| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3926909989 | Doc | 42.8% | CN | US | 2025-05-12 |

| 3920515050 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920594000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3916901000 | Doc | 61.5% | CN | US | 2025-05-12 |

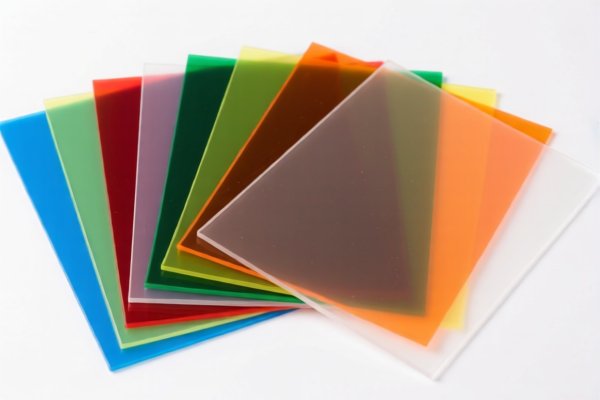

Here is the structured classification and tariff information for Acrylic Plastic Cut Sheets based on the provided HS codes:

✅ Product Classification: Acrylic Plastic Cut Sheets

🔢 HS CODE: 3920515050

Description: Polymethyl methacrylate (PMMA) sheets

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

🔢 HS CODE: 3920594000

Description: Plastic sheets, plates, films, foils, and strips made of acrylic polymers

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

🔢 HS CODE: 3916901000

Description: Other plastic monofilament, rods, sticks, and profiles made of acrylic polymers

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

🔢 HS CODE: 3926909989

Description: Other plastic products and products of other materials of chapters 3901 to 3914

- Base Tariff Rate: 5.3%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 42.8%

⚠️ Important Notes:

- April 11, 2025 Special Tariff: A 30% additional tariff is applied to all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be considered in your customs planning.

- Anti-dumping duties: Not applicable for acrylic plastic products in this classification.

- Material Verification: Confirm the exact material (e.g., PMMA, acrylic polymers) and unit price to ensure correct HS code classification.

- Certifications: Check if any certifications (e.g., RoHS, REACH) are required for import into the destination country.

📌 Proactive Advice:

- Double-check the product description to ensure it matches the HS code used.

- Consult with a customs broker or local customs authority for the most up-to-date and region-specific regulations.

- Plan ahead for the April 11, 2025 tariff increase to avoid unexpected costs.

Let me know if you need help with a specific import scenario or documentation! Here is the structured classification and tariff information for Acrylic Plastic Cut Sheets based on the provided HS codes:

✅ Product Classification: Acrylic Plastic Cut Sheets

🔢 HS CODE: 3920515050

Description: Polymethyl methacrylate (PMMA) sheets

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

🔢 HS CODE: 3920594000

Description: Plastic sheets, plates, films, foils, and strips made of acrylic polymers

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

🔢 HS CODE: 3916901000

Description: Other plastic monofilament, rods, sticks, and profiles made of acrylic polymers

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

🔢 HS CODE: 3926909989

Description: Other plastic products and products of other materials of chapters 3901 to 3914

- Base Tariff Rate: 5.3%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 42.8%

⚠️ Important Notes:

- April 11, 2025 Special Tariff: A 30% additional tariff is applied to all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be considered in your customs planning.

- Anti-dumping duties: Not applicable for acrylic plastic products in this classification.

- Material Verification: Confirm the exact material (e.g., PMMA, acrylic polymers) and unit price to ensure correct HS code classification.

- Certifications: Check if any certifications (e.g., RoHS, REACH) are required for import into the destination country.

📌 Proactive Advice:

- Double-check the product description to ensure it matches the HS code used.

- Consult with a customs broker or local customs authority for the most up-to-date and region-specific regulations.

- Plan ahead for the April 11, 2025 tariff increase to avoid unexpected costs.

Let me know if you need help with a specific import scenario or documentation!

Customer Reviews

No reviews yet.