| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920511000 | Doc | 61.0% | CN | US | 2025-05-12 |

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

| 3920631000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920591000 | Doc | 61.0% | CN | US | 2025-05-12 |

| 3916901000 | Doc | 61.5% | CN | US | 2025-05-12 |

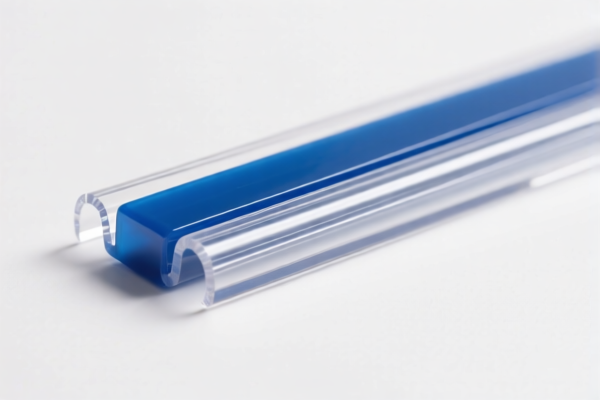

Here is the structured classification and tariff information for Acrylic Flexible Plastic Strip based on the provided HS codes and tax details:

✅ HS CODE: 3921905050

Product Description: Flexible plastic strips

Total Tax Rate: 34.8%

Breakdown of Tariffs:

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

Key Notes: - This is the most favorable rate among the options, as it has no additional tariffs before April 11, 2025. - After April 11, 2025, the total tax rate will increase to 34.8%.

⚠️ HS CODE: 3920511000

Product Description: Acrylic flexible plastic sheets or packaging film

Total Tax Rate: 61.0%

Breakdown of Tariffs:

- Base Tariff: 6.0%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

Key Notes: - This code is for acrylic sheets, not strips, so it may not be the best fit for your product. - High tax rate due to both additional and special tariffs.

⚠️ HS CODE: 3920631000

Product Description: Polyester flexible plastic strips or unsaturated polyester plastic strips

Total Tax Rate: 59.2%

Breakdown of Tariffs:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

Key Notes: - This code is for polyester or unsaturated polyester strips, not acrylic. - Higher tax rate than 3921905050, but lower than 3920511000.

⚠️ HS CODE: 3920591000

Product Description: Acrylic flexible sheets

Total Tax Rate: 61.0%

Breakdown of Tariffs:

- Base Tariff: 6.0%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

Key Notes: - This is for acrylic sheets, not strips, so it may not be the best fit for your product. - High tax rate due to additional and special tariffs.

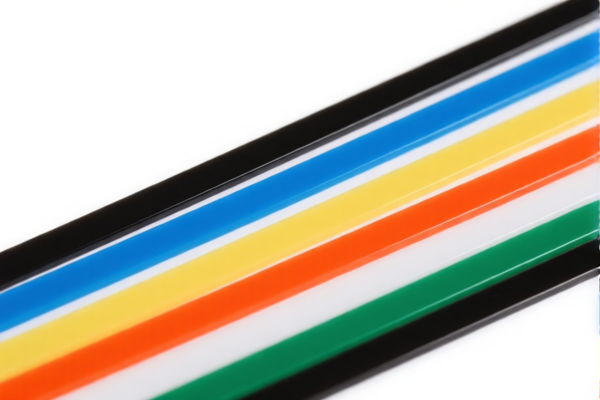

⚠️ HS CODE: 3916901000

Product Description: Acrylic plastic rods

Total Tax Rate: 61.5%

Breakdown of Tariffs:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

Key Notes: - This is for acrylic rods, not strips, so it may not be the best fit for your product. - Highest tax rate among all options.

📌 Proactive Advice:

- Verify the material composition of your product (e.g., is it acrylic, polyester, or another type of plastic?).

- Confirm the product form (strip, rod, sheet, etc.) to ensure correct classification.

- Check the unit price and total value to determine if any preferential tariff applies.

- Review required certifications (e.g., RoHS, REACH, or other compliance documents) for export.

- Monitor the April 11, 2025 deadline for potential tariff increases.

✅ Recommended HS Code: 3921905050

This is the most suitable and cost-effective option for acrylic flexible plastic strips, with the lowest total tax rate before April 11, 2025. Here is the structured classification and tariff information for Acrylic Flexible Plastic Strip based on the provided HS codes and tax details:

✅ HS CODE: 3921905050

Product Description: Flexible plastic strips

Total Tax Rate: 34.8%

Breakdown of Tariffs:

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

Key Notes: - This is the most favorable rate among the options, as it has no additional tariffs before April 11, 2025. - After April 11, 2025, the total tax rate will increase to 34.8%.

⚠️ HS CODE: 3920511000

Product Description: Acrylic flexible plastic sheets or packaging film

Total Tax Rate: 61.0%

Breakdown of Tariffs:

- Base Tariff: 6.0%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

Key Notes: - This code is for acrylic sheets, not strips, so it may not be the best fit for your product. - High tax rate due to both additional and special tariffs.

⚠️ HS CODE: 3920631000

Product Description: Polyester flexible plastic strips or unsaturated polyester plastic strips

Total Tax Rate: 59.2%

Breakdown of Tariffs:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

Key Notes: - This code is for polyester or unsaturated polyester strips, not acrylic. - Higher tax rate than 3921905050, but lower than 3920511000.

⚠️ HS CODE: 3920591000

Product Description: Acrylic flexible sheets

Total Tax Rate: 61.0%

Breakdown of Tariffs:

- Base Tariff: 6.0%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

Key Notes: - This is for acrylic sheets, not strips, so it may not be the best fit for your product. - High tax rate due to additional and special tariffs.

⚠️ HS CODE: 3916901000

Product Description: Acrylic plastic rods

Total Tax Rate: 61.5%

Breakdown of Tariffs:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

Key Notes: - This is for acrylic rods, not strips, so it may not be the best fit for your product. - Highest tax rate among all options.

📌 Proactive Advice:

- Verify the material composition of your product (e.g., is it acrylic, polyester, or another type of plastic?).

- Confirm the product form (strip, rod, sheet, etc.) to ensure correct classification.

- Check the unit price and total value to determine if any preferential tariff applies.

- Review required certifications (e.g., RoHS, REACH, or other compliance documents) for export.

- Monitor the April 11, 2025 deadline for potential tariff increases.

✅ Recommended HS Code: 3921905050

This is the most suitable and cost-effective option for acrylic flexible plastic strips, with the lowest total tax rate before April 11, 2025.

Customer Reviews

No reviews yet.