| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920598000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920591000 | Doc | 61.0% | CN | US | 2025-05-12 |

| 3916901000 | Doc | 61.5% | CN | US | 2025-05-12 |

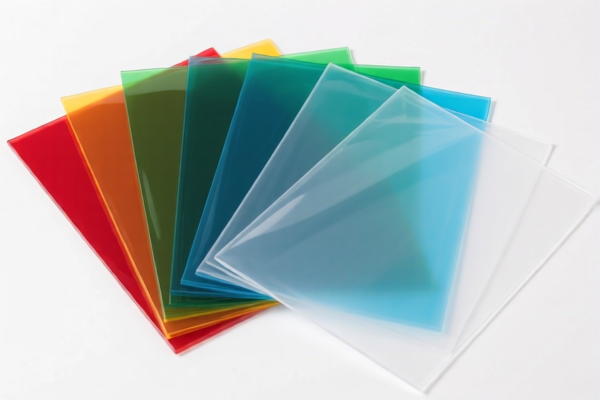

Product Name: Acrylic Plastic Packaging Sheets

Classification HS Codes and Tax Details:

- HS CODE: 3920598000

- Description: Plastic sheets, plates, films, foils, and strips based on acrylic polymers, for packaging purposes.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

-

Note: This code applies to acrylic plastic sheets used for packaging, but not specifically for rods or other forms.

-

HS CODE: 3920591000

- Description: Plastic sheets, plates, films, foils, and strips made of acrylic polymers, for packaging purposes.

- Total Tax Rate: 61.0%

- Breakdown:

- Base Tariff Rate: 6.0%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

-

Note: This code is similar to 3920598000 but may have slight differences in material specifications or origin.

-

HS CODE: 3916901000

- Description: Plastic rods made of acrylic polymers, for packaging purposes.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Note: This code is for acrylic plastic rods, not sheets or films.

📌 Important Notes and Recommendations:

- Time-Sensitive Policy Alert:

-

Additional tariffs of 30.0% will be imposed after April 2, 2025. Ensure your import timeline accounts for this increase.

-

Anti-Dumping Duties:

-

No specific anti-dumping duties are mentioned for acrylic plastics in this context, but always verify with the latest customs updates or consult a customs broker for confirmation.

-

Proactive Actions Required:

- Verify the exact material composition (e.g., whether it is 100% acrylic or a blend with other polymers).

- Check the unit price and total value to determine if any preferential tariff rates apply (e.g., under free trade agreements).

- Confirm required certifications (e.g., RoHS, REACH, or other compliance standards) depending on the destination country.

- Review the product form (sheet, rod, etc.) to ensure correct HS code classification.

If you have more details about the product (e.g., thickness, intended use, or origin), I can help refine the classification further.

Product Name: Acrylic Plastic Packaging Sheets

Classification HS Codes and Tax Details:

- HS CODE: 3920598000

- Description: Plastic sheets, plates, films, foils, and strips based on acrylic polymers, for packaging purposes.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

-

Note: This code applies to acrylic plastic sheets used for packaging, but not specifically for rods or other forms.

-

HS CODE: 3920591000

- Description: Plastic sheets, plates, films, foils, and strips made of acrylic polymers, for packaging purposes.

- Total Tax Rate: 61.0%

- Breakdown:

- Base Tariff Rate: 6.0%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

-

Note: This code is similar to 3920598000 but may have slight differences in material specifications or origin.

-

HS CODE: 3916901000

- Description: Plastic rods made of acrylic polymers, for packaging purposes.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Note: This code is for acrylic plastic rods, not sheets or films.

📌 Important Notes and Recommendations:

- Time-Sensitive Policy Alert:

-

Additional tariffs of 30.0% will be imposed after April 2, 2025. Ensure your import timeline accounts for this increase.

-

Anti-Dumping Duties:

-

No specific anti-dumping duties are mentioned for acrylic plastics in this context, but always verify with the latest customs updates or consult a customs broker for confirmation.

-

Proactive Actions Required:

- Verify the exact material composition (e.g., whether it is 100% acrylic or a blend with other polymers).

- Check the unit price and total value to determine if any preferential tariff rates apply (e.g., under free trade agreements).

- Confirm required certifications (e.g., RoHS, REACH, or other compliance standards) depending on the destination country.

- Review the product form (sheet, rod, etc.) to ensure correct HS code classification.

If you have more details about the product (e.g., thickness, intended use, or origin), I can help refine the classification further.

Customer Reviews

No reviews yet.