| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920511000 | Doc | 61.0% | CN | US | 2025-05-12 |

| 3920591000 | Doc | 61.0% | CN | US | 2025-05-12 |

| 3920598000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3926909989 | Doc | 42.8% | CN | US | 2025-05-12 |

| 3926909987 | Doc | 42.8% | CN | US | 2025-05-12 |

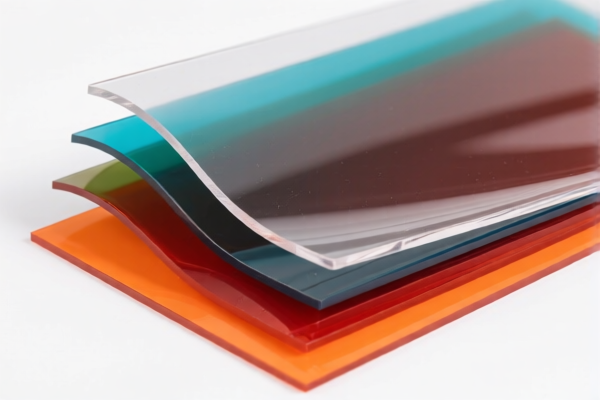

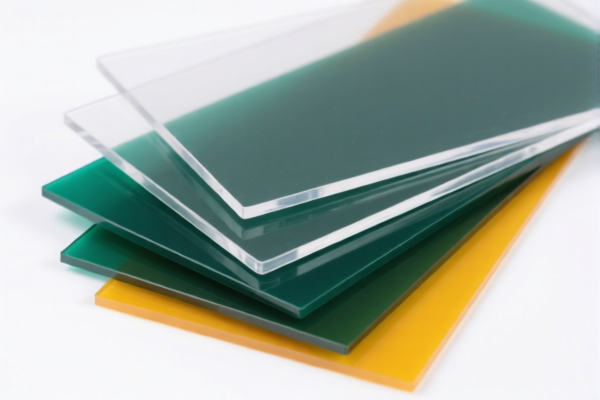

Product Classification: Acrylic Plastic Bending Sheets

HS CODEs and Tax Details:

- HS CODE: 3920511000

- Product Description: Acrylic flexible plastic sheets

- Total Tax Rate: 61.0%

-

Breakdown:

- Base Tariff: 6.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3920591000

- Product Description: Acrylic bendable film

- Total Tax Rate: 61.0%

-

Breakdown:

- Base Tariff: 6.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3920598000

- Product Description: Acrylic bending board

- Total Tax Rate: 61.5%

-

Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3926909989

- Product Description: Plastic acrylic sheet

- Total Tax Rate: 42.8%

-

Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3926909987

- Product Description: Plastic flexible conduit bending tube

- Total Tax Rate: 42.8%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

📌 Key Notes and Recommendations:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied to all the above HS codes after April 11, 2025. This is a time-sensitive policy and should be considered in your cost planning. -

Anti-Dumping Duties:

No specific anti-dumping duties are mentioned for acrylic products in this context, but it's advisable to confirm with customs or a trade compliance expert if your product is subject to any ongoing anti-dumping investigations. -

Material and Certification Verification:

Ensure that the product is indeed made of acrylic (PMMA) and not a different type of plastic, as misclassification can lead to penalties.

Confirm if any certifications (e.g., RoHS, REACH, or specific import permits) are required for the destination country. -

Unit Price and Tax Calculation:

Verify the unit price and total quantity to calculate the exact customs duty. The total tax rate is applied to the FOB value of the goods.

✅ Proactive Advice:

- Double-check the HS code with customs or a classification expert to avoid misclassification.

- Keep updated records of material composition and product specifications.

-

If exporting to China, be aware of the April 11, 2025 tariff change and plan accordingly. Product Classification: Acrylic Plastic Bending Sheets

HS CODEs and Tax Details: -

HS CODE: 3920511000

- Product Description: Acrylic flexible plastic sheets

- Total Tax Rate: 61.0%

-

Breakdown:

- Base Tariff: 6.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3920591000

- Product Description: Acrylic bendable film

- Total Tax Rate: 61.0%

-

Breakdown:

- Base Tariff: 6.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3920598000

- Product Description: Acrylic bending board

- Total Tax Rate: 61.5%

-

Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3926909989

- Product Description: Plastic acrylic sheet

- Total Tax Rate: 42.8%

-

Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3926909987

- Product Description: Plastic flexible conduit bending tube

- Total Tax Rate: 42.8%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

📌 Key Notes and Recommendations:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied to all the above HS codes after April 11, 2025. This is a time-sensitive policy and should be considered in your cost planning. -

Anti-Dumping Duties:

No specific anti-dumping duties are mentioned for acrylic products in this context, but it's advisable to confirm with customs or a trade compliance expert if your product is subject to any ongoing anti-dumping investigations. -

Material and Certification Verification:

Ensure that the product is indeed made of acrylic (PMMA) and not a different type of plastic, as misclassification can lead to penalties.

Confirm if any certifications (e.g., RoHS, REACH, or specific import permits) are required for the destination country. -

Unit Price and Tax Calculation:

Verify the unit price and total quantity to calculate the exact customs duty. The total tax rate is applied to the FOB value of the goods.

✅ Proactive Advice:

- Double-check the HS code with customs or a classification expert to avoid misclassification.

- Keep updated records of material composition and product specifications.

- If exporting to China, be aware of the April 11, 2025 tariff change and plan accordingly.

Customer Reviews

No reviews yet.