| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 9405490000 | Doc | 58.9% | CN | US | 2025-05-12 |

| 9405116010 | Doc | 62.6% | CN | US | 2025-05-12 |

| 3920591000 | Doc | 61.0% | CN | US | 2025-05-12 |

| 9405920000 | Doc | 58.7% | CN | US | 2025-05-12 |

| 3920591000 | Doc | 61.0% | CN | US | 2025-05-12 |

Here is the structured and professional breakdown of the HS codes and associated tariffs for Acrylic Plastic Profile Shapes for Lighting, based on your input:

🔍 HS Code Classification Overview

1. HS Code: 9405490000

Product Description: Acrylic parts for lighting, such as lampshades or lamp decorations

- Base Tariff Rate: 3.9%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Total Tax Rate: 58.9%

- Key Notes:

- This code is for components used in lighting systems, not complete lamps.

- Ensure the product is clearly identified as a lamp part (e.g., lampshade, diffuser) and not a finished lighting product.

2. HS Code: 9405116010

Product Description: Acrylic lamps for home use, typically with LED light sources

- Base Tariff Rate: 7.6%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Total Tax Rate: 62.6%

- Key Notes:

- This code applies to finished lamps, not just parts.

- Confirm the product is a complete lighting fixture (e.g., desk lamp, ceiling light) and not just a component.

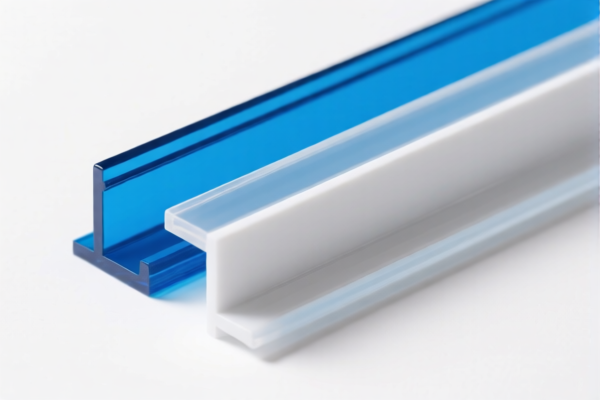

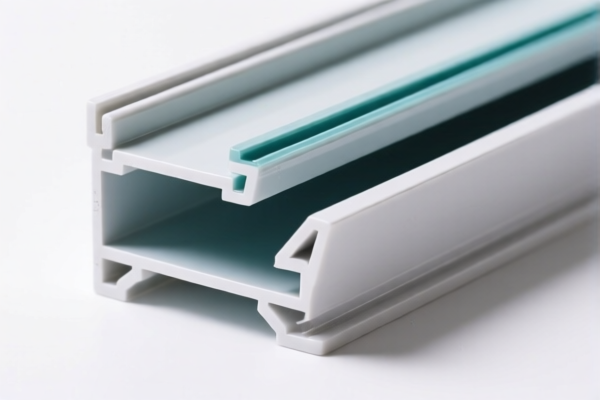

3. HS Code: 3920591000

Product Description: Acrylic plastic products, such as sheets or accessories

- Base Tariff Rate: 6.0%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Total Tax Rate: 61.0%

- Key Notes:

- This is a general category for acrylic plastic products, including sheets, profiles, or accessories.

- If the product is used in lighting, it may also fall under 9405 codes depending on its final use.

- Be cautious of double classification if the product is used in both general and lighting applications.

4. HS Code: 9405920000

Product Description: Acrylic lampshades or other lamp parts

- Base Tariff Rate: 3.7%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Total Tax Rate: 58.7%

- Key Notes:

- This code is for lampshades or other lamp parts made of acrylic.

- Similar to 9405490000, but more specific to lampshades.

📌 Important Reminders for Importers

- Verify Material and Unit Price: Ensure the product is indeed made of acrylic plastic and not a composite or mixed material.

- Check Required Certifications: Some products may require product conformity certificates, CE marking, or safety standards for lighting.

- Watch for April 2, 2025 Deadline: The special tariff of 30.0% applies after April 2, 2025. If your shipment is scheduled after this date, the higher rate will apply.

- Avoid Anti-Dumping Duties: These codes are not related to iron or aluminum, so anti-dumping duties do not apply here.

- Double-Check Classification: If the product can be classified under multiple HS codes, choose the most specific one to avoid delays or penalties.

✅ Proactive Advice

- Consult a Customs Broker: For complex or high-value shipments, seek professional help to ensure correct classification and tax calculation.

- Maintain Product Documentation: Keep records of material composition, intended use, and any certifications to support your HS code selection.

- Monitor Policy Updates: Tariff rates and classifications can change, so stay informed about new regulations or trade agreements that may affect your product.

Let me know if you need help determining the most appropriate HS code for your specific product. Here is the structured and professional breakdown of the HS codes and associated tariffs for Acrylic Plastic Profile Shapes for Lighting, based on your input:

🔍 HS Code Classification Overview

1. HS Code: 9405490000

Product Description: Acrylic parts for lighting, such as lampshades or lamp decorations

- Base Tariff Rate: 3.9%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Total Tax Rate: 58.9%

- Key Notes:

- This code is for components used in lighting systems, not complete lamps.

- Ensure the product is clearly identified as a lamp part (e.g., lampshade, diffuser) and not a finished lighting product.

2. HS Code: 9405116010

Product Description: Acrylic lamps for home use, typically with LED light sources

- Base Tariff Rate: 7.6%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Total Tax Rate: 62.6%

- Key Notes:

- This code applies to finished lamps, not just parts.

- Confirm the product is a complete lighting fixture (e.g., desk lamp, ceiling light) and not just a component.

3. HS Code: 3920591000

Product Description: Acrylic plastic products, such as sheets or accessories

- Base Tariff Rate: 6.0%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Total Tax Rate: 61.0%

- Key Notes:

- This is a general category for acrylic plastic products, including sheets, profiles, or accessories.

- If the product is used in lighting, it may also fall under 9405 codes depending on its final use.

- Be cautious of double classification if the product is used in both general and lighting applications.

4. HS Code: 9405920000

Product Description: Acrylic lampshades or other lamp parts

- Base Tariff Rate: 3.7%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Total Tax Rate: 58.7%

- Key Notes:

- This code is for lampshades or other lamp parts made of acrylic.

- Similar to 9405490000, but more specific to lampshades.

📌 Important Reminders for Importers

- Verify Material and Unit Price: Ensure the product is indeed made of acrylic plastic and not a composite or mixed material.

- Check Required Certifications: Some products may require product conformity certificates, CE marking, or safety standards for lighting.

- Watch for April 2, 2025 Deadline: The special tariff of 30.0% applies after April 2, 2025. If your shipment is scheduled after this date, the higher rate will apply.

- Avoid Anti-Dumping Duties: These codes are not related to iron or aluminum, so anti-dumping duties do not apply here.

- Double-Check Classification: If the product can be classified under multiple HS codes, choose the most specific one to avoid delays or penalties.

✅ Proactive Advice

- Consult a Customs Broker: For complex or high-value shipments, seek professional help to ensure correct classification and tax calculation.

- Maintain Product Documentation: Keep records of material composition, intended use, and any certifications to support your HS code selection.

- Monitor Policy Updates: Tariff rates and classifications can change, so stay informed about new regulations or trade agreements that may affect your product.

Let me know if you need help determining the most appropriate HS code for your specific product.

Customer Reviews

No reviews yet.