| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920511000 | Doc | 61.0% | CN | US | 2025-05-12 |

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

| 3920631000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920992000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920591000 | Doc | 61.0% | CN | US | 2025-05-12 |

Here is the structured classification and tariff information for Acrylic Flexible Plastic Strip Material based on the provided HS codes and tax details:

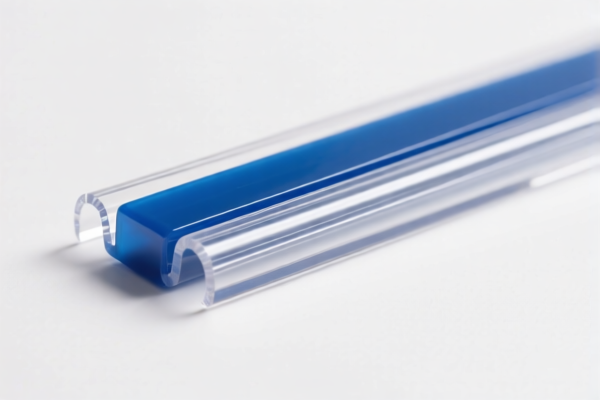

✅ HS CODE: 3920511000

Product Description: Acrylic flexible plastic strip material (PMMA, poly(methyl methacrylate))

Tariff Summary:

- Base Tariff Rate: 6.0%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Total Tax Rate: 61.0%

Key Notes:

- This code is specifically for acrylic (PMMA) flexible plastic strip material.

- The term "flexible" aligns with the HS code description.

- Time-sensitive alert: Additional tariffs apply after April 11, 2025.

✅ HS CODE: 3921905050

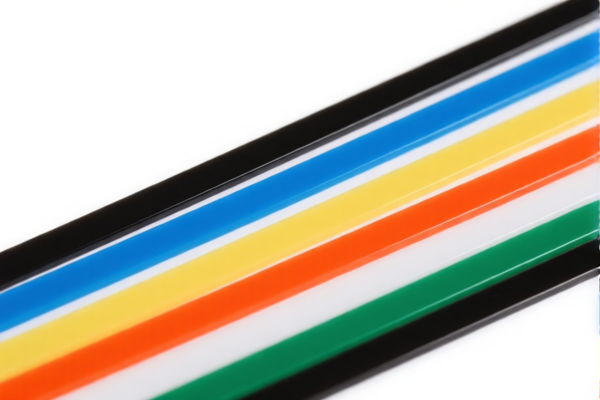

Product Description: Flexible plastic strip (other plastics, not cellular or reinforced)

Tariff Summary:

- Base Tariff Rate: 4.8%

- Additional Tariff: 0.0%

- April 11, 2025 Special Tariff: 30.0%

- Total Tax Rate: 34.8%

Key Notes:

- This code applies to other plastics (not acrylic) used for flexible strips.

- No additional tariffs currently apply, but 30% will be added after April 11, 2025.

- Proactive advice: Confirm the material composition to ensure correct classification.

✅ HS CODE: 3920631000

Product Description: Polyester flexible plastic strip material

Tariff Summary:

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Total Tax Rate: 59.2%

Key Notes:

- This code is for polyester-based flexible plastic strip material.

- Time-sensitive alert: Additional tariffs apply after April 11, 2025.

✅ HS CODE: 3920992000

Product Description: Other flexible plastic strip (non-cellular, non-reinforced, not laminated or combined with other materials)

Tariff Summary:

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Total Tax Rate: 59.2%

Key Notes:

- This code applies to other plastics (not acrylic or polyester) used for flexible strips.

- Time-sensitive alert: Additional tariffs apply after April 11, 2025.

- Proactive advice: Confirm the material type and processing method to avoid misclassification.

✅ HS CODE: 3920591000

Product Description: Acrylic flexible plastic sheet (PMMA)

Tariff Summary:

- Base Tariff Rate: 6.0%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Total Tax Rate: 61.0%

Key Notes:

- This code is for acrylic (PMMA) flexible plastic sheets.

- Time-sensitive alert: Additional tariffs apply after April 11, 2025.

📌 Proactive Advice for Importers:

- Verify the material composition (e.g., acrylic, polyester, or other plastics) to ensure correct HS code selection.

- Check the unit price and certifications required (e.g., RoHS, REACH, or other compliance standards).

- Monitor the April 11, 2025 deadline for additional tariffs.

- Consult a customs broker or classification expert if the product is complex or has mixed materials.

Let me know if you need help with a specific product or customs documentation. Here is the structured classification and tariff information for Acrylic Flexible Plastic Strip Material based on the provided HS codes and tax details:

✅ HS CODE: 3920511000

Product Description: Acrylic flexible plastic strip material (PMMA, poly(methyl methacrylate))

Tariff Summary:

- Base Tariff Rate: 6.0%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Total Tax Rate: 61.0%

Key Notes:

- This code is specifically for acrylic (PMMA) flexible plastic strip material.

- The term "flexible" aligns with the HS code description.

- Time-sensitive alert: Additional tariffs apply after April 11, 2025.

✅ HS CODE: 3921905050

Product Description: Flexible plastic strip (other plastics, not cellular or reinforced)

Tariff Summary:

- Base Tariff Rate: 4.8%

- Additional Tariff: 0.0%

- April 11, 2025 Special Tariff: 30.0%

- Total Tax Rate: 34.8%

Key Notes:

- This code applies to other plastics (not acrylic) used for flexible strips.

- No additional tariffs currently apply, but 30% will be added after April 11, 2025.

- Proactive advice: Confirm the material composition to ensure correct classification.

✅ HS CODE: 3920631000

Product Description: Polyester flexible plastic strip material

Tariff Summary:

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Total Tax Rate: 59.2%

Key Notes:

- This code is for polyester-based flexible plastic strip material.

- Time-sensitive alert: Additional tariffs apply after April 11, 2025.

✅ HS CODE: 3920992000

Product Description: Other flexible plastic strip (non-cellular, non-reinforced, not laminated or combined with other materials)

Tariff Summary:

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Total Tax Rate: 59.2%

Key Notes:

- This code applies to other plastics (not acrylic or polyester) used for flexible strips.

- Time-sensitive alert: Additional tariffs apply after April 11, 2025.

- Proactive advice: Confirm the material type and processing method to avoid misclassification.

✅ HS CODE: 3920591000

Product Description: Acrylic flexible plastic sheet (PMMA)

Tariff Summary:

- Base Tariff Rate: 6.0%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Total Tax Rate: 61.0%

Key Notes:

- This code is for acrylic (PMMA) flexible plastic sheets.

- Time-sensitive alert: Additional tariffs apply after April 11, 2025.

📌 Proactive Advice for Importers:

- Verify the material composition (e.g., acrylic, polyester, or other plastics) to ensure correct HS code selection.

- Check the unit price and certifications required (e.g., RoHS, REACH, or other compliance standards).

- Monitor the April 11, 2025 deadline for additional tariffs.

- Consult a customs broker or classification expert if the product is complex or has mixed materials.

Let me know if you need help with a specific product or customs documentation.

Customer Reviews

No reviews yet.