| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920515050 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920598000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920594000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3920515050 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3906100000 | Doc | 61.3% | CN | US | 2025-05-12 |

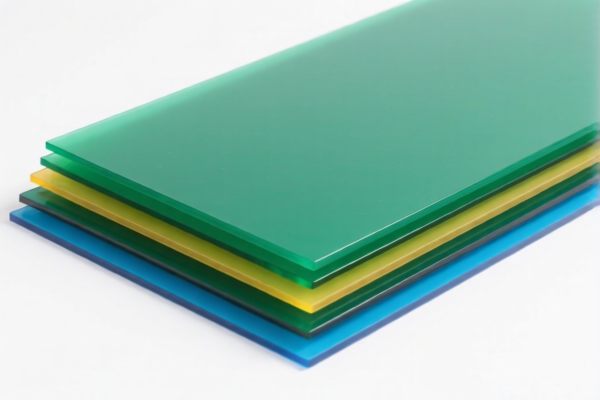

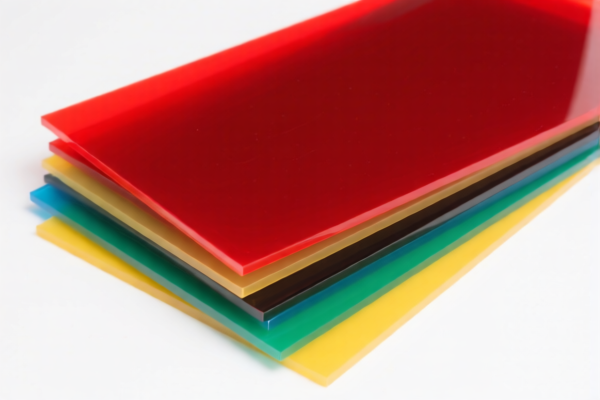

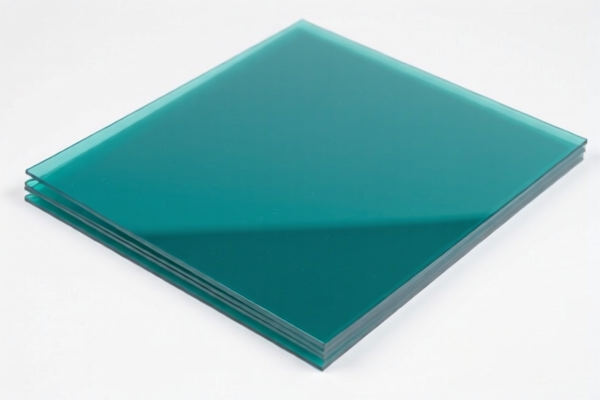

Product Classification: Acrylic Plastic Industrial Sheets

Based on the provided HS codes and descriptions, the following classifications and tariff details apply to acrylic plastic industrial sheets. Please note that the classification depends on the material composition, intended use, and specific product characteristics.

✅ HS CODE: 3920515050

Description: Applicable to acrylic plastic sheets, matching the description under HS code 3920515090.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0% (applies to all products under this code)

- Note: This code is repeated in the input, but the classification remains the same.

✅ HS CODE: 3920598000

Description: Applicable to acrylic industrial boards, matching the description "based on acrylic polymers."

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

- Note: This code is suitable for industrial-grade acrylic sheets made from acrylic polymers.

✅ HS CODE: 3920594000

Description: Applicable to industrial-grade acrylic sheets, matching the description under HS code 3920594000.

- Total Tax Rate: 55.0%

- Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

- Note: This code may be more favorable for industrial-grade acrylic sheets, especially if the base tariff is zero.

✅ HS CODE: 3906100000

Description: Applicable to raw materials for acrylic sheet production, matching HS code 3906.10.

- Total Tax Rate: 61.3%

- Breakdown:

- Base Tariff: 6.3%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

- Note: This code is for raw materials, not finished acrylic sheets. Ensure you are not misclassifying raw materials as finished products.

📌 Key Tax Rate Changes (April 11, 2025)

- All listed HS codes will be subject to an additional 30.0% tariff after April 11, 2025.

- This is a time-sensitive policy and may significantly increase import costs.

- Anti-dumping duties on iron and aluminum are not applicable for acrylic plastic sheets.

🛠️ Proactive Advice for Importers

- Verify the material composition (e.g., whether it is based on acrylic polymers or other resins).

- Check the unit price and certifications required (e.g., RoHS, REACH, or specific import permits).

- Confirm the intended use (industrial vs. commercial) to ensure correct HS code classification.

- Review the product specifications to determine whether it falls under 3920515050, 3920598000, or 3920594000.

- Consult a customs broker or HS code expert for final confirmation, especially if the product is borderline between categories.

📌 Summary of Tax Rates (April 11, 2025 onwards)

| HS Code | Total Tax Rate | Base Tariff | Additional Tariff | April 11 Tariff |

|---|---|---|---|---|

| 3920515050 | 61.5% | 6.5% | 25.0% | 30.0% |

| 3920598000 | 61.5% | 6.5% | 25.0% | 30.0% |

| 3920594000 | 55.0% | 0.0% | 25.0% | 30.0% |

| 3906100000 | 61.3% | 6.3% | 25.0% | 30.0% |

If you have more details about the product (e.g., thickness, color, intended use), I can help refine the classification further.

Product Classification: Acrylic Plastic Industrial Sheets

Based on the provided HS codes and descriptions, the following classifications and tariff details apply to acrylic plastic industrial sheets. Please note that the classification depends on the material composition, intended use, and specific product characteristics.

✅ HS CODE: 3920515050

Description: Applicable to acrylic plastic sheets, matching the description under HS code 3920515090.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0% (applies to all products under this code)

- Note: This code is repeated in the input, but the classification remains the same.

✅ HS CODE: 3920598000

Description: Applicable to acrylic industrial boards, matching the description "based on acrylic polymers."

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

- Note: This code is suitable for industrial-grade acrylic sheets made from acrylic polymers.

✅ HS CODE: 3920594000

Description: Applicable to industrial-grade acrylic sheets, matching the description under HS code 3920594000.

- Total Tax Rate: 55.0%

- Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

- Note: This code may be more favorable for industrial-grade acrylic sheets, especially if the base tariff is zero.

✅ HS CODE: 3906100000

Description: Applicable to raw materials for acrylic sheet production, matching HS code 3906.10.

- Total Tax Rate: 61.3%

- Breakdown:

- Base Tariff: 6.3%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

- Note: This code is for raw materials, not finished acrylic sheets. Ensure you are not misclassifying raw materials as finished products.

📌 Key Tax Rate Changes (April 11, 2025)

- All listed HS codes will be subject to an additional 30.0% tariff after April 11, 2025.

- This is a time-sensitive policy and may significantly increase import costs.

- Anti-dumping duties on iron and aluminum are not applicable for acrylic plastic sheets.

🛠️ Proactive Advice for Importers

- Verify the material composition (e.g., whether it is based on acrylic polymers or other resins).

- Check the unit price and certifications required (e.g., RoHS, REACH, or specific import permits).

- Confirm the intended use (industrial vs. commercial) to ensure correct HS code classification.

- Review the product specifications to determine whether it falls under 3920515050, 3920598000, or 3920594000.

- Consult a customs broker or HS code expert for final confirmation, especially if the product is borderline between categories.

📌 Summary of Tax Rates (April 11, 2025 onwards)

| HS Code | Total Tax Rate | Base Tariff | Additional Tariff | April 11 Tariff |

|---|---|---|---|---|

| 3920515050 | 61.5% | 6.5% | 25.0% | 30.0% |

| 3920598000 | 61.5% | 6.5% | 25.0% | 30.0% |

| 3920594000 | 55.0% | 0.0% | 25.0% | 30.0% |

| 3906100000 | 61.3% | 6.3% | 25.0% | 30.0% |

If you have more details about the product (e.g., thickness, color, intended use), I can help refine the classification further.

Customer Reviews

No reviews yet.