Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920591000 | Doc | 61.0% | CN | US | 2025-05-12 |

| 3920598000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920515050 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3916901000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920995000 | Doc | 60.8% | CN | US | 2025-05-12 |

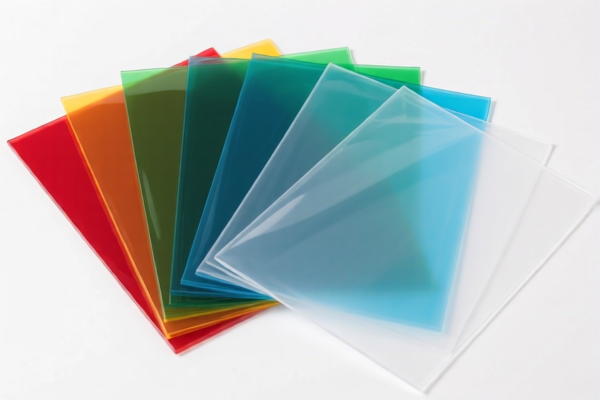

Product Classification: Acrylic Plastic Engraving Sheets

Based on the provided HS codes and descriptions, the most accurate classifications for Acrylic Plastic Engraving Sheets are as follows:

✅ HS CODE: 3920591000

- Description: Acrylic engraving sheets made of acrylic polymer, with flexible, laminated, or combined properties.

- Total Tax Rate: 61.0%

- Base Tariff: 6.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes:

- This code emphasizes flexibility or combination with other materials.

- Ensure the product is not rigid or reinforced.

✅ HS CODE: 3920598000

- Description: Acrylic engraving sheets made of acrylic polymer (PMMA), not rigid or reinforced.

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes:

- This code is suitable for non-cellular, non-reinforced acrylic sheets.

- Confirm the material composition is pure PMMA.

✅ HS CODE: 3920515050

- Description: Non-cellular, non-reinforced acrylic polymer (PMMA) sheets.

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes:

- This is a specific code for PMMA sheets.

- Ensure the product is not reinforced or cellular.

⚠️ HS CODE: 3916901000

- Description: Plastic rods (e.g., engraving rods), not further processed, with cross-section >1mm.

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes:

- This code is for rods, not sheets.

- Not suitable for engraving sheets.

⚠️ HS CODE: 3920995000

- Description: Plastic sheets, including engraving sheets, made of various plastics.

- Total Tax Rate: 60.8%

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes:

- This is a general code for plastic sheets.

- May not be the most accurate for acrylic-specific products.

📌 Proactive Advice for Importers:

- Verify Material: Confirm the product is made of acrylic polymer (PMMA) and not a composite or reinforced material.

- Check Unit Price: Tariff rates may vary based on value or quantity.

- Certifications: Ensure compliance with customs documentation, including material certificates and product specifications.

- April 11, 2025 Deadline: Be aware of the special tariff increase after this date. Plan accordingly for cost control.

- Avoid Misclassification: Use the most specific HS code (e.g., 3920591000 or 3920515050) for acrylic engraving sheets to avoid penalties.

📌 Summary of Tax Rates (April 11, 2025 onwards):

| HS Code | Base Tariff | Additional Tariff | Special Tariff (after April 11, 2025) | Total Tax |

|---|---|---|---|---|

| 3920591000 | 6.0% | 25.0% | 30.0% | 61.0% |

| 3920598000 | 6.5% | 25.0% | 30.0% | 61.5% |

| 3920515050 | 6.5% | 25.0% | 30.0% | 61.5% |

| 3916901000 | 6.5% | 25.0% | 30.0% | 61.5% |

| 3920995000 | 5.8% | 25.0% | 30.0% | 60.8% |

Let me know if you need help with customs documentation or tariff calculation tools.

Product Classification: Acrylic Plastic Engraving Sheets

Based on the provided HS codes and descriptions, the most accurate classifications for Acrylic Plastic Engraving Sheets are as follows:

✅ HS CODE: 3920591000

- Description: Acrylic engraving sheets made of acrylic polymer, with flexible, laminated, or combined properties.

- Total Tax Rate: 61.0%

- Base Tariff: 6.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes:

- This code emphasizes flexibility or combination with other materials.

- Ensure the product is not rigid or reinforced.

✅ HS CODE: 3920598000

- Description: Acrylic engraving sheets made of acrylic polymer (PMMA), not rigid or reinforced.

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes:

- This code is suitable for non-cellular, non-reinforced acrylic sheets.

- Confirm the material composition is pure PMMA.

✅ HS CODE: 3920515050

- Description: Non-cellular, non-reinforced acrylic polymer (PMMA) sheets.

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes:

- This is a specific code for PMMA sheets.

- Ensure the product is not reinforced or cellular.

⚠️ HS CODE: 3916901000

- Description: Plastic rods (e.g., engraving rods), not further processed, with cross-section >1mm.

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes:

- This code is for rods, not sheets.

- Not suitable for engraving sheets.

⚠️ HS CODE: 3920995000

- Description: Plastic sheets, including engraving sheets, made of various plastics.

- Total Tax Rate: 60.8%

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes:

- This is a general code for plastic sheets.

- May not be the most accurate for acrylic-specific products.

📌 Proactive Advice for Importers:

- Verify Material: Confirm the product is made of acrylic polymer (PMMA) and not a composite or reinforced material.

- Check Unit Price: Tariff rates may vary based on value or quantity.

- Certifications: Ensure compliance with customs documentation, including material certificates and product specifications.

- April 11, 2025 Deadline: Be aware of the special tariff increase after this date. Plan accordingly for cost control.

- Avoid Misclassification: Use the most specific HS code (e.g., 3920591000 or 3920515050) for acrylic engraving sheets to avoid penalties.

📌 Summary of Tax Rates (April 11, 2025 onwards):

| HS Code | Base Tariff | Additional Tariff | Special Tariff (after April 11, 2025) | Total Tax |

|---|---|---|---|---|

| 3920591000 | 6.0% | 25.0% | 30.0% | 61.0% |

| 3920598000 | 6.5% | 25.0% | 30.0% | 61.5% |

| 3920515050 | 6.5% | 25.0% | 30.0% | 61.5% |

| 3916901000 | 6.5% | 25.0% | 30.0% | 61.5% |

| 3920995000 | 5.8% | 25.0% | 30.0% | 60.8% |

Let me know if you need help with customs documentation or tariff calculation tools.

Customer Reviews

No reviews yet.