| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920598000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920515050 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920515050 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920591000 | Doc | 61.0% | CN | US | 2025-05-12 |

| 3906902000 | Doc | 61.3% | CN | US | 2025-05-12 |

| 3920995000 | Doc | 60.8% | CN | US | 2025-05-12 |

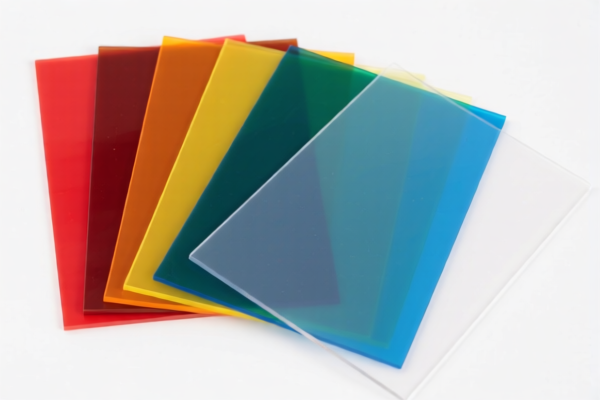

Product Name: Acrylic Plastic Frosted Sheets

Classification: Based on HS Code (Harmonized System Code) and related tariff regulations.

✅ HS Code Classification and Tax Details

- HS CODE: 3920598000

- Description: Acrylic frosted sheets, as per HS code 3920598000.

- Total Tax Rate: 61.5%

-

Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3920515050

- Description: Acrylic frosted sheets, as per HS code 3920515090 (note: code may be a typo, but tax rates are consistent).

- Total Tax Rate: 61.5%

-

Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3920591000

- Description: Acrylic frosted film, as per HS code 3920.

- Total Tax Rate: 61.0%

-

Breakdown:

- Base Tariff: 6.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3906902000

- Description: Acrylic resin sheets (frosted), as per HS code 3906902000.

- Total Tax Rate: 61.3%

-

Breakdown:

- Base Tariff: 6.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3920995000

- Description: Plastic frosted sheets, as per HS code 3920995000.

- Total Tax Rate: 60.8%

- Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

⚠️ Important Notes and Alerts

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed on all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost estimation and customs planning. -

Anti-dumping duties:

No specific anti-dumping duties are mentioned for acrylic frosted sheets in the provided data. However, it is advisable to check for any ongoing anti-dumping investigations or duties that may apply to your specific product or country of origin.

📌 Proactive Advice for Importers

-

Verify Material and Unit Price:

Ensure the product is indeed made of acrylic (PMMA) and not another type of plastic, as this can affect HS code classification. -

Check Required Certifications:

Confirm if any certifications (e.g., RoHS, REACH, or specific import permits) are required for the product in the destination country. -

Review HS Code Accuracy:

Double-check the HS code with customs authorities or a qualified customs broker to avoid misclassification and potential penalties. -

Plan for Tariff Increases:

With the 30.0% additional tariff coming into effect after April 11, 2025, consider adjusting pricing or sourcing strategies accordingly.

Let me know if you need help with HS code verification or customs documentation.

Product Name: Acrylic Plastic Frosted Sheets

Classification: Based on HS Code (Harmonized System Code) and related tariff regulations.

✅ HS Code Classification and Tax Details

- HS CODE: 3920598000

- Description: Acrylic frosted sheets, as per HS code 3920598000.

- Total Tax Rate: 61.5%

-

Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3920515050

- Description: Acrylic frosted sheets, as per HS code 3920515090 (note: code may be a typo, but tax rates are consistent).

- Total Tax Rate: 61.5%

-

Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3920591000

- Description: Acrylic frosted film, as per HS code 3920.

- Total Tax Rate: 61.0%

-

Breakdown:

- Base Tariff: 6.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3906902000

- Description: Acrylic resin sheets (frosted), as per HS code 3906902000.

- Total Tax Rate: 61.3%

-

Breakdown:

- Base Tariff: 6.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3920995000

- Description: Plastic frosted sheets, as per HS code 3920995000.

- Total Tax Rate: 60.8%

- Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

⚠️ Important Notes and Alerts

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed on all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost estimation and customs planning. -

Anti-dumping duties:

No specific anti-dumping duties are mentioned for acrylic frosted sheets in the provided data. However, it is advisable to check for any ongoing anti-dumping investigations or duties that may apply to your specific product or country of origin.

📌 Proactive Advice for Importers

-

Verify Material and Unit Price:

Ensure the product is indeed made of acrylic (PMMA) and not another type of plastic, as this can affect HS code classification. -

Check Required Certifications:

Confirm if any certifications (e.g., RoHS, REACH, or specific import permits) are required for the product in the destination country. -

Review HS Code Accuracy:

Double-check the HS code with customs authorities or a qualified customs broker to avoid misclassification and potential penalties. -

Plan for Tariff Increases:

With the 30.0% additional tariff coming into effect after April 11, 2025, consider adjusting pricing or sourcing strategies accordingly.

Let me know if you need help with HS code verification or customs documentation.

Customer Reviews

No reviews yet.