| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920591000 | Doc | 61.0% | CN | US | 2025-05-12 |

| 3920515050 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920598000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920515090 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920515050 | Doc | 61.5% | CN | US | 2025-05-12 |

Here is the structured classification and tariff information for Acrylic Flexible Transparent Sheets based on the provided HS codes and tax details:

✅ Product Classification Overview: Acrylic Flexible Transparent Sheet

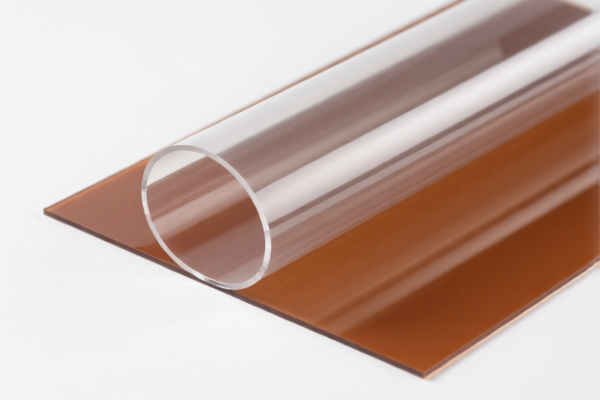

🔢 HS CODE: 3920591000

- Product Description: Flexible Acrylic Sheet

- Total Tax Rate: 61.0%

- Breakdown:

- Base Tariff: 6.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for flexible acrylic sheets, which may differ slightly in material properties from rigid sheets.

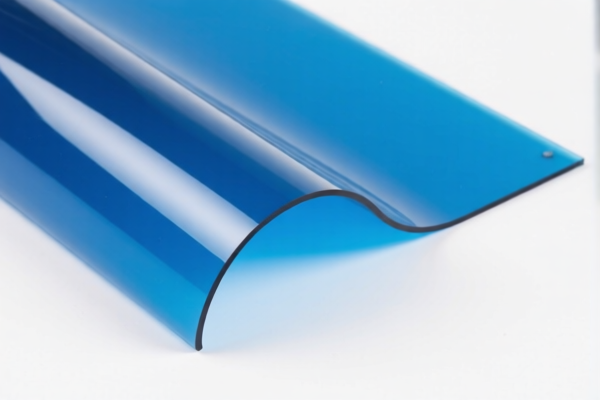

🔢 HS CODE: 3920515050

- Product Description: Acrylic Transparent Sheet

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to transparent acrylic sheets. It appears multiple times in the list with the same tax details.

🔢 HS CODE: 3920598000

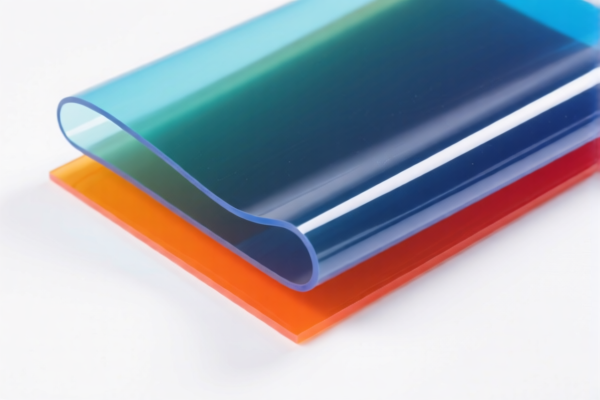

- Product Description: Acrylic Colored Transparent Sheet

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for colored transparent acrylic sheets, which may require additional documentation or certifications depending on the color and application.

🔢 HS CODE: 3920515090

- Product Description: Acrylic Transparent Sheet

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is another variant of transparent acrylic sheet, likely differing in thickness, size, or technical specifications.

⚠️ Important Notes and Recommendations:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied after April 11, 2025. Ensure your import timeline is planned accordingly to avoid unexpected costs. -

Anti-Dumping Duties:

No specific anti-dumping duties are mentioned for acrylic products in this context, but always verify with the latest customs updates or consult a customs broker for confirmation. -

Certifications and Documentation:

- Confirm the material composition (e.g., PMMA, polycarbonate) to ensure correct classification.

- Check if certifications (e.g., RoHS, REACH) are required for the intended market.

-

Verify unit price and product specifications to avoid misclassification.

-

Customs Clearance:

Ensure that the product description on the invoice and customs documents matches the HS code used. Mismatches can lead to delays or penalties.

📌 Proactive Advice:

- Double-check the product's physical properties (flexibility, color, thickness) to determine the most accurate HS code.

- Consult a customs expert if the product is used in specialized applications (e.g., medical, automotive) which may have different regulations.

- Monitor policy updates after April 11, 2025, as additional tariffs may be adjusted or extended.

Let me know if you need help selecting the most appropriate HS code for your specific product. Here is the structured classification and tariff information for Acrylic Flexible Transparent Sheets based on the provided HS codes and tax details:

✅ Product Classification Overview: Acrylic Flexible Transparent Sheet

🔢 HS CODE: 3920591000

- Product Description: Flexible Acrylic Sheet

- Total Tax Rate: 61.0%

- Breakdown:

- Base Tariff: 6.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for flexible acrylic sheets, which may differ slightly in material properties from rigid sheets.

🔢 HS CODE: 3920515050

- Product Description: Acrylic Transparent Sheet

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to transparent acrylic sheets. It appears multiple times in the list with the same tax details.

🔢 HS CODE: 3920598000

- Product Description: Acrylic Colored Transparent Sheet

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for colored transparent acrylic sheets, which may require additional documentation or certifications depending on the color and application.

🔢 HS CODE: 3920515090

- Product Description: Acrylic Transparent Sheet

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is another variant of transparent acrylic sheet, likely differing in thickness, size, or technical specifications.

⚠️ Important Notes and Recommendations:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied after April 11, 2025. Ensure your import timeline is planned accordingly to avoid unexpected costs. -

Anti-Dumping Duties:

No specific anti-dumping duties are mentioned for acrylic products in this context, but always verify with the latest customs updates or consult a customs broker for confirmation. -

Certifications and Documentation:

- Confirm the material composition (e.g., PMMA, polycarbonate) to ensure correct classification.

- Check if certifications (e.g., RoHS, REACH) are required for the intended market.

-

Verify unit price and product specifications to avoid misclassification.

-

Customs Clearance:

Ensure that the product description on the invoice and customs documents matches the HS code used. Mismatches can lead to delays or penalties.

📌 Proactive Advice:

- Double-check the product's physical properties (flexibility, color, thickness) to determine the most accurate HS code.

- Consult a customs expert if the product is used in specialized applications (e.g., medical, automotive) which may have different regulations.

- Monitor policy updates after April 11, 2025, as additional tariffs may be adjusted or extended.

Let me know if you need help selecting the most appropriate HS code for your specific product.

Customer Reviews

No reviews yet.