| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920598000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920515050 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3926909989 | Doc | 42.8% | CN | US | 2025-05-12 |

| 3921902550 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920515090 | Doc | 61.5% | CN | US | 2025-05-12 |

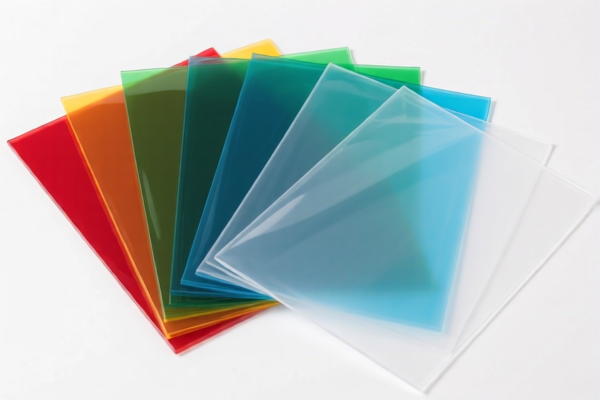

Product Classification: Acrylic Plastic Colored Sheets

Based on the provided HS codes and descriptions, the most likely classification for acrylic plastic colored sheets is under HS CODE: 3920598000 or 3920515050, depending on the specific composition and form of the product. Below is a detailed breakdown of the relevant HS codes and their associated tariff rates.

HS CODE: 3920598000

Description:

- Plastic sheets, plates, films, etc., based on acrylic polymers (not elsewhere specified).

Tariff Summary:

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 61.5%

Key Notes: - This code is suitable for acrylic plastic sheets that are not specifically defined under other more detailed HS codes (e.g., 3920515050). - The 30.0% additional tariff applies after April 11, 2025, so it is time-sensitive and must be considered in cost planning.

HS CODE: 3920515050

Description:

- Polymethyl methacrylate (PMMA) sheets.

Tariff Summary:

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 61.5%

Key Notes: - This code is for PMMA (acrylic) sheets, which are a specific type of acrylic polymer. - If your product is pure PMMA, this is the most accurate classification.

HS CODE: 3926909989

Description:

- Other plastic products, including those made from materials in Chapters 3901 to 3914.

Tariff Summary:

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 7.5%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 42.8%

Key Notes: - This code is for other plastic products that do not fit into more specific categories. - If your product is not a standard acrylic sheet (e.g., a composite or modified product), this may be applicable.

HS CODE: 3921902550

Description:

- Other plastic sheets, films, etc., combined with other textile materials.

Tariff Summary:

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 61.5%

Key Notes: - This code applies if your product is combined with textile materials (e.g., fabric-backed acrylic sheets). - If your product is not combined with textiles, this is not applicable.

HS CODE: 3920591000

Description:

- Flexible materials of non-cellulose plastics and not reinforced.

Tariff Summary:

- Base Tariff Rate: 6.0%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 61.0%

Key Notes: - This code is for flexible, non-reinforced plastic materials. - If your product is flexible and not reinforced, this may be a possible classification.

✅ Proactive Advice for Users:

- Verify Material Composition: Confirm whether your product is PMMA (polymethyl methacrylate) or a general acrylic polymer to choose the correct HS code.

- Check Unit Price and Certification: Some HS codes may require certifications (e.g., for origin or material content).

- Monitor Tariff Changes: The 30.0% additional tariff applies after April 11, 2025 — ensure your customs declarations and cost calculations reflect this.

- Consult a Customs Broker: For complex or high-value shipments, it is advisable to seek professional customs advice to avoid misclassification and penalties.

Let me know if you need help determining the most accurate HS code for your specific product.

Product Classification: Acrylic Plastic Colored Sheets

Based on the provided HS codes and descriptions, the most likely classification for acrylic plastic colored sheets is under HS CODE: 3920598000 or 3920515050, depending on the specific composition and form of the product. Below is a detailed breakdown of the relevant HS codes and their associated tariff rates.

HS CODE: 3920598000

Description:

- Plastic sheets, plates, films, etc., based on acrylic polymers (not elsewhere specified).

Tariff Summary:

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 61.5%

Key Notes: - This code is suitable for acrylic plastic sheets that are not specifically defined under other more detailed HS codes (e.g., 3920515050). - The 30.0% additional tariff applies after April 11, 2025, so it is time-sensitive and must be considered in cost planning.

HS CODE: 3920515050

Description:

- Polymethyl methacrylate (PMMA) sheets.

Tariff Summary:

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 61.5%

Key Notes: - This code is for PMMA (acrylic) sheets, which are a specific type of acrylic polymer. - If your product is pure PMMA, this is the most accurate classification.

HS CODE: 3926909989

Description:

- Other plastic products, including those made from materials in Chapters 3901 to 3914.

Tariff Summary:

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 7.5%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 42.8%

Key Notes: - This code is for other plastic products that do not fit into more specific categories. - If your product is not a standard acrylic sheet (e.g., a composite or modified product), this may be applicable.

HS CODE: 3921902550

Description:

- Other plastic sheets, films, etc., combined with other textile materials.

Tariff Summary:

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 61.5%

Key Notes: - This code applies if your product is combined with textile materials (e.g., fabric-backed acrylic sheets). - If your product is not combined with textiles, this is not applicable.

HS CODE: 3920591000

Description:

- Flexible materials of non-cellulose plastics and not reinforced.

Tariff Summary:

- Base Tariff Rate: 6.0%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 61.0%

Key Notes: - This code is for flexible, non-reinforced plastic materials. - If your product is flexible and not reinforced, this may be a possible classification.

✅ Proactive Advice for Users:

- Verify Material Composition: Confirm whether your product is PMMA (polymethyl methacrylate) or a general acrylic polymer to choose the correct HS code.

- Check Unit Price and Certification: Some HS codes may require certifications (e.g., for origin or material content).

- Monitor Tariff Changes: The 30.0% additional tariff applies after April 11, 2025 — ensure your customs declarations and cost calculations reflect this.

- Consult a Customs Broker: For complex or high-value shipments, it is advisable to seek professional customs advice to avoid misclassification and penalties.

Let me know if you need help determining the most accurate HS code for your specific product.

Customer Reviews

No reviews yet.