| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920594000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3920598000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920515050 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920515090 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3906902000 | Doc | 61.3% | CN | US | 2025-05-12 |

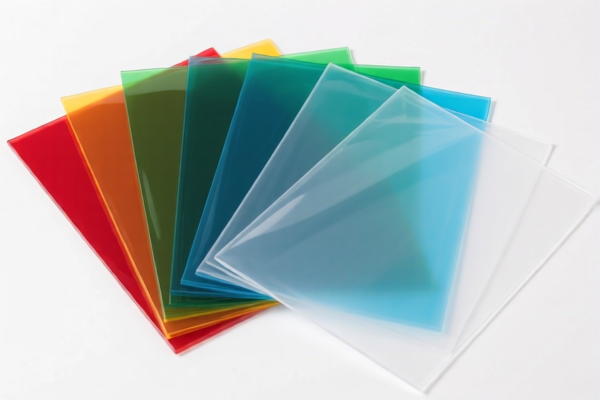

Here is the structured classification and tariff information for Acrylic Plastic Medical Sheets, based on the provided HS codes and tax details:

✅ HS CODE: 3920594000

Product Description: Medical-grade acrylic sheets

Total Tax Rate: 55.0%

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: No anti-dumping duties or special tariffs on iron/aluminum apply here.

✅ HS CODE: 3920598000

Product Description: Acrylic medical sheets

Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: No anti-dumping duties or special tariffs on iron/aluminum apply here.

✅ HS CODE: 3920515050

Product Description: Acrylic plastic sheets

Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: No anti-dumping duties or special tariffs on iron/aluminum apply here.

✅ HS CODE: 3920515090

Product Description: PMMA medical-grade acrylic sheets

Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: No anti-dumping duties or special tariffs on iron/aluminum apply here.

✅ HS CODE: 3906902000

Product Description: Acrylic resin sheets (medical-grade)

Total Tax Rate: 61.3%

- Base Tariff: 6.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: No anti-dumping duties or special tariffs on iron/aluminum apply here.

📌 Important Notes and Recommendations:

- April 11, 2025 Special Tariff: A 30% additional tariff will be applied to all the above HS codes after April 11, 2025. Ensure your import timeline is planned accordingly.

- Material Verification: Confirm the exact material composition (e.g., PMMA, medical-grade, etc.) to ensure correct HS code classification.

- Certifications: Medical-grade products may require specific certifications (e.g., ISO, FDA, CE) for customs clearance and market compliance.

- Unit Price: Verify the unit price and total value for accurate duty calculation, as customs may use the transaction value method.

If you have further details about the product (e.g., thickness, intended use, origin), I can help refine the classification and tax calculation further. Here is the structured classification and tariff information for Acrylic Plastic Medical Sheets, based on the provided HS codes and tax details:

✅ HS CODE: 3920594000

Product Description: Medical-grade acrylic sheets

Total Tax Rate: 55.0%

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: No anti-dumping duties or special tariffs on iron/aluminum apply here.

✅ HS CODE: 3920598000

Product Description: Acrylic medical sheets

Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: No anti-dumping duties or special tariffs on iron/aluminum apply here.

✅ HS CODE: 3920515050

Product Description: Acrylic plastic sheets

Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: No anti-dumping duties or special tariffs on iron/aluminum apply here.

✅ HS CODE: 3920515090

Product Description: PMMA medical-grade acrylic sheets

Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: No anti-dumping duties or special tariffs on iron/aluminum apply here.

✅ HS CODE: 3906902000

Product Description: Acrylic resin sheets (medical-grade)

Total Tax Rate: 61.3%

- Base Tariff: 6.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: No anti-dumping duties or special tariffs on iron/aluminum apply here.

📌 Important Notes and Recommendations:

- April 11, 2025 Special Tariff: A 30% additional tariff will be applied to all the above HS codes after April 11, 2025. Ensure your import timeline is planned accordingly.

- Material Verification: Confirm the exact material composition (e.g., PMMA, medical-grade, etc.) to ensure correct HS code classification.

- Certifications: Medical-grade products may require specific certifications (e.g., ISO, FDA, CE) for customs clearance and market compliance.

- Unit Price: Verify the unit price and total value for accurate duty calculation, as customs may use the transaction value method.

If you have further details about the product (e.g., thickness, intended use, origin), I can help refine the classification and tax calculation further.

Customer Reviews

No reviews yet.