If your product is flexible and made of acrylic, 3920591000 is the most accurate classification.

- If in doubt, consult a customs broker or use a product classification tool with detailed material specifications.

Customer Reviews

No reviews yet.