| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920515050 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920515090 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3926909989 | Doc | 42.8% | CN | US | 2025-05-12 |

| 3906902000 | Doc | 61.3% | CN | US | 2025-05-12 |

| 3906100000 | Doc | 61.3% | CN | US | 2025-05-12 |

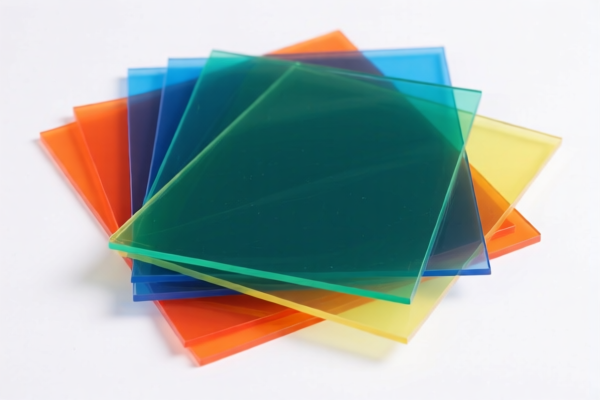

Here is the structured classification and tariff information for Acrylic Plastic Building Sheets, based on the provided HS codes and tax details:

✅ HS CODE: 3920515050

Product Description: Acrylic plastic sheets containing flame retardants

Total Tax Rate: 61.5%

Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This code is specific to acrylic sheets with flame retardants.

✅ HS CODE: 3920515090

Product Description: Acrylic plastic sheets without specific flame retardant restrictions

Total Tax Rate: 61.5%

Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This code applies to general acrylic sheets, regardless of flame retardant content.

✅ HS CODE: 3926909989

Product Description: Plastic products and sheets (not specifically acrylic)

Total Tax Rate: 42.8%

Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

Note: This is a catch-all code for general plastic sheets, not specifically for acrylic.

✅ HS CODE: 3906902000

Product Description: Acrylic resin sheets, primary form of acrylic resin

Total Tax Rate: 61.3%

Breakdown:

- Base Tariff: 6.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This code applies to raw acrylic resin sheets, not finished building materials.

✅ HS CODE: 3906100000

Product Description: Acrylic sheets made from polymethyl methacrylate (PMMA), primary form

Total Tax Rate: 61.3%

Breakdown:

- Base Tariff: 6.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This is for raw PMMA sheets, not finished products.

📌 Important Notes and Recommendations:

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be applied to all the above codes after April 11, 2025. Ensure your import timeline is planned accordingly.

- Material Verification: Confirm whether the product contains flame retardants (use 3920515050) or is a general acrylic sheet (use 3920515090).

- Certifications: Check if any safety or environmental certifications are required for import (e.g., RoHS, REACH, etc.).

- Unit Price: Verify the unit price and product form (raw material vs. finished product) to ensure correct classification.

- Anti-dumping duties: Not applicable for acrylic products, but always confirm with customs or a compliance expert for the latest updates.

Let me know if you need help selecting the most appropriate HS code for your specific product. Here is the structured classification and tariff information for Acrylic Plastic Building Sheets, based on the provided HS codes and tax details:

✅ HS CODE: 3920515050

Product Description: Acrylic plastic sheets containing flame retardants

Total Tax Rate: 61.5%

Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This code is specific to acrylic sheets with flame retardants.

✅ HS CODE: 3920515090

Product Description: Acrylic plastic sheets without specific flame retardant restrictions

Total Tax Rate: 61.5%

Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This code applies to general acrylic sheets, regardless of flame retardant content.

✅ HS CODE: 3926909989

Product Description: Plastic products and sheets (not specifically acrylic)

Total Tax Rate: 42.8%

Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

Note: This is a catch-all code for general plastic sheets, not specifically for acrylic.

✅ HS CODE: 3906902000

Product Description: Acrylic resin sheets, primary form of acrylic resin

Total Tax Rate: 61.3%

Breakdown:

- Base Tariff: 6.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This code applies to raw acrylic resin sheets, not finished building materials.

✅ HS CODE: 3906100000

Product Description: Acrylic sheets made from polymethyl methacrylate (PMMA), primary form

Total Tax Rate: 61.3%

Breakdown:

- Base Tariff: 6.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This is for raw PMMA sheets, not finished products.

📌 Important Notes and Recommendations:

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be applied to all the above codes after April 11, 2025. Ensure your import timeline is planned accordingly.

- Material Verification: Confirm whether the product contains flame retardants (use 3920515050) or is a general acrylic sheet (use 3920515090).

- Certifications: Check if any safety or environmental certifications are required for import (e.g., RoHS, REACH, etc.).

- Unit Price: Verify the unit price and product form (raw material vs. finished product) to ensure correct classification.

- Anti-dumping duties: Not applicable for acrylic products, but always confirm with customs or a compliance expert for the latest updates.

Let me know if you need help selecting the most appropriate HS code for your specific product.

Customer Reviews

No reviews yet.