Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920511000 | Doc | 61.0% | CN | US | 2025-05-12 |

| 3920515050 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920598000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920591000 | Doc | 61.0% | CN | US | 2025-05-12 |

| 3907610050 | Doc | 61.5% | CN | US | 2025-05-12 |

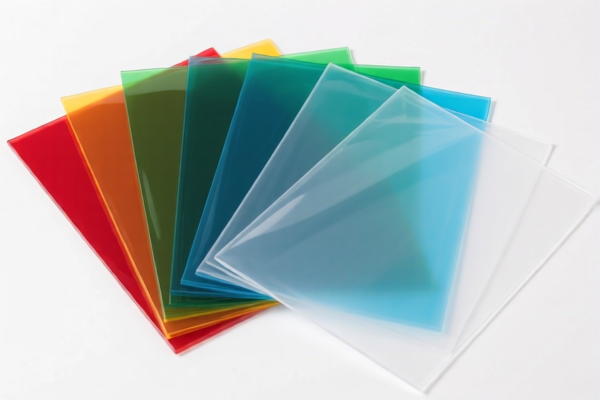

Product Name: Acrylic Plastic Electronic Sheets

Classification HS Codes and Tax Details:

✅ HS CODE: 3920511000

- Description: Acrylic flexible plastic sheets (acrylic is PMMA, poly(methyl methacrylate))

- Base Tariff Rate: 6.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.0%

- Notes: Suitable for flexible acrylic sheets. Ensure the product is indeed flexible and not rigid.

✅ HS CODE: 3920515050

- Description: Acrylic plastic sheets (PMMA)

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Notes: Applies to acrylic sheets, whether flame-retardant or not. Confirm if the product contains additives.

✅ HS CODE: 3920598000

- Description: Acrylic electronic boards (based on acrylic polymer)

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Notes: Designed for electronic applications. Verify if the product is used in electronics and if any certifications (e.g., RoHS) are required.

✅ HS CODE: 3920591000

- Description: Acrylic plastic sheets (flexible or rigid)

- Base Tariff Rate: 6.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.0%

- Notes: Applies to acrylic sheets in roll form. Confirm if the product is in sheet or roll form.

✅ HS CODE: 3907610050

- Description: Acrylic resin sheets (PMMA)

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Notes: Applies to acrylic resin sheets. Ensure the product is made of resin and not a composite.

📌 Proactive Advice:

- Verify Material: Confirm the product is made of PMMA (acrylic) and not a composite or modified material.

- Check Unit Price: High-value products may be subject to additional scrutiny or duties.

- Certifications: If used in electronics, ensure compliance with relevant standards (e.g., RoHS, REACH).

- Tariff Date: Be aware that the April 11, 2025 special tariff applies to all listed HS codes. Plan accordingly for import costs.

- Documentation: Maintain clear product descriptions and technical specifications to support HS code classification.

Let me know if you need help selecting the most appropriate HS code based on your product's specific attributes.

Product Name: Acrylic Plastic Electronic Sheets

Classification HS Codes and Tax Details:

✅ HS CODE: 3920511000

- Description: Acrylic flexible plastic sheets (acrylic is PMMA, poly(methyl methacrylate))

- Base Tariff Rate: 6.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.0%

- Notes: Suitable for flexible acrylic sheets. Ensure the product is indeed flexible and not rigid.

✅ HS CODE: 3920515050

- Description: Acrylic plastic sheets (PMMA)

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Notes: Applies to acrylic sheets, whether flame-retardant or not. Confirm if the product contains additives.

✅ HS CODE: 3920598000

- Description: Acrylic electronic boards (based on acrylic polymer)

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Notes: Designed for electronic applications. Verify if the product is used in electronics and if any certifications (e.g., RoHS) are required.

✅ HS CODE: 3920591000

- Description: Acrylic plastic sheets (flexible or rigid)

- Base Tariff Rate: 6.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.0%

- Notes: Applies to acrylic sheets in roll form. Confirm if the product is in sheet or roll form.

✅ HS CODE: 3907610050

- Description: Acrylic resin sheets (PMMA)

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Notes: Applies to acrylic resin sheets. Ensure the product is made of resin and not a composite.

📌 Proactive Advice:

- Verify Material: Confirm the product is made of PMMA (acrylic) and not a composite or modified material.

- Check Unit Price: High-value products may be subject to additional scrutiny or duties.

- Certifications: If used in electronics, ensure compliance with relevant standards (e.g., RoHS, REACH).

- Tariff Date: Be aware that the April 11, 2025 special tariff applies to all listed HS codes. Plan accordingly for import costs.

- Documentation: Maintain clear product descriptions and technical specifications to support HS code classification.

Let me know if you need help selecting the most appropriate HS code based on your product's specific attributes.

Customer Reviews

No reviews yet.