| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3916901000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3906905000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920598000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920591000 | Doc | 61.0% | CN | US | 2025-05-12 |

| 3906902000 | Doc | 61.3% | CN | US | 2025-05-12 |

Here is the structured customs compliance analysis for Acrylic Plastic Mold Sheets and related products, based on the provided HS codes and tax details:

🔍 Product Classification Overview

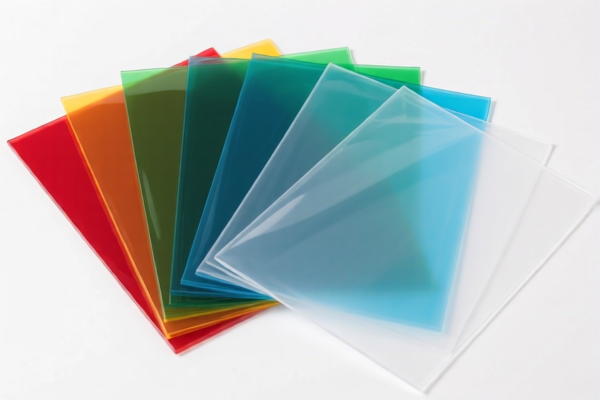

Product Name: Acrylic Plastic Mold Sheets

HS Code: 3920598000 / 3920591000 (depending on specific product details)

📦 HS Code Breakdown and Tax Rates

1. HS Code: 3920598000 – Acrylic Plastic Thin Sheets (General)

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

2. HS Code: 3920591000 – Acrylic Plastic Thin Sheets (More Specific)

- Base Tariff Rate: 6.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.0%

3. HS Code: 3916901000 – Acrylic Plastic Mold Rods

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

4. HS Code: 3906905000 – Acrylic Resin Mold Material

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

5. HS Code: 3906902000 – Acrylic Plastic Primary Raw Material Sheets

- Base Tariff Rate: 6.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.3%

⚠️ Important Notes and Alerts

- April 11, 2025 Special Tariff: A 30% additional tariff will be applied to all these products after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost planning.

- Anti-dumping duties: Not applicable for acrylic plastics, but always verify if your product is subject to any anti-dumping or countervailing duties based on the country of origin.

- Material and Certification Requirements: Ensure the product is correctly classified based on its material composition (e.g., whether it's a finished product or raw material) and unit price. Some HS codes may require specific certifications (e.g., REACH, RoHS, or customs documentation).

✅ Proactive Advice for Importers

- Verify the exact product description (e.g., whether it's a thin sheet, rod, or raw material) to ensure the correct HS code is used.

- Check the country of origin to determine if any additional duties or trade agreements apply.

- Review the April 11, 2025 deadline and plan accordingly to avoid unexpected cost increases.

- Consult with customs brokers or legal advisors if the product is part of a complex supply chain or subject to special regulations.

Let me know if you need help determining the correct HS code for a specific product description or if you need assistance with customs documentation. Here is the structured customs compliance analysis for Acrylic Plastic Mold Sheets and related products, based on the provided HS codes and tax details:

🔍 Product Classification Overview

Product Name: Acrylic Plastic Mold Sheets

HS Code: 3920598000 / 3920591000 (depending on specific product details)

📦 HS Code Breakdown and Tax Rates

1. HS Code: 3920598000 – Acrylic Plastic Thin Sheets (General)

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

2. HS Code: 3920591000 – Acrylic Plastic Thin Sheets (More Specific)

- Base Tariff Rate: 6.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.0%

3. HS Code: 3916901000 – Acrylic Plastic Mold Rods

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

4. HS Code: 3906905000 – Acrylic Resin Mold Material

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

5. HS Code: 3906902000 – Acrylic Plastic Primary Raw Material Sheets

- Base Tariff Rate: 6.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.3%

⚠️ Important Notes and Alerts

- April 11, 2025 Special Tariff: A 30% additional tariff will be applied to all these products after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost planning.

- Anti-dumping duties: Not applicable for acrylic plastics, but always verify if your product is subject to any anti-dumping or countervailing duties based on the country of origin.

- Material and Certification Requirements: Ensure the product is correctly classified based on its material composition (e.g., whether it's a finished product or raw material) and unit price. Some HS codes may require specific certifications (e.g., REACH, RoHS, or customs documentation).

✅ Proactive Advice for Importers

- Verify the exact product description (e.g., whether it's a thin sheet, rod, or raw material) to ensure the correct HS code is used.

- Check the country of origin to determine if any additional duties or trade agreements apply.

- Review the April 11, 2025 deadline and plan accordingly to avoid unexpected cost increases.

- Consult with customs brokers or legal advisors if the product is part of a complex supply chain or subject to special regulations.

Let me know if you need help determining the correct HS code for a specific product description or if you need assistance with customs documentation.

Customer Reviews

No reviews yet.