| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920515050 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920598000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920511000 | Doc | 61.0% | CN | US | 2025-05-12 |

| 3920591000 | Doc | 61.0% | CN | US | 2025-05-12 |

| 3920631000 | Doc | 59.2% | CN | US | 2025-05-12 |

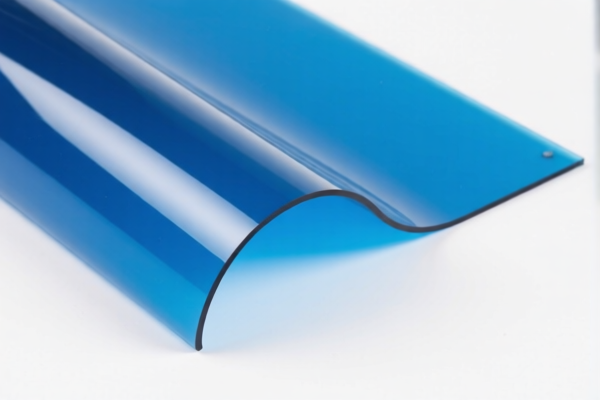

Product Classification: Acrylic Flexible Transparent Plastic Sheet

HS CODE: 3920515050 (Acrylic Transparent Sheet)

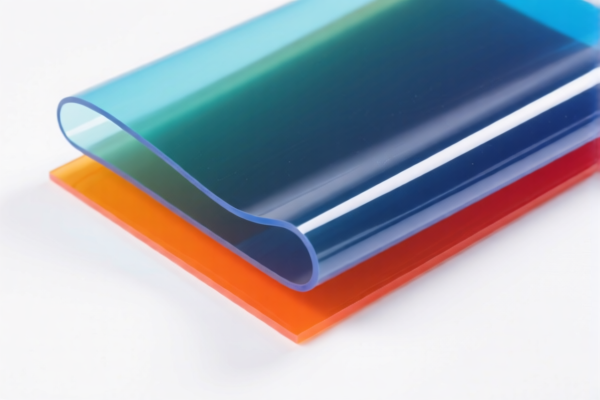

HS CODE: 3920598000 (Acrylic Colored Transparent Sheet)

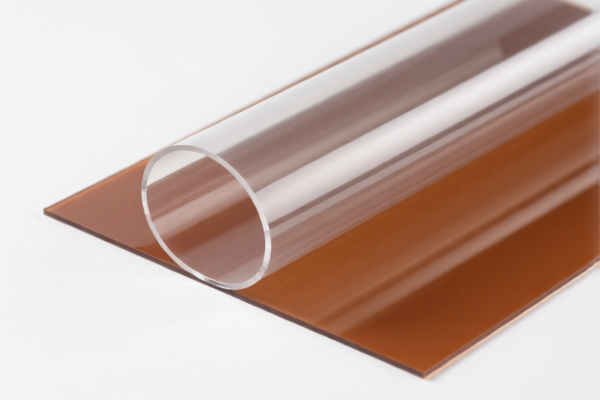

HS CODE: 3920511000 (Acrylic Flexible Light Guide Plate)

HS CODE: 3920591000 (Acrylic Flexible Sheet)

HS CODE: 3920515050 (Acrylic Transparent Board)

🔍 Classification Summary

Acrylic flexible transparent plastic sheets fall under Chapter 3920 of the HS code, which covers cellulose and other plastic sheets, plates, and strips. The specific HS codes depend on the product's characteristics, such as color, flexibility, and intended use (e.g., light guide plates).

📊 Tariff Overview (as of now)

- Base Tariff Rate: 6.0% to 6.5% (varies by product type)

- Additional Tariff: 25.0% (applies to all products)

- Special Tariff after April 11, 2025: 30.0% (applies to all products)

- Anti-dumping duties on iron and aluminum: Not applicable (these are for metal products, not plastics)

📌 Key Tax Rate Changes

- Total Tax Rate: 61.0% to 61.5% (depending on base rate)

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be imposed on all products in this category after April 11, 2025. This is a critical date to note for import planning.

- No anti-dumping duties are currently applicable for acrylic products.

🛠️ Proactive Advice for Importers

- Verify Material Composition: Ensure the product is indeed made of acrylic (PMMA) and not a composite or blended material, as this can affect classification.

- Check Unit Price and Specifications: The HS code may vary based on thickness, flexibility, and color. For example, "flexible" or "light guide" may lead to different codes.

- Certifications Required: Confirm if any certifications (e.g., RoHS, REACH) are needed for the product's intended market.

- Plan for Tariff Increases: With the 30.0% additional tariff coming into effect after April 11, 2025, consider adjusting your import strategy or sourcing plans accordingly.

- Consult a Customs Broker: For complex or high-value shipments, professional assistance is recommended to ensure accurate classification and compliance.

📌 Summary Table

| HS Code | Product Description | Base Tariff | Additional Tariff | April 11, 2025 Tariff | Total Tax Rate |

|---|---|---|---|---|---|

| 3920515050 | Acrylic Transparent Sheet | 6.5% | 25.0% | 30.0% | 61.5% |

| 3920598000 | Acrylic Colored Transparent Sheet | 6.5% | 25.0% | 30.0% | 61.5% |

| 3920511000 | Acrylic Flexible Light Guide Plate | 6.0% | 25.0% | 30.0% | 61.0% |

| 3920591000 | Acrylic Flexible Sheet | 6.0% | 25.0% | 30.0% | 61.0% |

If you have more details about the product (e.g., thickness, color, intended use), I can help refine the HS code further.

Product Classification: Acrylic Flexible Transparent Plastic Sheet

HS CODE: 3920515050 (Acrylic Transparent Sheet)

HS CODE: 3920598000 (Acrylic Colored Transparent Sheet)

HS CODE: 3920511000 (Acrylic Flexible Light Guide Plate)

HS CODE: 3920591000 (Acrylic Flexible Sheet)

HS CODE: 3920515050 (Acrylic Transparent Board)

🔍 Classification Summary

Acrylic flexible transparent plastic sheets fall under Chapter 3920 of the HS code, which covers cellulose and other plastic sheets, plates, and strips. The specific HS codes depend on the product's characteristics, such as color, flexibility, and intended use (e.g., light guide plates).

📊 Tariff Overview (as of now)

- Base Tariff Rate: 6.0% to 6.5% (varies by product type)

- Additional Tariff: 25.0% (applies to all products)

- Special Tariff after April 11, 2025: 30.0% (applies to all products)

- Anti-dumping duties on iron and aluminum: Not applicable (these are for metal products, not plastics)

📌 Key Tax Rate Changes

- Total Tax Rate: 61.0% to 61.5% (depending on base rate)

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be imposed on all products in this category after April 11, 2025. This is a critical date to note for import planning.

- No anti-dumping duties are currently applicable for acrylic products.

🛠️ Proactive Advice for Importers

- Verify Material Composition: Ensure the product is indeed made of acrylic (PMMA) and not a composite or blended material, as this can affect classification.

- Check Unit Price and Specifications: The HS code may vary based on thickness, flexibility, and color. For example, "flexible" or "light guide" may lead to different codes.

- Certifications Required: Confirm if any certifications (e.g., RoHS, REACH) are needed for the product's intended market.

- Plan for Tariff Increases: With the 30.0% additional tariff coming into effect after April 11, 2025, consider adjusting your import strategy or sourcing plans accordingly.

- Consult a Customs Broker: For complex or high-value shipments, professional assistance is recommended to ensure accurate classification and compliance.

📌 Summary Table

| HS Code | Product Description | Base Tariff | Additional Tariff | April 11, 2025 Tariff | Total Tax Rate |

|---|---|---|---|---|---|

| 3920515050 | Acrylic Transparent Sheet | 6.5% | 25.0% | 30.0% | 61.5% |

| 3920598000 | Acrylic Colored Transparent Sheet | 6.5% | 25.0% | 30.0% | 61.5% |

| 3920511000 | Acrylic Flexible Light Guide Plate | 6.0% | 25.0% | 30.0% | 61.0% |

| 3920591000 | Acrylic Flexible Sheet | 6.0% | 25.0% | 30.0% | 61.0% |

If you have more details about the product (e.g., thickness, color, intended use), I can help refine the HS code further.

Customer Reviews

No reviews yet.